Free CT Tax Form Download: A Comprehensive Guide

Filing taxes can be a daunting task, but it doesn’t have to be. With the availability of free Connecticut tax forms online, you can save time and money while ensuring accuracy in your tax preparation.

This comprehensive guide will provide you with all the information you need to download, fill out, and file your CT tax forms with ease. Whether you’re a first-time filer or a seasoned taxpayer, this guide has got you covered.

Free CT Tax Form Download

Cheers mate, if you’re a CT resident, downloading free CT tax forms online is the bee’s knees. It’s like having a mate who’s a tax whizz, only better – it’s free! No more faffing about trying to find the right forms or wasting dosh on postage.

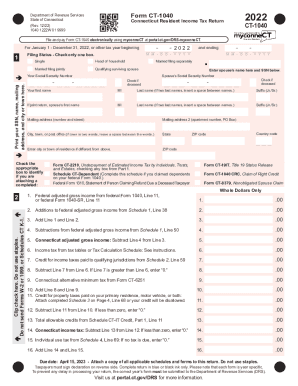

There’s a right form for every tax situation, so you need to suss out which one you need. Like, if you’re a bit of a wage slave, you’ll need the CT-1040. If you’re self-employed, the CT-1040ES is your ticket. And if you’re a property mogul, the CT-1040PC is your go-to.

Different types of CT tax forms

- CT-1040: Individual Income Tax Return

- CT-1040ES: Estimated Income Tax Return

- CT-1040PC: Property Tax Return

- CT-1040EZ: Short Form Income Tax Return

- CT-1040NR: Nonresident Income Tax Return

Remember, using the wrong form is like trying to fit a square peg in a round hole – it just won’t work. So, make sure you’ve got the right form for your situation, or you could end up with a right cock-up on your hands.

How to Download Free CT Tax Forms

There are several ways to download free CT tax forms online. You can use a search engine, visit the Connecticut Department of Revenue Services website, or use a tax software program.

To use a search engine, simply type in “free CT tax forms” and hit enter. This will bring up a list of websites that offer free CT tax forms. You can then click on any of the links to download the forms you need.

To visit the Connecticut Department of Revenue Services website, go to www.ct.gov/drs. Once on the website, click on the “Forms” tab and then select the “Individual Income Tax” sub-tab. This will bring up a list of all the individual income tax forms that are available for download.

To use a tax software program, simply open the program and click on the “Forms” tab. This will bring up a list of all the tax forms that are available for download. You can then select the forms you need and click on the “Download” button.

Tips for Filling Out CT Tax Forms

Filling out your CT tax forms can be a bit of a pain, but it’s important to do it accurately and efficiently. Here are a few tips to help you get the job done right:

