Free Daycare Tax Forms Download: A Comprehensive Guide

Navigating the complexities of tax filing can be daunting, especially when it comes to claiming benefits related to childcare expenses. This comprehensive guide provides a detailed overview of free daycare tax forms, their importance, and how to file them accurately to maximize your tax savings.

Whether you’re a working parent, a stay-at-home caregiver, or a provider of daycare services, understanding the tax implications of daycare expenses is crucial. This guide will empower you with the knowledge and resources you need to optimize your tax deductions and credits, reducing your tax liability and increasing your refunds.

Additional Resources and Support

Taxpayers seeking assistance with free daycare tax forms can access a range of resources and support services. These include government agencies, tax professionals, and non-profit organizations.

To ensure accurate tax form completion and maximize eligible deductions, consider reaching out to these entities for guidance and support.

Government Agencies

- Internal Revenue Service (IRS): The IRS provides comprehensive information on tax forms, deductions, and credits related to daycare expenses. Visit the IRS website or call 1-800-829-1040 for assistance.

- State Tax Agencies: State tax agencies can provide information on specific tax laws and regulations related to daycare expenses within their jurisdiction.

Tax Professionals

- Certified Public Accountants (CPAs): CPAs are licensed professionals who can provide tax advice and prepare tax returns. They can assist with maximizing daycare tax deductions and ensuring compliance with tax laws.

- Enrolled Agents (EAs): EAs are federally licensed tax practitioners who can represent taxpayers before the IRS. They can provide guidance on daycare tax forms and help resolve tax-related issues.

Non-Profit Organizations

- United Way: United Way offers free tax preparation assistance to low- and moderate-income families. They can help with completing daycare tax forms and claiming eligible deductions.

- Volunteer Income Tax Assistance (VITA): VITA provides free tax preparation services to low-income taxpayers. They can assist with daycare tax forms and ensure accurate tax return filing.

FAQs

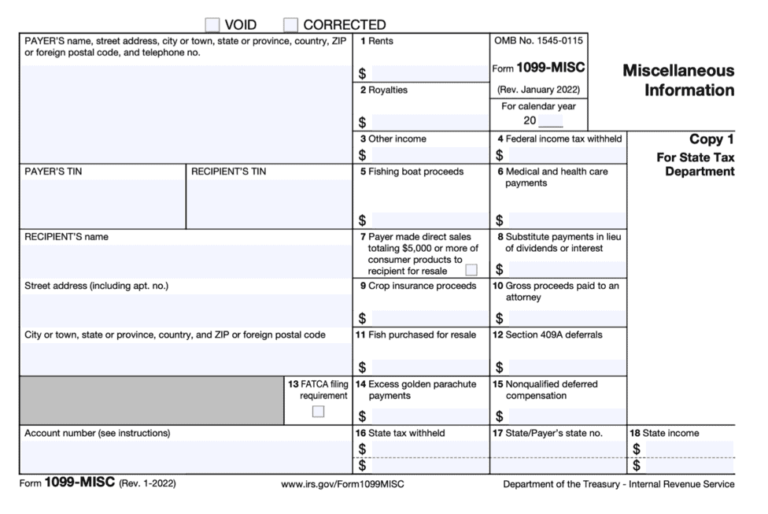

What is the purpose of Form 2441, Child and Dependent Care Expenses?

Form 2441 is used to calculate and claim the child and dependent care tax credit, which provides a tax break for expenses incurred for the care of qualifying dependents, including children under age 13, disabled spouses, and elderly dependents.

How do I determine if I’m eligible to claim the child and dependent care tax credit?

To claim the child and dependent care tax credit, you must meet certain eligibility requirements, including having earned income, maintaining a household for your qualifying dependents, and paying for eligible care expenses.

Where can I find additional resources and support for filing daycare tax forms?

The Internal Revenue Service (IRS) website provides a wealth of resources, including publications, forms, and online tools. You can also consult with a tax professional for personalized guidance.