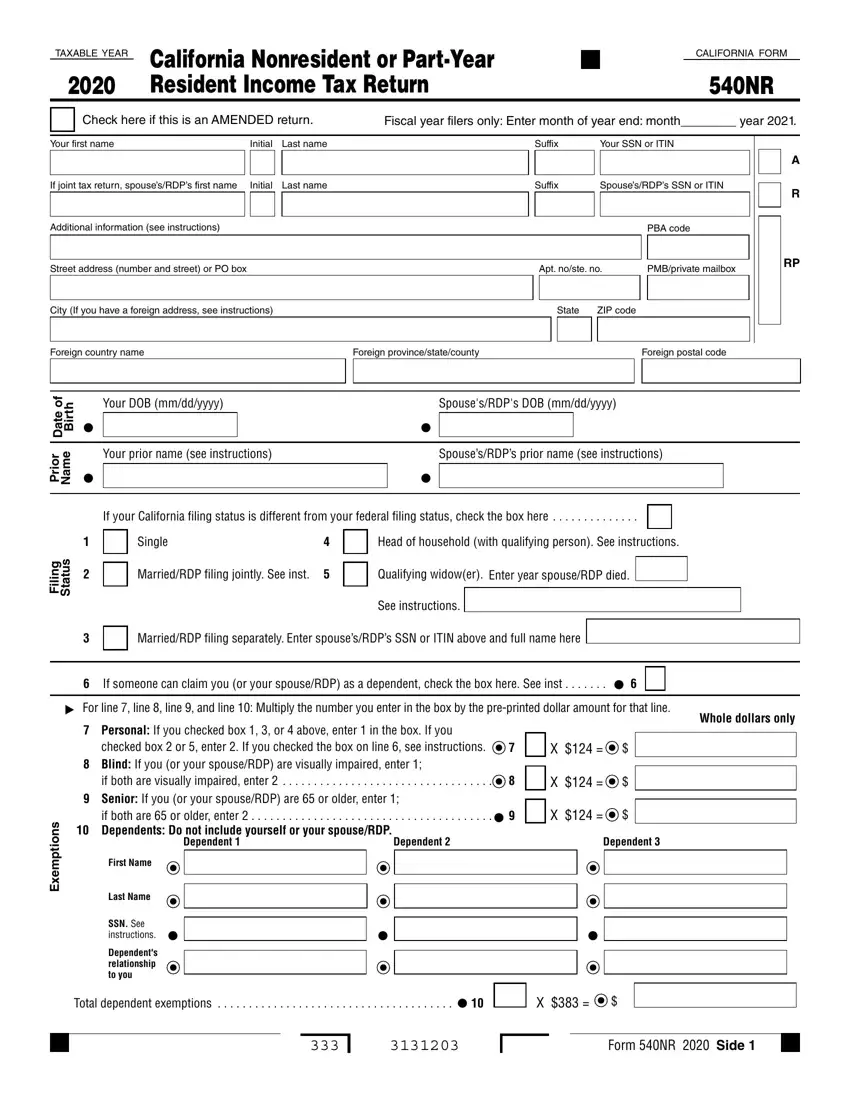

Free Ca Form 540nr Download: A Comprehensive Guide

Navigating the complexities of tax filing can be daunting, especially for non-residents. However, understanding and completing Form 540NR is crucial for non-residents with California source income. This guide will provide a comprehensive overview of Form 540NR, from its purpose and eligibility to downloading, filling out, and filing the form accurately. By following our step-by-step instructions and addressing common mistakes, you can ensure a smooth and compliant tax filing experience.

Free Ca Form 540nr Overview

Yo, check it, Form 540NR is a tax form that’s like the golden ticket for non-resident aliens (NRAs) living in California, blud. It’s like a passport to sorting out your taxes in the Golden State, innit?

If you’re an NRA, you need to file Form 540NR to declare your income earned in California. This includes wages, self-employment income, and other types of cheddar you might have stashed away. It’s like showing the taxman what you’re working with, so he can calculate how much dough you owe.

Who’s Eligible?

Not everyone can roll with Form 540NR, fam. You gotta meet certain criteria to be eligible:

- You must be a non-resident alien, meaning you don’t have a permanent home in California.

- You must have earned income in California during the tax year.

- You must not be a dependent on someone else’s tax return.

Form 540nr Sections and s

Form 540NR is divided into several sections, each with a specific purpose. Understanding these sections and s will help you fill out the form accurately and avoid errors.

The main sections of Form 540NR include:

Personal Information

- This section collects basic personal information, such as your name, address, and Social Security number.

- Ensure all information matches your official records, including your passport and visa.

