Free D-400 Form Download: A Comprehensive Guide

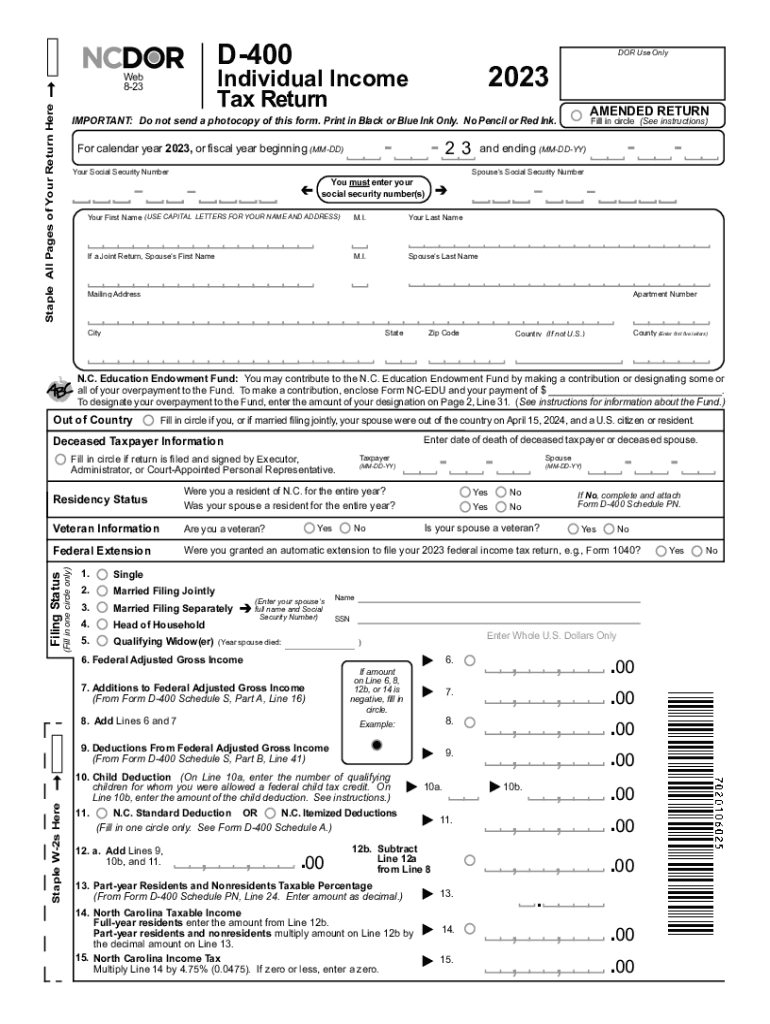

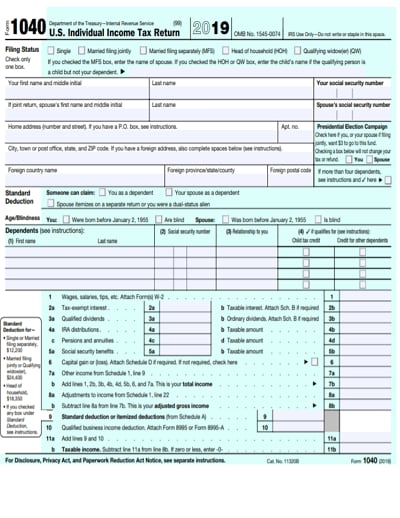

The D-400 Form, officially known as the US Individual Income Tax Return, is a crucial document used by taxpayers to report their annual income and calculate their tax liability. Understanding how to download and use this form is essential for fulfilling your tax obligations accurately and efficiently. This guide will provide a comprehensive overview of the D-400 Form, its key features, benefits, and step-by-step instructions for downloading and using it.

The D-400 Form is a multi-page document that consists of various sections, each designed to collect specific information about your income, deductions, credits, and other financial details. Completing this form accurately is vital to ensure that you pay the correct amount of taxes and avoid potential penalties or delays in your refund.

Key Features of the D-400 Form

The D-400 Form, also known as the Request for Permission to Work Overtime, is a crucial document used by employees to request authorization to work overtime. It serves as a record of the employee’s request, including the specific details of the overtime work, and acts as a legal agreement between the employee and the employer.