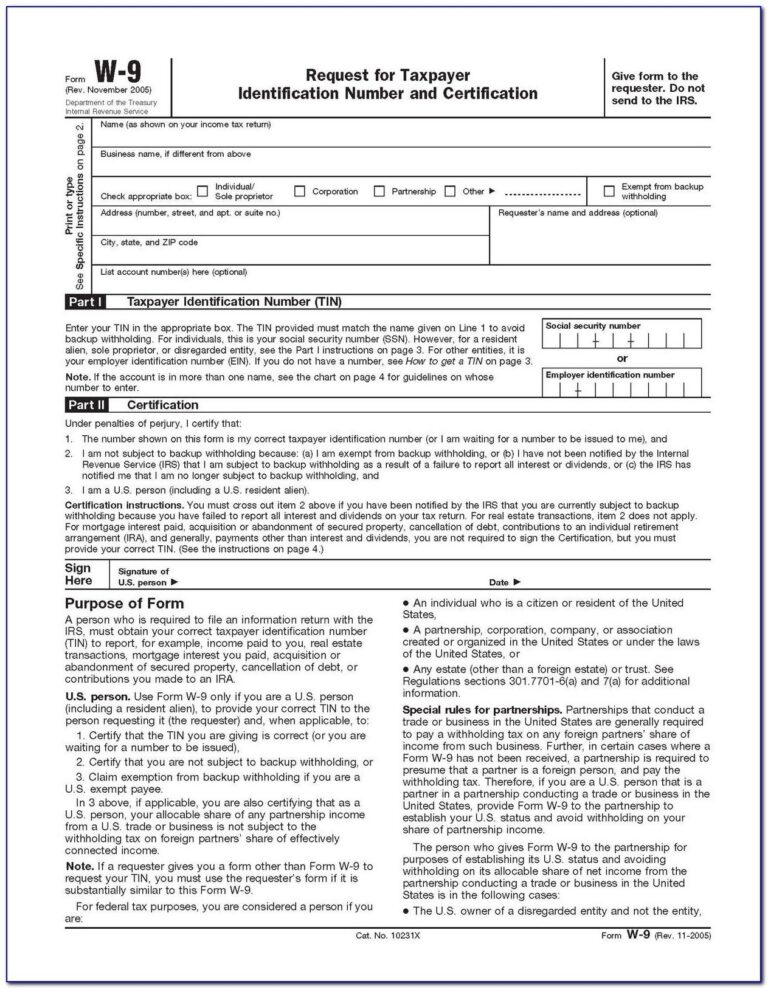

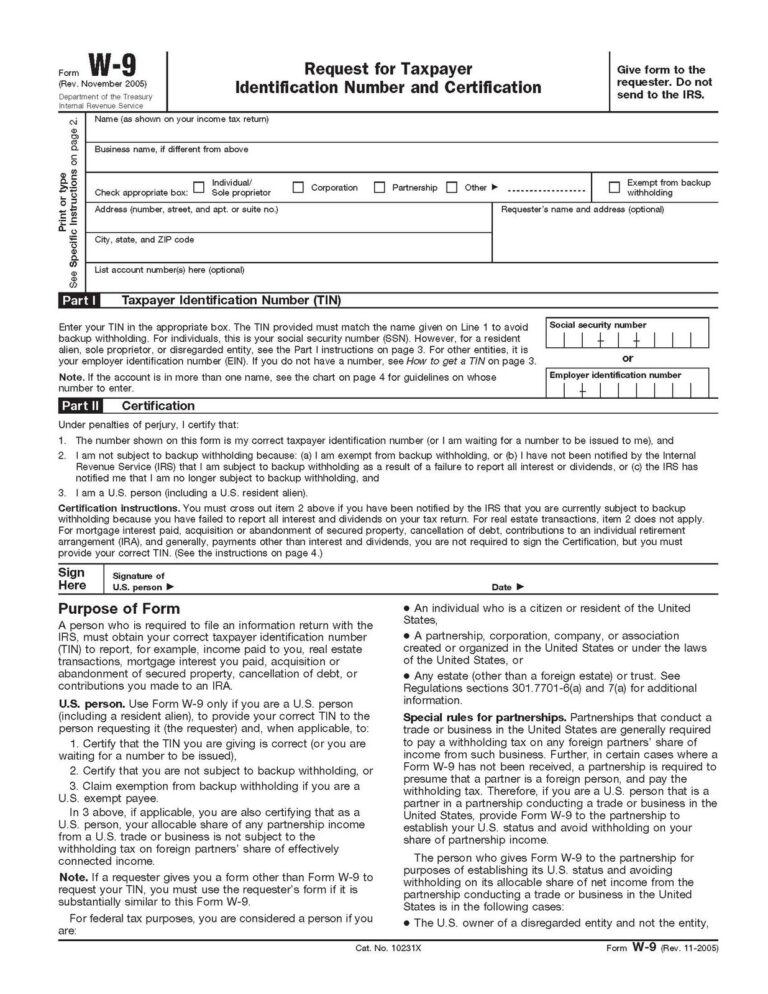

- Gather all of your necessary documents before you start filling out your forms. This includes your W-2s, 1099s, and any other tax-related documents.

- Read the instructions carefully before you start filling out your forms. This will help you avoid making any mistakes.

- Be sure to answer all of the questions on the forms completely and accurately. If you’re not sure how to answer a question, refer to the instructions or seek professional help.

- Double-check your work before you submit your forms. This will help you catch any errors that you may have made.

Common Mistakes to Avoid

Here are some of the most common mistakes that people make when filling out CT tax forms:

- Not gathering all of the necessary documents. This can lead to delays in processing your return and could result in you having to pay additional taxes.

- Not reading the instructions carefully. This can lead to mistakes that could cost you money.

- Not answering all of the questions on the forms completely and accurately. This can also lead to delays in processing your return and could result in you having to pay additional taxes.

- Not double-checking your work before you submit your forms. This can lead to errors that could cost you money.

Getting Help

If you need help filling out your CT tax forms, there are a few resources available to you. You can:

- Contact the CT Department of Revenue. The department offers free tax assistance to taxpayers. You can reach the department by phone at (860) 297-4960 or by visiting their website at www.ct.gov/drs.

- Hire a tax preparer. A tax preparer can help you fill out your forms and make sure that they are filed correctly. Tax preparers typically charge a fee for their services.

- Use a tax software program. There are a number of tax software programs available that can help you fill out your CT tax forms. These programs typically cost money, but they can save you time and hassle.

By following these tips, you can help ensure that your CT tax forms are filled out accurately and efficiently.

Where to File CT Tax Forms

Filing your CT tax forms can be done in a few different ways. You can file online, by mail, or in person. Each method has its own advantages and disadvantages, so it’s important to choose the one that’s right for you.

Here’s a table comparing the different filing methods:

| Method | Advantages | Disadvantages |

|---|---|---|

| Online | – Fast and easy – Secure – Can track your progress |

– Requires an internet connection – May have to pay a fee |

| By mail | – Free – Can file at your own pace |

– Can take longer to process – Not as secure as online filing |

| In person | – Can get help from a tax preparer – Can file your taxes immediately |

– Can be time-consuming – May have to pay a fee |

The deadline for filing your CT tax forms is April 15th. If you file by mail, your return must be postmarked by April 15th. If you file online, you have until midnight on April 15th to file your return.

Resources for CT Tax Forms

Need assistance with CT tax forms? Here’s a list of resources to help you navigate the process.

From online portals to expert guidance, these resources provide comprehensive support to ensure accurate and timely tax filing.

Frequently Asked Questions

| Question | Answer |

|---|---|

| Where can I find the latest CT tax forms? | Visit the CT Department of Revenue website or refer to the links provided in this guide. |

| Who can I contact for help with tax forms? | Reach out to the CT Department of Revenue by phone, email, or mail. |

| What are the deadlines for filing CT tax returns? | Refer to the CT Department of Revenue website for specific deadlines. |

Additional Resources

FAQ Summary

Can I download all CT tax forms for free online?

Yes, all official CT tax forms are available for free download on the Connecticut Department of Revenue Services website.

What are the different types of CT tax forms available for download?

There are various CT tax forms available, including individual income tax forms, business tax forms, and property tax forms. The specific forms you need will depend on your individual circumstances.

How do I choose the correct CT tax form for my situation?

The Connecticut Department of Revenue Services provides guidance on which forms to use based on your specific tax situation. You can also consult a tax professional for assistance.

Where can I get help if I need assistance filling out my CT tax forms?

The Connecticut Department of Revenue Services offers a variety of resources, including online help, phone support, and in-person assistance. You can also seek guidance from a tax professional.