Free Columbus Tax Forms Download: A Comprehensive Guide for Residents

Navigating the tax season can be a daunting task, but it doesn’t have to be. For Columbus residents, there’s a convenient solution: free downloadable tax forms. These forms provide a simple and cost-effective way to fulfill your tax obligations while ensuring accuracy and timeliness.

In this comprehensive guide, we’ll explore the benefits, eligibility, and steps involved in accessing and completing Columbus tax forms. We’ll also provide additional resources to assist you throughout the process, making tax filing a breeze.

Free Columbus Tax Forms Download

Blud, if you’re a G in Columbus and need to sort out your taxes, you’re in luck. There’s a right load of free tax forms available to download, so you can get your tax return sorted without breaking the bank.

These forms are bang on for anyone who needs to file their taxes in Columbus, Ohio. Whether you’re a resident or non-resident, there’s a form for you. And the best part is, they’re all free to download and use.

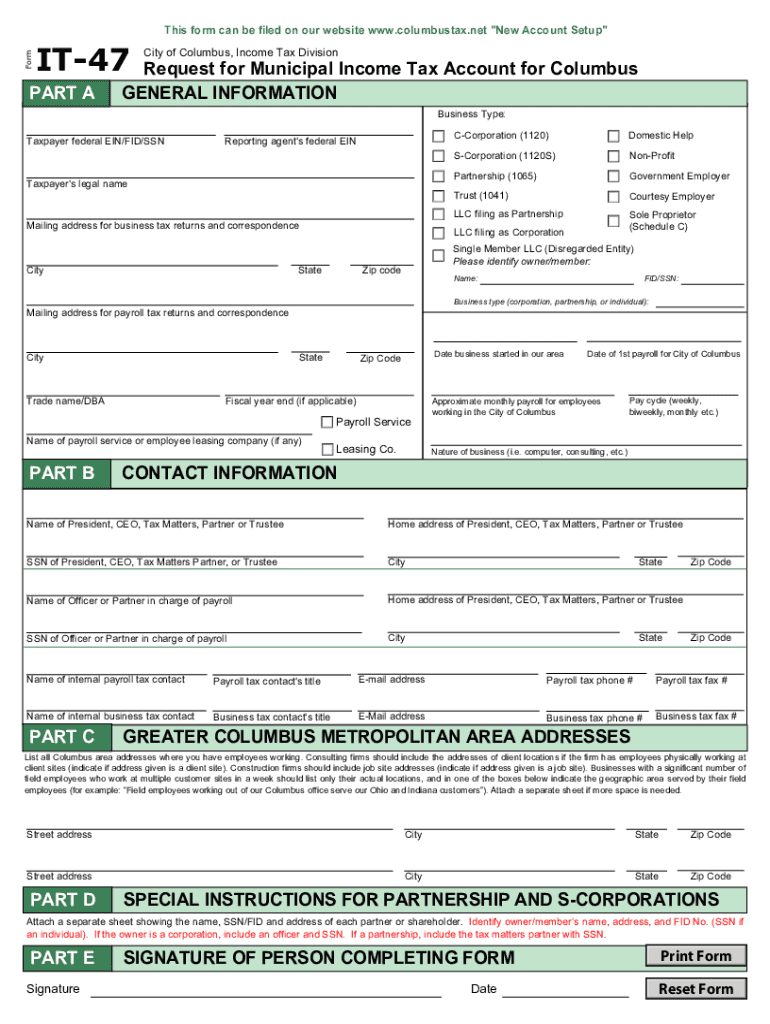

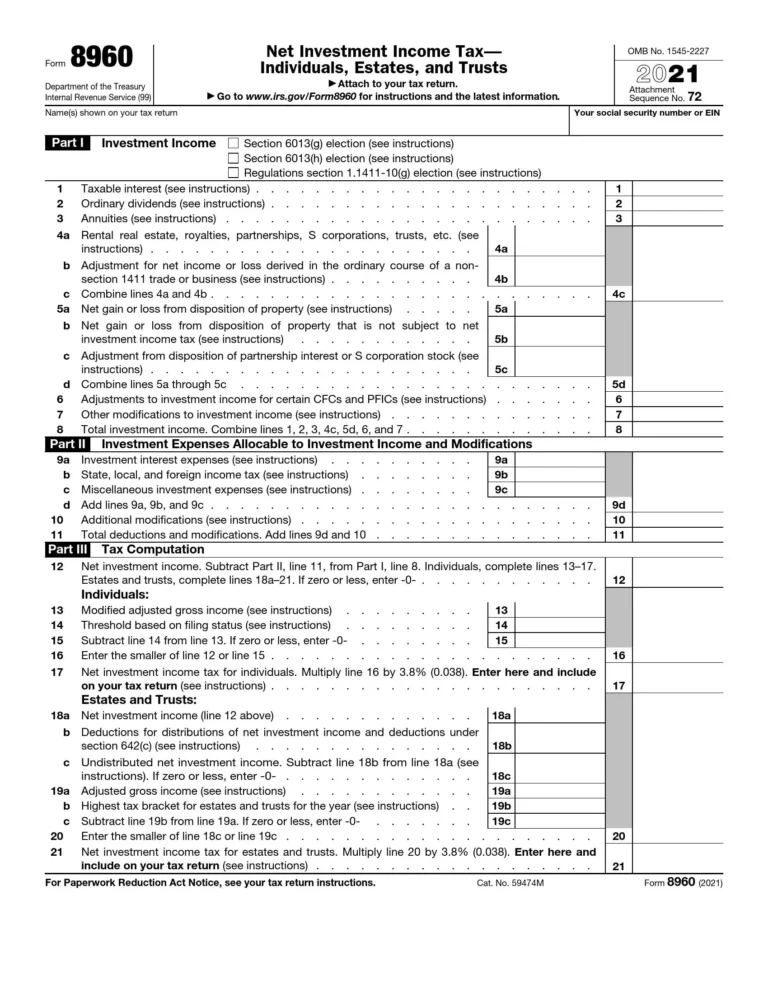

Available Columbus Tax Forms

- Columbus City Income Tax Return (Form CIT-1040)

- Columbus City School District Income Tax Return (Form SD-1040)

- Columbus City School District Property Tax Return (Form PTR-1)

- Franklin County Income Tax Return (Form FCIT-1040)

- Franklin County Real Property Tax Return (Form RPT-1)

Each of these forms has its own specific purpose, so make sure you choose the right one for your situation.

Eligibility Requirements

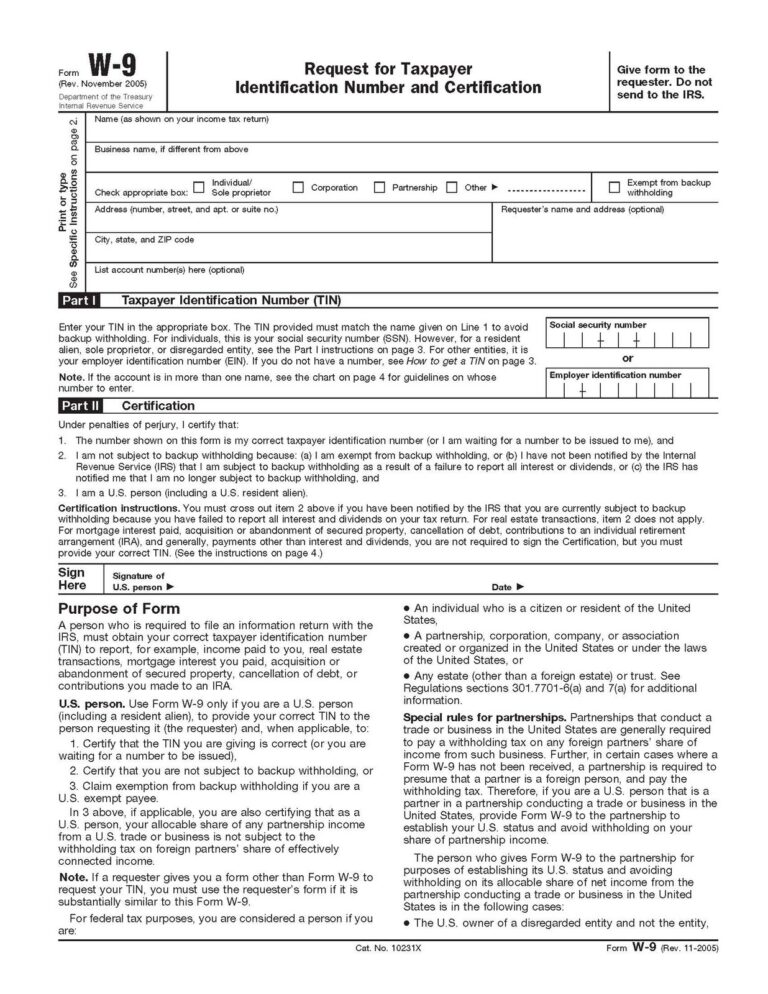

To be eligible to download these free Columbus tax forms, you must meet the following requirements:

- You must be a resident of Columbus, Ohio, or a non-resident who earns income in the city.

- You must have a valid Social Security number or Individual Taxpayer Identification Number (ITIN).

- You must have all of the necessary documentation to support your tax return.

If you meet all of these requirements, you can download the free Columbus tax forms that you need from the City of Columbus website.

