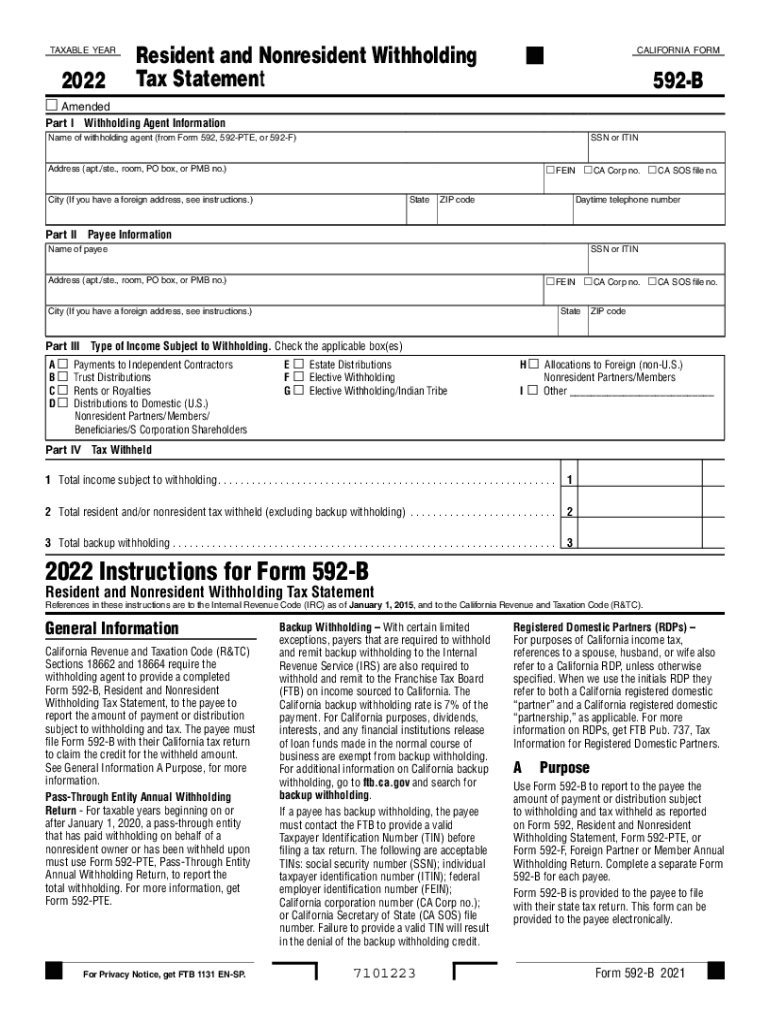

Free California Non Resident Tax Form 2024 Download: A Comprehensive Guide

Filing taxes as a non-resident in California can be a daunting task. But with the right guidance, you can navigate the process seamlessly. This comprehensive guide provides all the essential information you need to download, complete, and file California Non Resident Tax Form 2024.

Understanding the purpose and eligibility criteria for Form 2024 is crucial. We’ll delve into the specific income sources subject to California’s non-resident income tax and guide you through the form’s sections, explaining each field and providing examples to ensure accuracy.

Free California Non Resident Tax Form 2024 Download

This is a complete guide to downloading the free California Non Resident Tax Form 2024. We’ll cover everything you need to know, from where to find the form to how to fill it out. So whether you’re a new resident of California or you’re just visiting for a short time, make sure you have the right tax forms.

Downloading the Form

The California Non Resident Tax Form 2024 is available for download from the California Franchise Tax Board website. To download the form, visit the FTB website and click on the “Forms” tab. Then, scroll down to the “Personal Income Tax” section and click on the link for Form 2024.

Once you have clicked on the link, you will be taken to a page where you can download the form. You can either download the form as a PDF file or you can print it out. If you choose to download the form as a PDF file, you will need to have a PDF reader installed on your computer.

Once you have downloaded the form, you can fill it out and mail it to the FTB. The address for the FTB is:

Franchise Tax Board

PO Box 942849

Sacramento, CA 94249-0037

Eligibility for Using Form 2024

Blud, if you’re not reppin’ California full-time, but you’re still raking in the dough there, you might need to fill in Form 2024. This form’s for non-residents who have to pay up on their California income tax.

Who Needs to File Form 2024?

You’re on the hook for Form 2024 if:

- You’re a non-resident of California, meaning you don’t live there for more than half the year.

- You’ve got income from California sources, like wages, self-employment, or investments.