The D-400 Form typically consists of several sections, each with its own specific purpose:

– Employee Information: This section captures basic information about the employee, such as their name, employee ID, and department.

– Overtime Request Details: This section Artikels the details of the overtime work, including the date(s) and time(s) of the overtime, the reason for the overtime, and the number of overtime hours requested.

– Approvals: This section includes spaces for the employee’s manager and/or other authorized personnel to approve or deny the overtime request.

It is important for employees to complete the D-400 Form accurately and thoroughly, as it serves as a formal record of the overtime request and may be used for payroll purposes or in the event of any disputes.

Benefits of Downloading the D-400 Form for Free

Downloading the D-400 form for free offers numerous advantages. It not only saves money but also simplifies the process of obtaining the form, making it more convenient and accessible.

Financial Savings

Downloading the D-400 form for free eliminates the need to purchase it from a third-party vendor or pay for printing and postage costs. This can result in significant savings, especially if you need multiple copies of the form.

Time-Saving and Effortless

Downloading the D-400 form for free saves time and effort. Instead of searching for the form online or visiting a government office, you can simply download it from a reputable website with just a few clicks. This process is quick and easy, allowing you to obtain the form without any hassle.

Convenience

Having the D-400 form readily available on your computer or mobile device provides unparalleled convenience. You can access the form anytime, anywhere, without the need to carry physical copies or worry about losing them. This makes it easy to fill out the form and submit it electronically, saving you both time and effort.

Troubleshooting Common Issues with the D-400 Form

Mate, if you’re having a right mare with the D-400 Form, don’t fret. We’ve got your back with this banging guide to sort out any niggles you might be having.

Can’t Download the Form

If you’re stuck trying to cop the D-400 Form, here’s what to do:

– Check your blimmin’ internet connection. You need a decent signal to get the form downloaded in a jiffy.

– Try a different browser or incognito mode. Sometimes, your browser might be acting up.

– Clear your cache and cookies. This can get rid of any dodgy bits that might be messing with your download.

Form Not Opening

If you’ve got the form but it’s not playing ball, try this:

– Make sure you’re using the right software. You’ll need Adobe Acrobat Reader or a similar PDF viewer.

– Check if the file is corrupted. Download it again and see if that does the trick.

– Contact the IRS for assistance. They’re the dons when it comes to the D-400 Form.

Need Help with Filling Out the Form

If you’re feeling a bit lost filling out the D-400 Form, here’s what to do:

– Read the instructions carefully. They’re there for a reason, mate.

– Use the IRS website or other reputable sources for guidance.

– Contact the IRS for assistance. They’re always happy to lend a hand.

Additional Resources for the D-400 Form

Need more help with the D-400 Form? Here are some additional resources that you may find useful.

The IRS website has a dedicated page for the D-400 Form, which includes instructions, FAQs, and other helpful information. You can access this page at https://www.irs.gov/forms-pubs/about-form-d-400.

Contact Information

If you have any questions about the D-400 Form that are not answered by the IRS website, you can contact the IRS by phone at 1-800-829-1040. You can also contact the IRS by mail at the following address:

Internal Revenue Service

Attn: D-400 Form

Ogden, UT 84201-0027

Summary Table

The following table summarizes the key features and benefits of the D-400 Form:

| Feature | Benefit |

|---|---|

| Electronic filing | Faster processing times and reduced risk of errors |

| Pre-populated data | Saves time and reduces the risk of errors |

| Automatic calculations | Eliminates the need for manual calculations |

| Validation checks | Helps to ensure that the form is complete and accurate |

| Secure transmission | Protects taxpayer information |

Answers to Common Questions

What are the key benefits of downloading the D-400 Form for free?

Downloading the D-400 Form for free offers several advantages, including saving money on printing and mailing costs, convenience of having the form readily available on your computer or mobile device, and saving time by eliminating the need to visit an IRS office or library to obtain a physical copy.

How can I avoid common mistakes when completing the D-400 Form?

To avoid common mistakes when completing the D-400 Form, carefully read the instructions provided by the IRS, use the correct tax tables and schedules, double-check your calculations, and consider seeking professional assistance if you have complex tax situations.

What should I do if I encounter problems downloading or using the D-400 Form?

If you encounter problems downloading or using the D-400 Form, refer to the troubleshooting tips provided in this guide, visit the IRS website for additional support, or contact the IRS directly for assistance.