Free Co Tax Forms Download: A Comprehensive Guide

Navigating the complexities of tax preparation can be daunting, especially when faced with the costs associated with obtaining tax forms. Fortunately, there is a solution: free Co tax forms download. These forms, readily available online, offer a convenient and cost-effective alternative to paid options, empowering individuals and businesses to file their taxes with ease.

In this comprehensive guide, we will delve into the world of free Co tax forms download, exploring their benefits, types, and where to find them. We will also provide practical tips to ensure accurate and efficient form completion, leaving you equipped with the knowledge to tackle tax season with confidence.

Benefits of Using Free Co Tax Forms

If you’re like most people, you probably don’t look forward to doing your taxes. But it’s a necessary evil, and it’s important to make sure you do them correctly. One way to save money on your taxes is to use free Co tax forms.

There are several advantages to using free Co tax forms. First, they can save you money. Commercial tax software can cost upwards of £100, and even basic versions can cost around £50. If you’re on a tight budget, free tax forms are a great way to save some money.

Convenience and Accessibility

Second, free Co tax forms are convenient and easy to access. You can download them from the Colorado Department of Revenue website, or you can pick them up at your local library or tax office. This makes it easy to get the forms you need, even if you don’t have a computer or internet access.

Types of Free Co Tax Forms

There’s a buncha different types of Co tax forms you can grab for free, bruv. These forms are split into categories based on what they’re for, like your own dosh, your business, or your gaff.

Individual Income Tax Forms

- Form 1040: This is the main form for filing your income tax if you’re a single or married filer.

- Form 1040-EZ: This is a simpler version of the 1040 if your tax situation is pretty straightforward.

- Form 1040-SR: This form is for seniors who are 65 or older.

Business Tax Forms

- Form 1120: This form is for corporations.

- Form 1120-S: This form is for S corporations.

- Form 1065: This form is for partnerships.

- Form 1041: This form is for trusts and estates.

Property Tax Forms

- Form 521: This form is for residential property.

- Form 571-B: This form is for commercial property.

- Form 571-D: This form is for agricultural property.

Where to Find Free Co Tax Forms

Finding free Co tax forms is a breeze these days, thanks to the abundance of reputable websites and online resources.

Official Government Websites

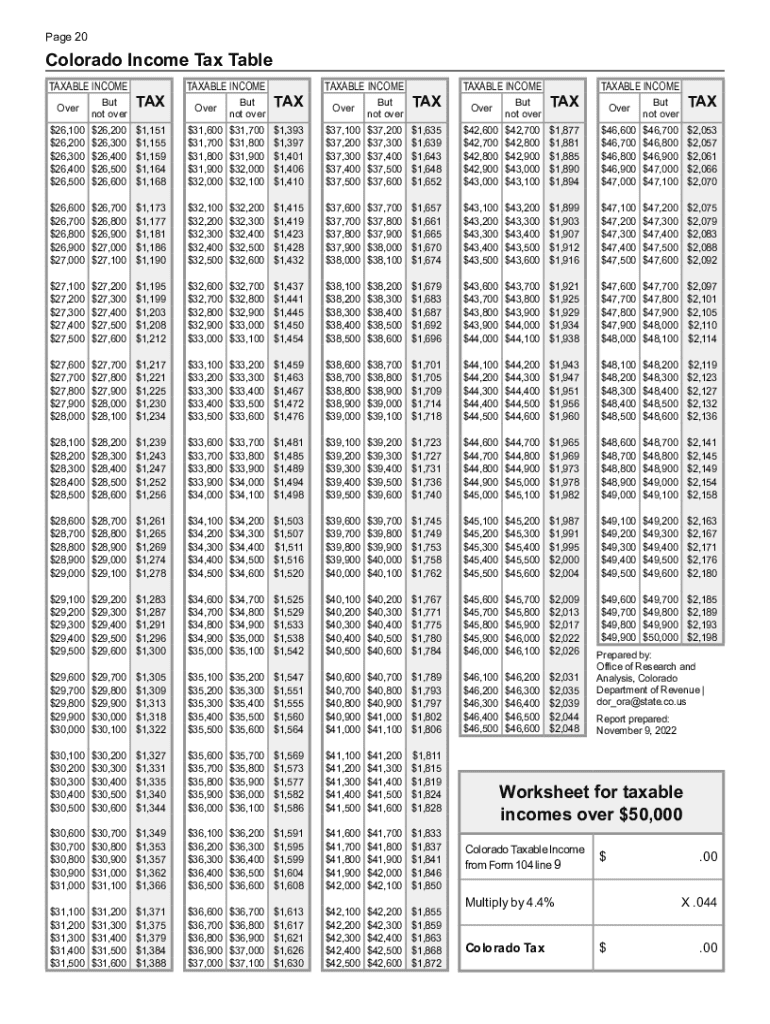

The Colorado Department of Revenue (DOR) website is the go-to source for all things tax-related in the state. Here, you’ll find a treasure trove of free tax forms, including individual income tax returns, business tax returns, and property tax forms.

Tax Preparation Software Providers

Tax preparation software providers like TurboTax and H&R Block offer free downloadable tax forms as well. These forms are typically easy to use and come with helpful instructions, making them a great option for those who prefer a guided tax preparation experience.

Importance of Verifying Authenticity

Before you download any tax forms, it’s crucial to make sure they’re legit. Check the source of the forms and ensure they come from an official government website or a reputable tax preparation software provider. This will guarantee that the forms are accurate and up-to-date.

Tips for Using Free Co Tax Forms

Using free Co tax forms can be a great way to save money and time during tax season. However, it’s important to use them correctly to avoid any costly mistakes. Here are a few tips to help you get the most out of free Co tax forms:

Make sure you’re using the right form. There are different tax forms for different types of income, so it’s important to choose the right one for your situation. You can find a list of all the available Co tax forms on the Colorado Department of Revenue website.

Filling Out the Forms

Fill out the forms completely and accurately. Make sure to answer all the questions and provide all the necessary information. If you’re not sure how to answer a question, you can refer to the instructions on the form or seek help from a tax professional.

Double-check your work before you submit your forms. Make sure you’ve filled out all the forms correctly and that you’ve included all the necessary documentation. This will help you avoid any delays in processing your return.

Getting Help

If you need help filling out your Co tax forms, there are a number of resources available to you. You can contact the Colorado Department of Revenue for assistance, or you can seek help from a tax professional. There are also a number of online resources that can provide you with guidance on how to fill out your forms.

Common Queries

Where can I find reputable websites to download free Co tax forms?

You can find free Co tax forms on official government websites, such as the Internal Revenue Service (IRS) website, and reputable tax preparation software providers, such as TurboTax and H&R Block.

How do I ensure the accuracy of the forms I download?

Before downloading any forms, check the source to ensure it is a trusted and official website. Once downloaded, carefully review the forms for any errors or discrepancies. If you have any concerns, consult with a tax professional for assistance.

What should I do if I need help filling out the forms?

If you encounter difficulties while filling out the forms, there are several resources available to assist you. You can consult online support forums, refer to IRS publications, or seek guidance from a tax professional. They can provide valuable insights and ensure that your forms are completed accurately.