Accessing Free Columbus Tax Forms

Accessing free Columbus tax forms online is a straightforward process that requires minimal effort. Here’s a step-by-step guide to help you get started:

1. Visit the official website of the City of Columbus at columbus.gov.

2. Navigate to the ‘Taxes’ section of the website and select ‘Forms’ from the dropdown menu.

3. On the ‘Forms’ page, scroll down to the section titled ‘Individual Income Tax Forms’ or ‘Business Tax Forms,’ depending on your filing status.

4. Locate the specific form you need to download. Most forms are available in PDF format, which requires Adobe Acrobat Reader or a similar software to view and print.

5. Click on the ‘Download’ link next to the form to save it to your computer.

6. Once the download is complete, open the PDF file using Adobe Acrobat Reader or a compatible software.

7. You can now view, print, or fill out the form as needed.

Completing Columbus Tax Forms

Filling out your Columbus tax forms can be a bit of a faff, but it’s important to get it right. Here’s a quick guide to help you avoid any cock-ups.

First off, gather all the info you need. This includes your Social Security number, income, and any deductions or credits you’re claiming. It’s also a good idea to have a copy of your previous year’s tax return handy.

Tips for Completing Columbus Tax Forms

- Use the correct forms. Columbus has its own set of tax forms, so make sure you’re using the right ones.

- Fill out the forms completely. Don’t leave any blanks. If you don’t know the answer to a question, write “N/A” or “Unknown”.

- Sign and date the forms. This is required for your tax return to be valid.

Avoiding Common Errors

- Don’t forget to include your Social Security number. This is a common mistake that can delay your refund.

- Don’t overstate your deductions or credits. This can lead to an audit.

- Don’t file your return late. There’s a penalty for late filing.

Getting Help

If you need help completing your Columbus tax forms, there are a few resources available.

- The Columbus Tax Department offers free tax preparation assistance to low-income residents.

- You can also hire a tax preparer to help you.

Filing Columbus Tax Forms

Columbus tax forms can be filed online, by mail, or in person. Each method has its own set of instructions and deadlines.

Filing Online

- Go to the Columbus City Treasurer’s website and click on the “File Online” link.

- Create an account and log in.

- Follow the instructions to complete and submit your tax forms.

Filing by Mail

- Download the necessary tax forms from the Columbus City Treasurer’s website.

- Complete the forms and mail them to the address provided on the forms.

Filing in Person

- Visit the Columbus City Treasurer’s office in person.

- Bring the completed tax forms with you.

- Submit the forms to a customer service representative.

Deadlines and Consequences of Late Filing

- The deadline for filing Columbus tax forms is April 15th.

- Late filing may result in penalties and interest charges.

Additional Resources for Columbus Taxpayers

There are numerous resources available to assist Columbus taxpayers in completing their tax forms accurately and efficiently. These resources include tax preparation assistance, online calculators, and frequently asked questions (FAQs).

Tax Preparation Assistance

The City of Columbus offers free tax preparation assistance to low- and moderate-income residents. This assistance is provided through a partnership with the IRS Volunteer Income Tax Assistance (VITA) program. VITA volunteers are trained to help taxpayers with basic tax returns and can provide guidance on a variety of tax-related issues. To find a VITA site near you, visit the IRS website or call 1-800-906-9887.

Online Calculators

The City of Columbus website provides a variety of online calculators that can help taxpayers estimate their tax liability and make informed decisions about their finances. These calculators include:

- Income tax calculator

- Property tax calculator

- Sales tax calculator

- Vehicle registration fee calculator

FAQs

The City of Columbus website also provides a comprehensive list of FAQs that address common tax-related questions. These FAQs cover a wide range of topics, including:

- Who is required to file a Columbus tax return?

- What are the deadlines for filing Columbus tax returns?

- How can I get a copy of my Columbus tax return?

- What are the penalties for filing a late or incorrect Columbus tax return?

If you have any questions about Columbus taxes that are not answered on the City of Columbus website, you can contact the Columbus Department of Finance at (614) 645-7321.

Frequently Asked Questions

What are the benefits of using free Columbus tax forms?

Free Columbus tax forms offer several advantages, including cost savings, ease of use, and accuracy.

Who is eligible to access free Columbus tax forms?

All Columbus residents are eligible to download and use free tax forms.

How do I access free Columbus tax forms?

Free Columbus tax forms can be accessed online through the City of Columbus website.

What information do I need to gather before completing Columbus tax forms?

Before completing Columbus tax forms, gather your Social Security number, income information, and any necessary deductions or credits.

Where can I find additional resources for Columbus taxpayers?

The City of Columbus website provides a range of resources for taxpayers, including tax preparation assistance, online calculators, and FAQs.