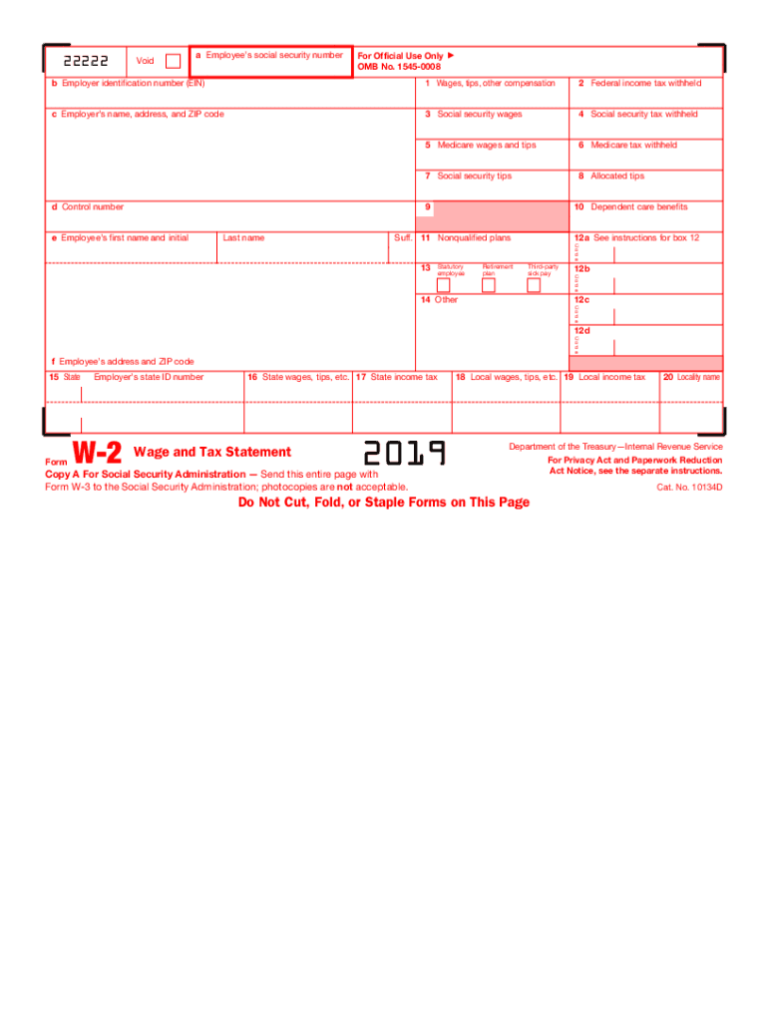

Income

- This section includes various schedules for reporting different types of income, such as wages, self-employment income, and investment income.

- Refer to the specific instructions for each schedule to determine which one applies to your situation.

Deductions and Credits

- This section allows you to claim eligible deductions and credits that can reduce your taxable income.

- Common deductions include the standard deduction, itemized deductions, and certain business expenses.

Tax Calculation

- This section calculates your tax liability based on your taxable income and applicable tax rates.

- The form provides instructions and tables to help you determine your tax.

Payments and Refunds

- This section includes information about any estimated tax payments you made during the year and any refunds you may be entitled to.

- Ensure you have accurate records of your payments and any applicable documentation.

Signatures

- This section requires your signature and the signature of a paid preparer, if applicable.

- Review the form carefully before signing to ensure all information is correct.

Common Mistakes to Avoid

Filling out Form 540NR can be a bit of a minefield, especially if you’re not used to dealing with tax forms. To help you out, here are some of the most common mistakes people make when completing this form, along with some tips on how to avoid them.

By being aware of these common pitfalls, you can increase your chances of getting your tax return processed quickly and accurately.

Incorrectly claiming residency status

One of the most common mistakes people make is incorrectly claiming residency status. This can lead to you paying more taxes than you should, or even being denied a refund. To avoid this mistake, make sure you carefully review the residency requirements before you file your return.

Not reporting all of your income

Another common mistake is not reporting all of your income. This can include income from sources outside the United States, such as wages, dividends, or interest. If you fail to report all of your income, you could end up owing taxes on it.

Taking deductions that you’re not eligible for

There are a number of deductions that you may be able to take on your tax return, but not everyone is eligible for all of them. If you take deductions that you’re not eligible for, you could end up owing taxes on the amount of the deduction.

Making math errors

Math errors are another common mistake that people make when completing their tax returns. These errors can lead to you paying more taxes than you should, or even being denied a refund. To avoid this mistake, make sure you carefully check your math before you file your return.

Filing late

Filing your tax return late can lead to penalties and interest charges. To avoid this mistake, make sure you file your return by the deadline. You can file an extension if you need more time, but you must do so before the deadline.

Resources and Support

If you need help understanding or completing Form 540NR, there are plenty of resources available to you.

Online Guides and FAQs

The California Franchise Tax Board (FTB) has a website with a variety of resources to help you with Form 540NR, including:

– Online guides that explain the form and its instructions in detail

– FAQs that answer common questions about the form

– A searchable database of tax forms and publications

Tax Professionals

If you need more help, you can also contact a tax professional. Tax professionals can help you with a variety of tasks, including:

– Preparing and filing your tax return

– Answering your questions about the tax code

– Representing you in an audit

Online Forums and Communities

There are also a number of online forums and communities where you can connect with other filers and seek support. These forums can be a great way to get answers to your questions and learn from the experiences of others.

Q&A

What is the purpose of Form 540NR?

Form 540NR is a tax return form specifically designed for non-residents who have income sourced from California.

Who is eligible to file Form 540NR?

Individuals who are not legal residents of California but have earned income from California sources are eligible to file Form 540NR.

Where can I download Form 540NR?

Form 540NR can be downloaded from the official California Franchise Tax Board (FTB) website.

What are the common mistakes to avoid when filling out Form 540NR?

Common mistakes include incorrect residency status, inaccurate income reporting, and missed deadlines. Carefully review the instructions and consult professional assistance if needed to avoid these errors.