Free Af 2096 Form Download: A Comprehensive Guide

Navigating the complexities of business operations can be a daunting task, but having the right tools can make all the difference. Form 2096 is an essential document that plays a crucial role in streamlining various business processes. This comprehensive guide will provide you with all the information you need to download, complete, and utilize Form 2096 effectively.

Delving into the world of Form 2096, we will explore its significance, structure, and content. We will guide you through the step-by-step process of downloading and filling out the form, ensuring accuracy and efficiency. Additionally, we will discuss common errors and troubleshooting tips to help you avoid potential pitfalls.

Overview

Form 2096, also known as the “Application for Transfer of Residence”, is a crucial document in the context of business operations, particularly for those involving international relocations.

This form serves as an official request submitted to the relevant immigration authorities by individuals seeking to transfer their residency to a new country. It plays a pivotal role in facilitating the legal and orderly movement of individuals across borders, ensuring compliance with immigration laws and regulations.

Key Features of Form 2096

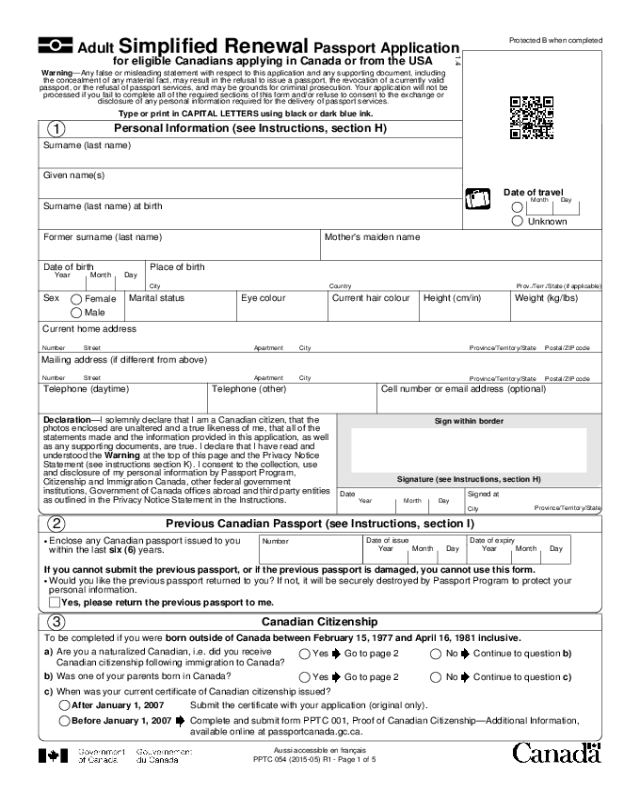

Form 2096 typically includes the following key features:

- Personal information of the applicant, including their full name, date of birth, nationality, and current address.

- Details of the intended new country of residence.

- Purpose of the relocation, such as employment, education, or family reunification.

- Supporting documentation, such as proof of employment, admission letters, or marriage certificates.

- Signature and date of submission.