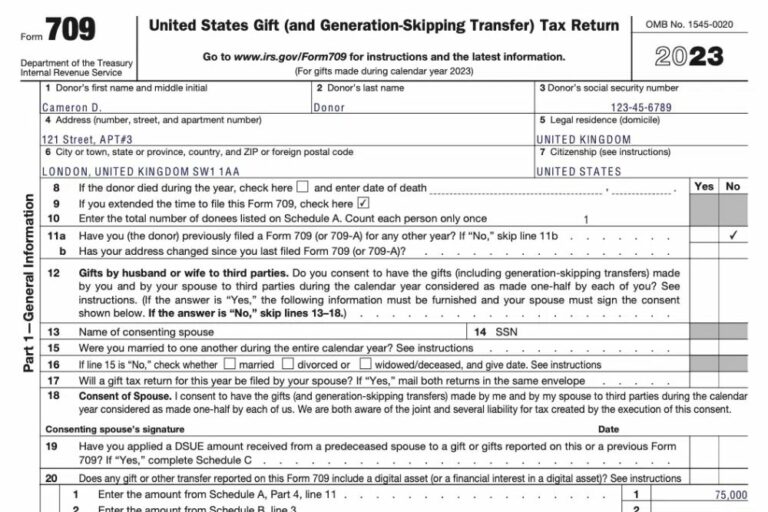

Completing Form 2024

Blud, filling out Form 2024 is a doddle. Just follow these sick steps and you’ll be sorted.

Form Sections

The form’s got three main bits: personal info, income, and tax.

- Personal info: Blag your name, addy, and Social Security number.

- Income: Chuck in your wages, dividends, and any other bread you’ve made.

- Tax: Work out how much dosh you owe the taxman.

Common Errors

Don’t be a donut and make these rookie mistakes:

- Forgetting to sign: Don’t be a tit, sign the form before you send it off.

- Wrong info: Check your deets twice before you submit. Any dodgy info will get you in the slammer.

- Missing docs: Don’t be a numpty, attach all the right bits and bobs.

Filing s

Filing Form 2024 is easy. You can do it online, by mail, or through a tax preparer. The filing deadline is April 15th, but you can file an extension if you need more time.

If you file by mail, you’ll need to include a copy of your federal tax return and any other relevant documents. You can find a list of these documents on the Form 2024 instructions.

Filing Online

- Go to the California Franchise Tax Board website.

- Click on the “File and Pay” tab.

- Select “File My Return Online”.

- Follow the instructions on the screen.

Filing by Mail

- Print out Form 2024 from the California Franchise Tax Board website.

- Fill out the form and sign it.

- Make a copy of your federal tax return and any other relevant documents.

- Mail your return to the following address:

Franchise Tax Board

P.O. Box 942849

Sacramento, CA 94249-0036

Filing Through a Tax Preparer

- Find a tax preparer who is licensed to practice in California.

- Give the tax preparer your federal tax return and any other relevant documents.

- The tax preparer will prepare and file your Form 2024 for you.

Tax Credits and Deductions

Non-residents may be eligible for certain tax credits and deductions on Form 2024. These can help reduce their overall tax liability.

Standard Deduction

The standard deduction is a specific amount that you can deduct from your taxable income before calculating your taxes. For 2024, the standard deduction for non-residents is £12,570. This means that you can reduce your taxable income by this amount before calculating your taxes.

Personal Allowance

The personal allowance is a tax-free amount that you can earn before you start paying taxes. For 2024, the personal allowance for non-residents is £12,570. This means that you don’t have to pay any taxes on the first £12,570 of your income.

Tax Credits

Tax credits are amounts that you can deduct from your tax bill. There are a number of different tax credits available, including:

– The basic tax credit

– The child tax credit

– The working tax credit

You can find out more about tax credits on the GOV.UK website.

Calculating and Claiming Credits and Deductions

To calculate and claim tax credits and deductions, you will need to complete the Form 2024. The form will ask you for information about your income, expenses, and other financial information. Once you have completed the form, you can submit it to HMRC. HMRC will then process your form and calculate your tax liability.

Payment and Refund Options

Non-residents filing Form 2024 have various payment options to settle their tax liabilities. These include electronic payments, mail-in payments, and payments made through a tax professional.

To make an electronic payment, you can use the Franchise Tax Board’s (FTB) online payment system. You will need your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and your California Nonresident Income Tax Return (Form 540NR) or California Nonresident or Part-Year Resident Income Tax Return (Form 540). You can also mail your payment to the FTB using the address provided on the payment voucher.

Requesting a Refund

If you have overpaid your taxes, you are entitled to a refund. To request a refund, you must complete the refund section on Form 2024 and attach it to your tax return. The FTB will process your refund and send it to you via direct deposit or mail.

Resources and Support

If you need assistance with Form 2024, there are several resources and support options available.

California Franchise Tax Board

– The California Franchise Tax Board (FTB) provides a variety of resources to help non-residents with Form 2024. You can visit the FTB website, call the FTB at 1-800-852-5711, or visit a local FTB office.

Other Organizations

– In addition to the FTB, there are a number of other organizations that can provide assistance with Form 2024. These organizations include:

– The California Society of CPAs

– The National Association of Tax Professionals

– The American Institute of Certified Public Accountants

Frequently Asked Questions

What is the purpose of Form 2024?

Form 2024 is used by non-residents to report their California income and calculate their California income tax liability.

Who is required to file Form 2024?

Non-residents with California-sourced income above certain thresholds are required to file Form 2024.

Where can I download Form 2024?

Form 2024 can be downloaded from the California Franchise Tax Board website.

What are the common errors to avoid when filling out Form 2024?

Common errors include incorrect calculation of income, failure to claim eligible deductions and credits, and missing the filing deadline.