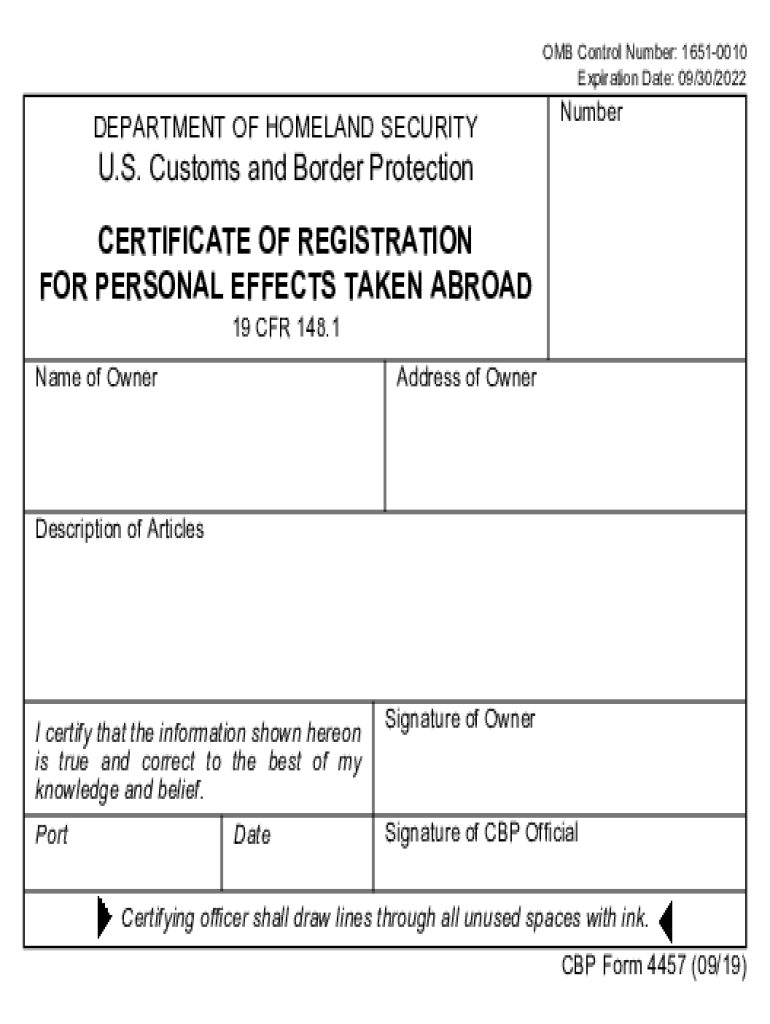

Free Customs Form 4457 Download: A Comprehensive Guide

Navigating customs clearance can be a daunting task, but with the right tools and knowledge, it can be a breeze. One essential document in this process is the Customs Form 4457, which plays a crucial role in facilitating the smooth flow of goods across borders. In this comprehensive guide, we will delve into the intricacies of this form, providing you with a step-by-step guide to downloading, filling out, and submitting it, along with expert tips and troubleshooting solutions to ensure a seamless customs clearance experience.

Whether you’re a seasoned importer or exporter or just starting out, this guide will empower you with the knowledge and resources you need to navigate the customs process with confidence. So, let’s dive right in and explore the world of Customs Form 4457!

Tips for Efficient Form Completion

Filling out the Free Customs Form 4457 doesn’t have to be a chore. With a bit of preparation and some handy tips, you can get it done quickly and accurately.

To start with, gather all the necessary information and documents you’ll need. This includes your passport, visa (if applicable), and any receipts or invoices for the goods you’re bringing in.

Organising Your Documents

Once you’ve got everything together, take a moment to organise it so that you can easily find what you need when you’re filling out the form.

- Put your passport and visa in one place, and keep them handy.

- Keep all your receipts and invoices together in a separate pile.

- If you’re bringing in any gifts, make sure you have a list of them and their value.

Filling Out the Form

Now that you’re organised, you can start filling out the form. Here are a few tips to make it easier:

- Use a black or blue pen and write clearly.

- Answer all the questions on the form, even if they don’t seem to apply to you.

- If you’re not sure about something, ask a customs officer for help.

- Once you’ve filled out the form, check it carefully for any mistakes before you submit it.

Sample Form and Case Studies

In this section, we’ll delve into a sample Form 4457, dissecting its key elements to enhance your understanding. Additionally, we’ll explore real-life case studies showcasing successful form submissions, highlighting best practices and serving as valuable guides for your own submissions.

Sample Form 4457 with Annotations

Below is a sample Form 4457 with annotations to illustrate its key elements:

- Importer Information: This section captures details about the individual or organization importing the goods.

- Exporter Information: Similar to the Importer Information section, this section gathers details about the individual or organization exporting the goods.

- Goods Information: Here, you’ll provide a detailed description of the goods being imported, including their quantity, value, and country of origin.

- Customs Value: This section calculates the value of the goods for customs purposes, which may differ from their commercial value.

- Duty and Taxes: Based on the Customs Value, this section calculates the amount of duty and taxes owed on the imported goods.

- Certification: This section includes a statement certifying the accuracy of the information provided on the form.

Case Studies of Successful Form Submissions

To further illustrate best practices, let’s examine some case studies of successful Form 4457 submissions:

- Case Study 1: A small business successfully imported a shipment of raw materials by providing clear and accurate information on the Form 4457, resulting in a smooth and efficient customs clearance process.

- Case Study 2: A large corporation utilized the Form 4457 to import a high-value piece of machinery, ensuring compliance with customs regulations and avoiding any potential delays or penalties.

Related Resources and Additional Information

Innit, if you’re stuck or need some extra guidance, check out these resources:

Official Customs Websites

- HM Revenue & Customs (HMRC): https://www.gov.uk/government/organisations/hm-revenue-customs

- World Customs Organization (WCO): https://www.wcoomd.org/

Support Hotlines

- HMRC Customs & Excise National Advice Service: 0300 200 3700

- WCO InfoLine: +32 2 209 92 11

Additional Information

Moreover, don’t forget these extra bits:

- Stay updated on the latest customs regulations and procedures.

- Consider using a customs broker or freight forwarder for assistance.

- Be aware of potential customs duties and taxes that may apply.

- Keep all necessary documentation organized and easily accessible.

Helpful Answers

Where can I download the official Customs Form 4457?

You can download the official Customs Form 4457 from the U.S. Customs and Border Protection (CBP) website.

What information do I need to fill out the form?

You will need to provide information about the goods being imported or exported, including the quantity, value, and country of origin.

How do I submit the completed form?

You can submit the completed form to CBP electronically or by mail.

What are some common errors to avoid when filling out the form?

Some common errors to avoid include incorrect tariff classification, missing information, and incorrect calculations.

What should I do if I make a mistake on the form?

If you make a mistake on the form, you should contact CBP immediately.