Free Az Withholding Form 2024 Download: A Comprehensive Guide

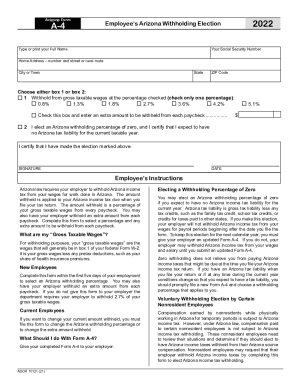

Navigating the complexities of Arizona withholding can be a daunting task, but with the right resources, it doesn’t have to be. The Arizona Department of Revenue’s Form 2024, Arizona Withholding Tax Return, is a crucial document for accurately calculating and remitting withholding taxes. To ensure you have the most up-to-date version and avoid any potential tax issues, it’s essential to download the latest Form 2024. In this comprehensive guide, we’ll provide you with all the necessary information and resources to download and complete Form 2024 seamlessly.

Whether you’re a seasoned taxpayer or just starting out, this guide will empower you with the knowledge and confidence to handle Arizona withholding efficiently. So, let’s dive right in and explore the world of Form 2024!

Step-by-Step Download Guide

If you’re after the Form 2024, brace yourself for this right bangin’ guide. We’ll break it down step by step, blud, so you can grab it like a pro.

- First off, head to the Internal Revenue Service (IRS) website. It’s the official crib for all things tax, innit.

- Once you’re there, do a cheeky search for “Form 2024.” It’s like finding a needle in a haystack, but you’ll get there.

- When you’ve found it, click the “Download” button. Easy as pie, bruv.

- Save the file to your computer or device. Remember where you put it, or you’ll be hunting for it like a lost puppy.

- Open up the file using a PDF reader like Adobe Acrobat or Preview on a Mac. Boom, you’ve got the Form 2024 right there.

Now that you’ve got your hands on the form, it’s time to get your fill in. Good luck, mate!

Filling Out the Form

Completing Form 2024 requires careful attention to each section. Understanding the purpose of each field and following these tips will ensure an accurate submission.

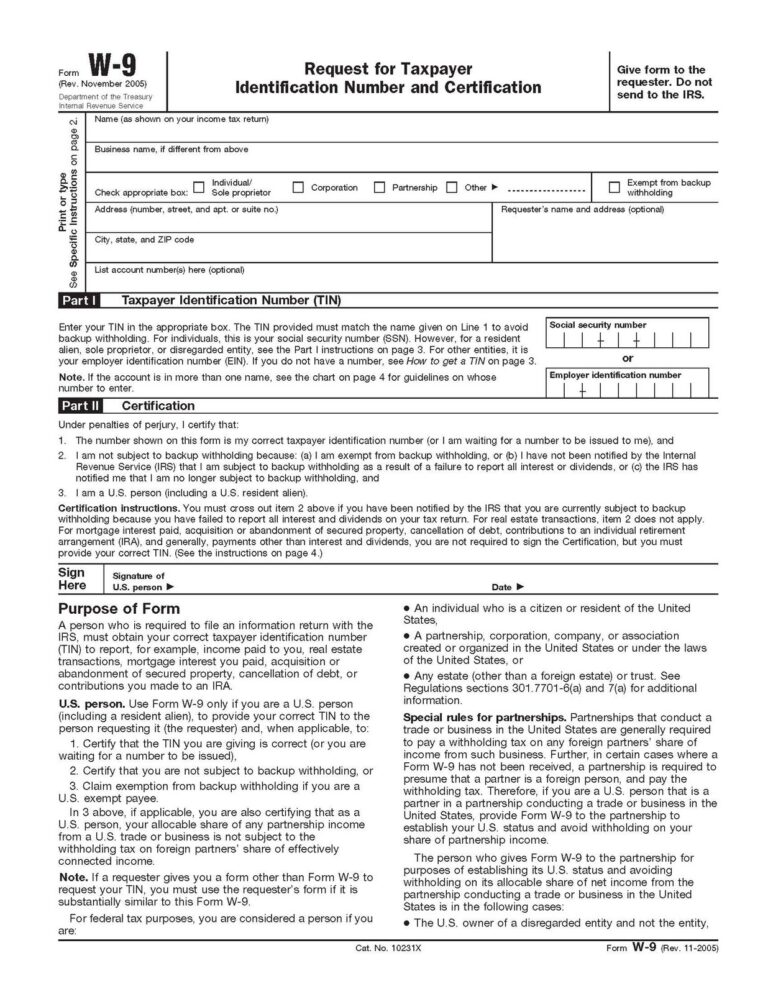

Personal Information

Enter your full name, address, and contact information as it appears on your official identification documents.

Income Information

List all sources of income, including wages, salaries, dividends, and interest. Be sure to provide the correct amounts and tax identification numbers for each.

Deductions and Credits

Itemize any eligible deductions or credits that reduce your taxable income. Common deductions include mortgage interest, charitable contributions, and retirement savings.

Payment Information

Indicate the amount of withholding tax you have already paid and any estimated tax payments you have made. This information will help determine your refund or balance due.

Signature and Date

Sign and date the form in the designated area. This verifies the accuracy of the information provided and authorizes the IRS to process your return.

Filing and Submission

Once you’ve filled out Form 2024, you need to file it with the Arizona Department of Revenue. You can do this by mail or electronically.

Filing Deadlines and Penalties

The deadline for filing Form 2024 is April 15th. If you file late, you may have to pay penalties and interest.

Filing Options

By Mail

You can mail Form 2024 to the following address:

Arizona Department of Revenue

P.O. Box 29040

Phoenix, AZ 85038-9040

Electronically

You can also file Form 2024 electronically through the Arizona Department of Revenue’s website.

Common Queries

Q: Where can I download the latest version of Form 2024?

A: You can download the latest version of Form 2024 directly from the Arizona Department of Revenue’s website at https://azdor.gov/Forms-Publications/Forms/Withholding-Forms.

Q: What information do I need to fill out Form 2024?

A: To fill out Form 2024 accurately, you’ll need your federal employer identification number (FEIN), legal business name, address, and contact information. You’ll also need to provide details about your employees’ wages, withholding allowances, and tax payments.

Q: When is the deadline to file Form 2024?

A: The deadline to file Form 2024 is April 15th for the previous calendar year. If you file electronically, the deadline is extended to April 30th.