Free Dfas Form 9098 Download: A Comprehensive Guide to Obtaining and Using the Form

Form 9098, provided by the Defense Finance and Accounting Service (DFAS), is a crucial document for individuals and organizations involved in financial transactions with the US Department of Defense. Whether you’re a contractor, vendor, or military member, understanding how to obtain and use Form 9098 is essential for ensuring accurate and timely payments.

In this comprehensive guide, we will delve into the purpose, contents, and benefits of Form 9098. We’ll provide clear instructions on how to locate, download, and fill out the form, ensuring a seamless experience for our readers. Additionally, we’ll address common challenges and provide troubleshooting tips to make the process as smooth as possible.

Free Dfas Form 9098 Download Overview

DFAS Form 9098 is an essential document for military members and their families. It is a critical tool for managing finances, taxes, and other important aspects of military life. By obtaining this form, you can ensure that you are meeting your financial obligations and taking advantage of all the benefits available to you as a member of the military.

DFAS Form 9098 is a multi-purpose form that can be used for a variety of purposes, including:

- Applying for military pay and allowances

- Updating your personal information

- Reporting changes in your income or dependents

li>Requesting a refund of overpaid taxes

It is important to obtain DFAS Form 9098 if you are a member of the military or a family member of a military member. This form can help you manage your finances, taxes, and other important aspects of military life.

Locating and Downloading Form 9098

Blud, listen up! If you’re after Form 9098, you’re in the right crib. We’ll show you the official gaff and give you the lowdown on how to bag it.

DFAS Website

The official website for downloading Form 9098 is the Defense Finance and Accounting Service (DFAS) website. Just click on the link below, and you’ll be sorted:

- https://www.dfas.mil/taxes/forms-publications/

Once you’re on the DFAS website, you’ll need to find the “Forms” section. It’s usually at the top of the page, under the “Resources” tab. Click on that, and you’ll be taken to a list of all the forms that DFAS offers.

Scroll down the list until you find Form 9098. It’s usually near the bottom, under the “Tax Forms” section. Once you’ve found it, click on the link to download the form.

Saving the Form

Once you’ve clicked on the link, the form will start downloading. Make sure you save it in a place where you can easily find it later. You can also choose to open the form directly in your browser if you want to fill it out online.

Filling Out and Submitting Form 9098

Filling out Form 9098 is crucial to ensure accurate and timely payment of your refund or credit. This guide will provide you with step-by-step instructions and tips to complete the form efficiently.

Before you start, ensure you meet the eligibility requirements. You must have a valid tax return and be entitled to a refund or credit. If you are unsure about your eligibility, consult a tax professional or refer to the IRS website for guidance.

Completing Each Section

Form 9098 is divided into several sections. Each section requires specific information to process your refund or credit accurately. Let’s break down each section and provide tips for completing it correctly:

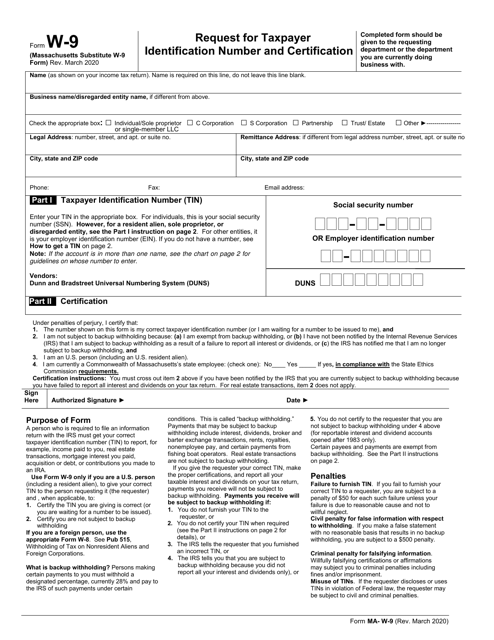

Part I: Taxpayer Information

- Enter your personal information, including name, address, Social Security number, and phone number. Ensure the information matches your tax return.

- Indicate whether you are filing as an individual or a representative.

Part II: Refund or Credit Information

- Specify the amount of refund or credit you are claiming.

- Indicate how you want to receive your refund (direct deposit, check, etc.).

Part III: Bank Information (for Direct Deposit)

- If you choose direct deposit, provide your bank’s routing number and account number. Double-check the accuracy of this information.

- Indicate the type of account (checking or savings).

Part IV: Signature and Date

- Sign and date the form in the designated area.

- If you are filing as a representative, you must provide your name, title, and signature.

Submission Process

Once you have completed the form, you have two options for submission:

- Mail: Send the completed form to the address provided on the form.

- Fax: You can fax the form to the designated number if you need a faster response.

Note that the submission process may take several weeks, depending on the method you choose. If you have any questions or concerns, contact the IRS directly for assistance.

Benefits of Using Form 9098

The Dfas Form 9098 is a valuable tool that offers numerous advantages to businesses and individuals. Its standardized format simplifies processes, enhances accuracy, and provides a consistent method for capturing and reporting financial information.

One of the key benefits of using Form 9098 is its ability to streamline and simplify financial reporting processes. The form’s pre-defined structure and clear instructions guide users through the process of gathering and organizing financial data, ensuring that all necessary information is captured and presented in a consistent and standardized manner.

Improved Accuracy and Error Reduction

Form 9098 is designed to minimize errors and ensure the accuracy of financial reporting. Its standardized format and clear instructions help to reduce the likelihood of mistakes, as users are less likely to overlook or misinterpret information. The form also includes built-in checks and balances to identify and correct any errors that may occur during the data entry process.

Real-Life Examples

Numerous businesses and individuals have experienced firsthand the benefits of using Form 9098. For example, a small business owner reported that the form helped them to streamline their financial reporting process, reducing the time it took to prepare financial statements by over 50%. Another business reported that the use of Form 9098 significantly reduced the number of errors in their financial reporting, resulting in improved accuracy and reliability.

Updates and Changes to Form 9098

Form 9098 has undergone some changes and updates to improve its functionality and accuracy. These updates have been made to streamline the form and make it easier for users to complete.

The most recent version of Form 9098 is available on the official website. Users are advised to always use the most up-to-date version of the form to ensure that they are using the correct version and that their information is accurate.

Impact of Changes on Form’s Usage and Requirements

The changes made to Form 9098 have impacted its usage and requirements in several ways:

- Simplified instructions: The instructions for completing the form have been simplified and made easier to understand.

- Additional guidance: Additional guidance has been added to the form to help users complete it correctly.

- Updated requirements: Some of the requirements for completing the form have been updated to reflect changes in regulations.

Users are advised to carefully review the changes to the form before completing it to ensure that they are using the correct version and that their information is accurate.

Q&A

Where can I find the most up-to-date version of Form 9098?

You can find the most up-to-date version of Form 9098 on the official website of the Defense Finance and Accounting Service (DFAS).

What are the eligibility requirements for completing Form 9098?

To be eligible to complete Form 9098, you must be a contractor, vendor, or military member who has received payments from the US Department of Defense.

What are some common challenges users may encounter while downloading or completing Form 9098?

Some common challenges users may encounter include technical issues with the DFAS website, difficulties navigating the form’s sections, and errors in data entry. These challenges can be addressed by following the instructions provided in this guide and seeking assistance from DFAS support resources if needed.