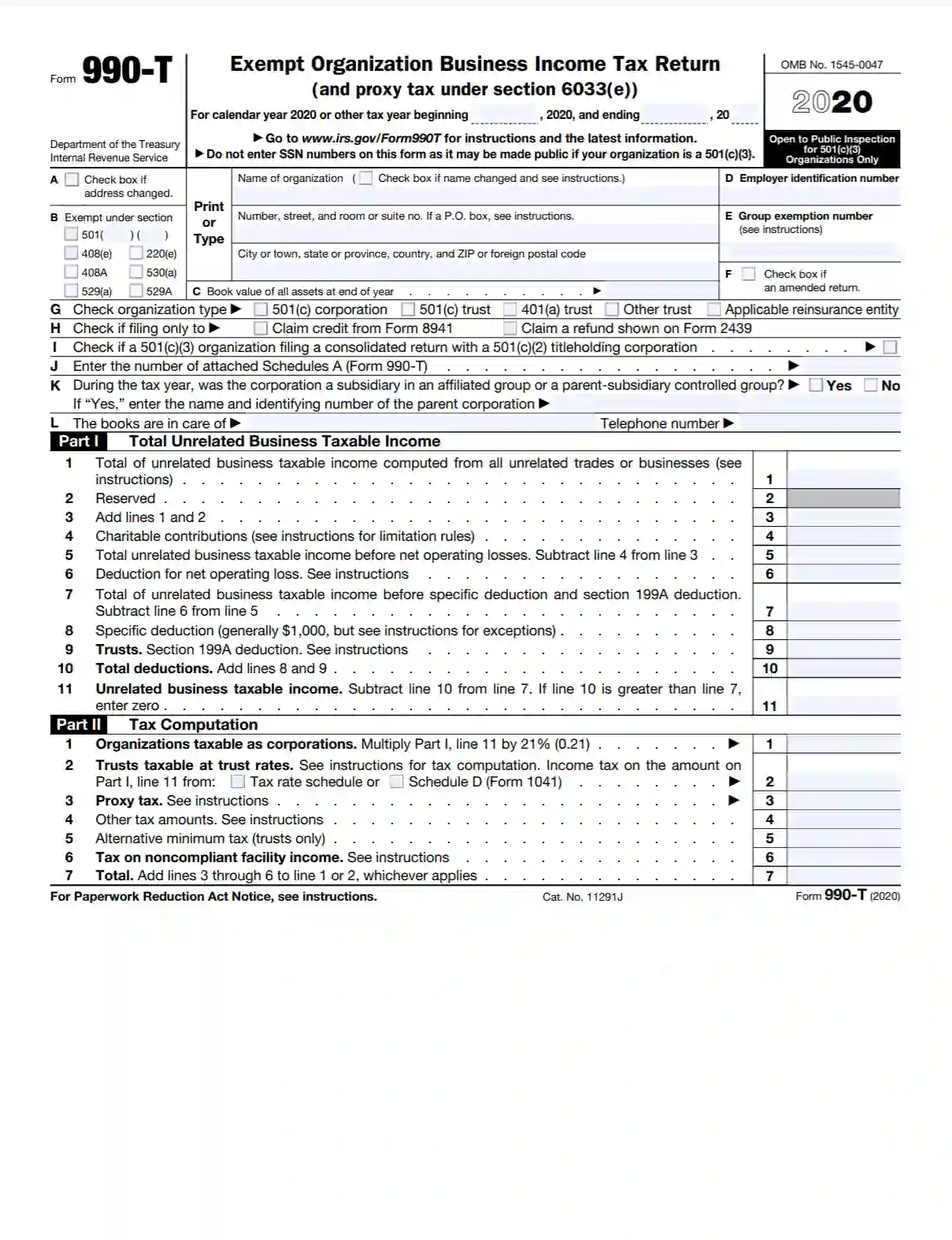

Free 990-t Form Download: A Comprehensive Guide for Tax Filers

Navigating the complexities of tax filing can be a daunting task, but it doesn’t have to be. With the availability of free 990-t forms, individuals and organizations can simplify their tax filing process while ensuring accuracy and compliance.

This comprehensive guide will provide you with all the essential information you need to download, understand, and complete the 990-t form. We will cover where to find the free form, the different sections and fields it comprises, and the benefits of using this digital resource. Additionally, we will address common mistakes to avoid and provide links to helpful resources for further support.

Common Mistakes to Avoid

Completing the 990-t form might seem like a daunting task, but by steering clear of common pitfalls, you can ensure a smooth submission.