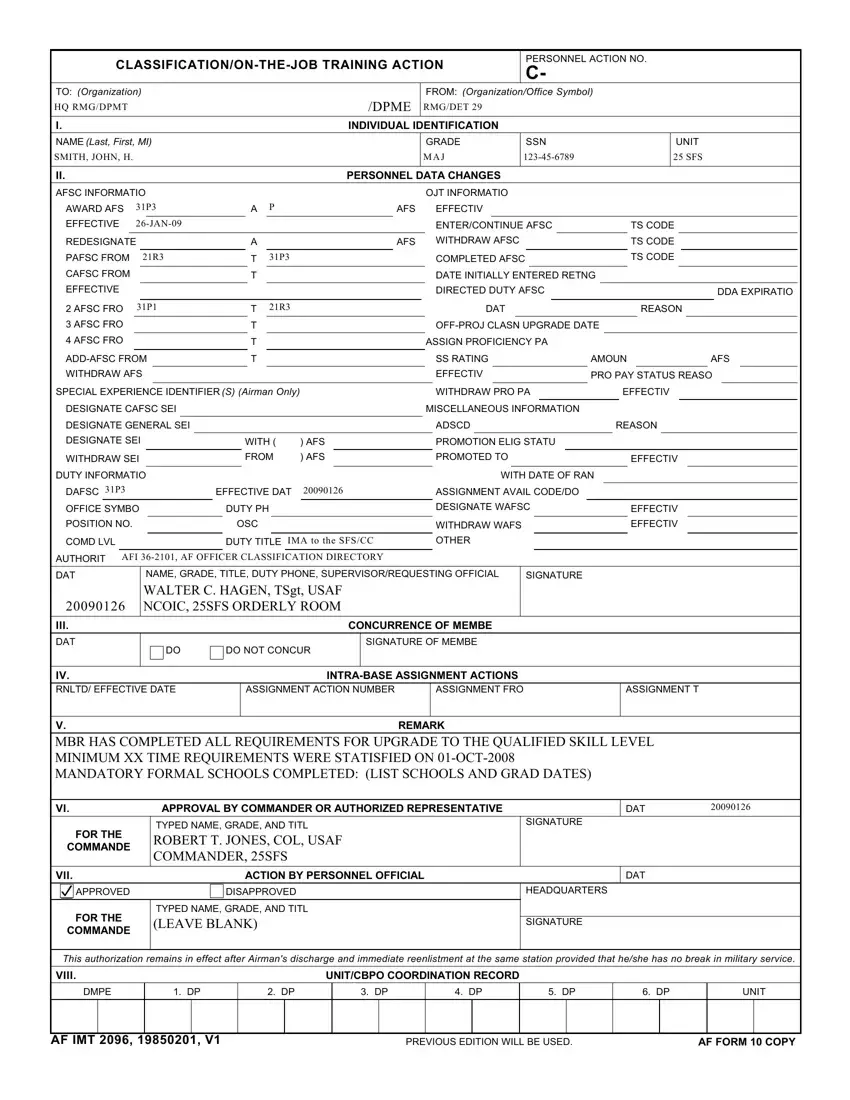

Form Structure and Content

Form 2096 comprises various sections, each serving a specific purpose in capturing information for tax purposes. Understanding the structure and content of each section is crucial for accurate completion of the form.

The sections and fields included in Form 2096 are Artikeld below:

Part 1: Personal Information

- This section gathers basic personal details, such as name, address, National Insurance number, and contact information.

- It’s essential to provide accurate information in this section to ensure proper identification and communication.

Part 2: Income and Expenses

- This section focuses on reporting income from various sources, including employment, self-employment, investments, and benefits.

- Additionally, it includes details of allowable expenses incurred in generating the income.

- Accurate reporting of income and expenses is vital for calculating the correct tax liability.

Part 3: Tax Calculation

- Based on the income and expenses reported in Part 2, this section calculates the tax liability using the appropriate tax rates and allowances.

- It also includes details of any tax credits or deductions claimed.

- Understanding the tax calculation process helps ensure the accuracy of the final tax liability.

Part 4: Payments and Repayments

- This section records any payments made towards tax liability, such as PAYE deductions or self-assessment payments.

- It also includes details of any tax refunds or repayments due.

- Reconciling payments and repayments ensures proper accounting and timely resolution of any outstanding tax obligations.

Part 5: Declarations and Signatures

- This section requires the taxpayer to declare the accuracy and completeness of the information provided in the form.

- It also includes space for signatures and the date of submission.

- Proper completion of this section ensures the validity and authenticity of the tax return.

Common Errors and Troubleshooting

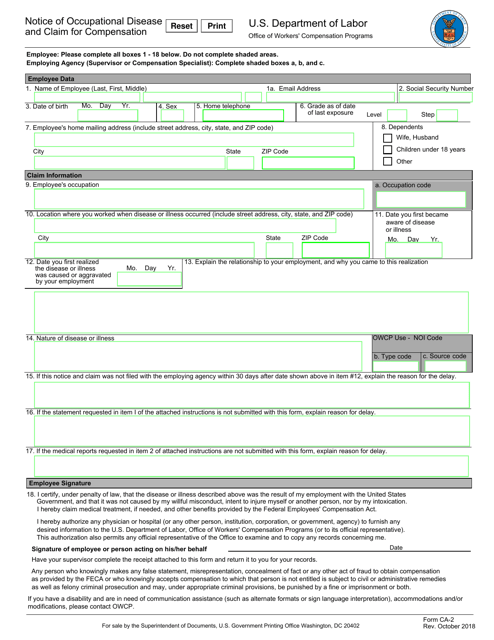

Filling out Form 2096 correctly is essential to avoid delays or rejections. Here are some common mistakes to watch out for and how to fix them:

Mistakes can happen, but with a bit of care and attention, you can make sure your Form 2096 is accurate and complete. If you do encounter any problems, don’t hesitate to seek help from a qualified professional.

Incorrect Information

Providing incorrect or incomplete information is a common error that can delay processing. Ensure you carefully review all details, including personal information, income, and deductions. If you make a mistake, simply cross out the incorrect information and write the correct details legibly.

Missing Signatures

All required signatures must be included for the form to be valid. Make sure both the taxpayer and the preparer (if applicable) have signed and dated the form. If a signature is missing, the form will be returned for completion.

Incomplete Sections

Leaving sections of the form blank can also cause delays. Carefully review the form and ensure all applicable sections are completed. If a section is not applicable to you, write “N/A” or “Not Applicable” to indicate this.

Incorrect Calculations

Mathematical errors can also lead to problems. Double-check all calculations, especially when dealing with complex formulas or large numbers. If you are unsure about a calculation, seek professional assistance.

