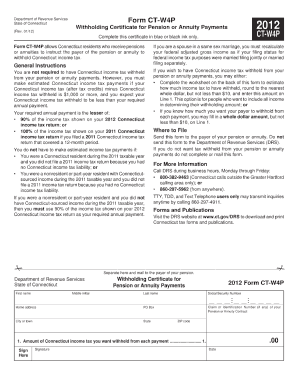

Free Ct W4p Form Download: A Comprehensive Guide to Simplifying Tax Withholding

Navigating the complexities of tax withholding can be a daunting task. However, with the availability of the Free Ct W4p Form, individuals and businesses in Connecticut can simplify this process and ensure accurate tax calculations. This guide provides a comprehensive overview of the Free Ct W4p Form, its benefits, and step-by-step instructions for downloading and completing it.

The Free Ct W4p Form is an essential tool for employees and employers alike. It allows individuals to indicate their withholding allowances, which determine the amount of federal and state income tax withheld from their paychecks. By utilizing this form, taxpayers can avoid underpayment penalties and ensure they receive the appropriate tax refunds.

Filling Out the Free Ct W4p Form

The Free Ct W4p Form is a simple and straightforward document that can be completed in a few minutes. Here are the key sections and fields of the form:

* Personal Information: This section includes your name, address, and Social Security number.

* Exemptions: This section allows you to claim exemptions from withholding taxes. You can claim up to four exemptions.

* Additional Income: This section allows you to report any additional income that you expect to receive during the year.

* Signature: This section must be signed and dated by you.

It is important to complete the Free Ct W4p Form accurately. If you make a mistake, you may end up paying too much or too little in taxes. If you are not sure how to complete the form, you can consult with a tax professional.

Completing the Form Accurately

Here are some tips for completing the Free Ct W4p Form accurately:

* Use the correct form: Make sure you are using the correct form for your state.

* Fill out the form completely: Do not leave any fields blank.

* Be accurate: Make sure the information you provide is accurate and up-to-date.

* Sign and date the form: The form must be signed and dated by you.

By following these tips, you can ensure that your Free Ct W4p Form is completed accurately and that you are paying the correct amount of taxes.

Common Questions About the Free Ct W4p Form

Got questions about the Free Ct W4p Form? We’ve got the answers. Check out these frequently asked questions to clear up any confusion.

This form is designed to help Connecticut residents calculate their state income tax withholding. It’s important to fill out the form accurately to avoid overpaying or underpaying your taxes.

Eligibility

Who can use the Free Ct W4p Form?

- Residents of Connecticut who are employed in the state

- Non-residents who earn income from Connecticut sources

Withholding Allowances

What are withholding allowances and how do they affect my refund?

Withholding allowances reduce the amount of tax withheld from your paycheck. Each allowance represents a specific dollar amount that is not subject to withholding. The more allowances you claim, the less tax will be withheld from your paycheck, but you may also end up owing more taxes when you file your return.

Deadlines

When is the Free Ct W4p Form due?

The Free Ct W4p Form is due on or before April 15th of each year. However, you can file the form at any time during the year. If you file the form after April 15th, you may be subject to penalties and interest.

Alternatives to the Free Ct W4p Form

Aside from the Free Ct W4p Form, other options are available for completing tax withholding forms. These alternatives offer various features and benefits, catering to different needs and preferences.

Online Platforms

Online platforms provide a convenient and efficient way to complete tax withholding forms. They typically offer user-friendly interfaces, step-by-step guidance, and automated calculations. These platforms often integrate with tax preparation software, making it easy to import and export information.

- Benefits: Convenient, user-friendly, automated calculations, integration with tax software.

- Considerations: May require an account or subscription, potential security concerns.

Software Options

Tax preparation software offers a comprehensive solution for completing tax withholding forms. These software packages typically include guided interviews, error-checking features, and the ability to generate multiple forms. They can also be used to file taxes electronically.

- Benefits: Comprehensive, guided interviews, error-checking, e-filing capabilities.

- Considerations: May require purchase or subscription, can be complex for beginners.

Best Practices for Using the Free Ct W4p Form

Utilising the Free Ct W4p Form efficiently entails adhering to certain best practices. Heed these tips to maximise accuracy and minimise potential pitfalls:

Ensure meticulous completion of all sections, providing accurate and comprehensive information. This aids in determining the appropriate tax withholding amount, ensuring neither overpayment nor underpayment.

Double-Check Your Information

Prior to submitting the form, thoroughly review the information provided to eliminate any errors or omissions. Inaccuracies can result in incorrect tax withholding, leading to potential penalties or refunds.

Consider Your Allowances

Determine the appropriate number of allowances to claim based on your personal circumstances, including dependents and income level. Claiming excessive allowances may result in underpayment, while claiming insufficient allowances may lead to overpayment.

Use the Form Annually

Review and update the Ct W4p Form annually, particularly following life events such as marriage, childbirth, or changes in income. These events may necessitate adjustments to your allowances to ensure accurate tax withholding.

Seek Professional Advice if Needed

If you encounter difficulties completing the form or have complex tax situations, consider seeking assistance from a tax professional. They can provide guidance and ensure the form is completed correctly.

FAQ

Who is eligible to use the Free Ct W4p Form?

The Free Ct W4p Form is available to all individuals who are employed in Connecticut and receive wages subject to federal and state income tax.

How many withholding allowances can I claim on the Free Ct W4p Form?

The number of withholding allowances you can claim depends on various factors, such as your filing status, dependents, and income. Refer to the instructions on the form or consult with a tax professional for guidance.

What is the deadline for submitting the Free Ct W4p Form?

There is no specific deadline for submitting the Free Ct W4p Form. However, it is recommended to submit the form to your employer as soon as possible to ensure accurate tax withholding throughout the year.