Supporting Documentation

In some cases, you may need to provide supporting documentation to support the information provided on the form. Make sure you attach all necessary documents, such as proof of income or deductions. If you fail to provide supporting documentation, your form may be rejected.

Benefits and Applications

Blud, listen up. Form 2096 ain’t just a bit of paper, it’s a game-changer for your biz. It’s like having a cheat code that makes everything run smoother than a fresh fade.

This form’s gonna streamline your operations like a boss. It’ll help you keep track of your bread, manage your expenses, and make sure your books are squeaky clean. It’s the perfect way to get your business on point and keep it there.

Example 1: Tracking Your Bread

Need to know where your dough’s going? Form 2096’s got you covered. It’ll show you exactly how much you’re making, where it’s coming from, and where it’s going. No more guessing games or late-night panic attacks about your finances.

Example 2: Managing Your Expenses

Sick of receipts piling up on your desk? Form 2096 will sort that out. It’s like having a personal assistant who keeps all your expenses organized and ready to go. You’ll know exactly what you’re spending, when you spent it, and why.

Example 3: Keeping Your Books Clean

Tax season got you feeling stressed? Not with Form 2096. It’ll keep your books in tip-top shape, making it a breeze to file your taxes. The taxman will be so impressed, he might even give you a high-five.

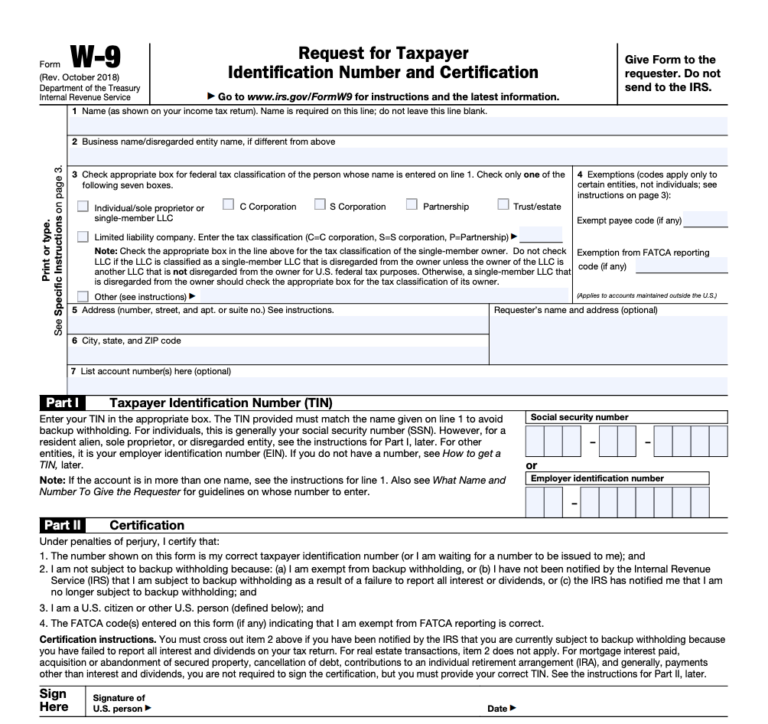

Alternatives and Considerations

There are other ways to get the same info that’s on Form 2096. Let’s check out the pros and cons of each option so you can pick the best one for you.

Online Resources

The internet is a treasure trove of information, and you can find a lot of helpful resources online. Some websites and forums have copies of Form 2096 that you can download and fill out.

- Pros: Easy to access, free to use, can be filled out and submitted electronically.

- Cons: May not be the most up-to-date version of the form, may not be accepted by all organisations.

Government Agencies

You can also get a copy of Form 2096 from government agencies. The Social Security Administration (SSA) and the Internal Revenue Service (IRS) both have copies of the form that you can download or request by mail.

- Pros: Official and up-to-date version of the form, free to obtain.

- Cons: May take some time to receive the form by mail.

Libraries

Libraries are another great place to find a copy of Form 2096. Many libraries have a reference section where you can find a variety of forms and documents.

- Pros: Free to use, can be accessed in person or online.

- Cons: May not have the most up-to-date version of the form.

Common Queries

What are the benefits of using Form 2096?

Form 2096 offers numerous benefits, including streamlining business processes, improving efficiency, reducing errors, and enhancing communication between departments.

Where can I find reputable sources to download Form 2096?

Reputable sources for downloading Form 2096 include the official government website, legal document repositories, and trusted business software providers.

What are common errors to avoid when completing Form 2096?

Common errors include incorrect data entry, missing information, and failing to attach required documents. Carefully review the form before submission to minimize errors.

How can I troubleshoot errors in Form 2096?

If you encounter errors, check for incorrect data entry, missing information, or formatting issues. If the problem persists, contact the relevant authority or software provider for assistance.

Are there alternatives to using Form 2096?

Yes, there may be alternative methods or software solutions that provide similar functionality to Form 2096. Consider factors such as cost, accessibility, and accuracy when exploring alternatives.