Here are some blunders to dodge:

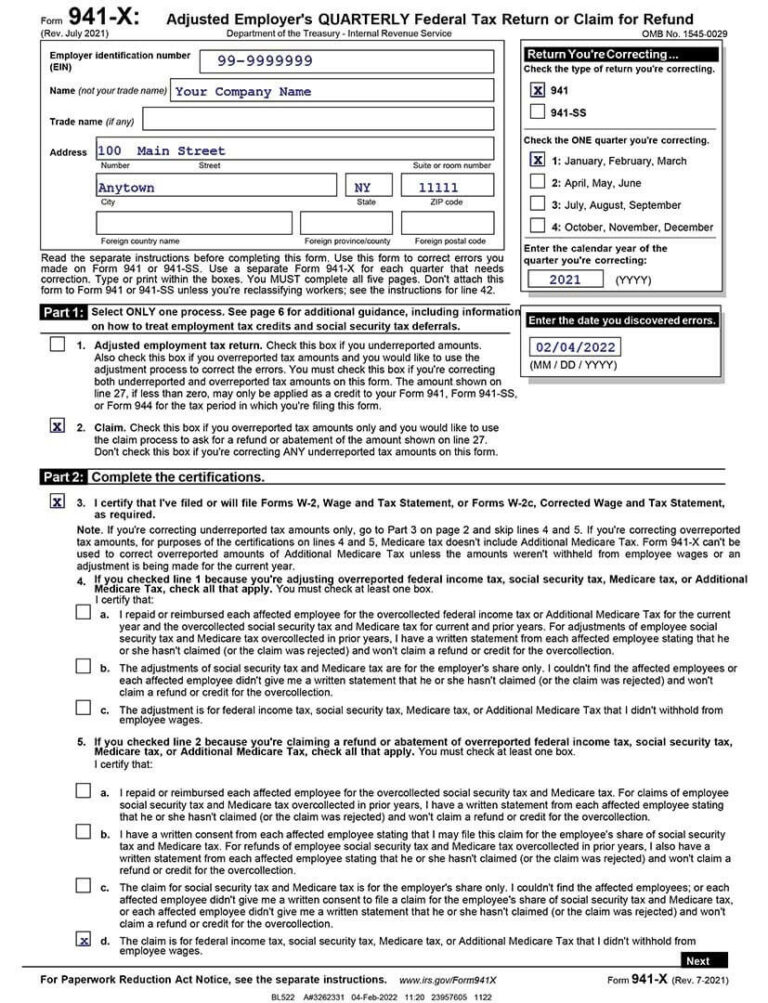

Not Providing a Valid EIN

Your Employer Identification Number (EIN) is crucial for the IRS to identify your organization. Make sure you enter the correct 9-digit EIN.

Incorrectly Reporting Gross Receipts

Gross receipts represent the total income your organization has generated. Ensure you accurately report this amount to avoid discrepancies.

Misclassifying Expenses

Expenses should be categorized correctly to comply with IRS regulations. Avoid mixing up different types of expenses, such as program expenses and administrative costs.

Failing to File on Time

Timeliness is of the essence. Missing the filing deadline can result in penalties. Mark your calendars and submit your form promptly.

Incomplete or Inaccurate Information

Incomplete or inaccurate information can delay the processing of your form. Double-check all the details you provide to ensure they are complete and correct.

Additional Resources and Support

Completing the 990-t form can be a daunting task, but there are plenty of resources available to help you through the process. Here are a few places where you can find assistance:

- The IRS website has a wealth of information on the 990-t form, including instructions, FAQs, and a fillable form.

- The Taxpayer Advocate Service can provide free assistance to taxpayers who are having trouble with the 990-t form.

- Many tax preparation software programs include features that can help you complete the 990-t form.

- There are also a number of online forums where you can ask questions and get help from other taxpayers.

Assistance Programs

If you need additional assistance completing the 990-t form, there are a number of assistance programs available. These programs can provide you with free or low-cost help from trained volunteers.

- The Volunteer Income Tax Assistance (VITA) program offers free tax preparation services to low-income taxpayers.

- The Tax Counseling for the Elderly (TCE) program offers free tax preparation services to seniors.

- The IRS also offers a number of low-income taxpayer clinics where you can get free help completing your tax return.

Answers to Common Questions

Where can I download the free 990-t form?

You can download the free 990-t form from the official IRS website at irs.gov.

What are the benefits of using the free 990-t form?

Using the free 990-t form offers several benefits, including cost savings, convenience, and accessibility.

What are some common mistakes to avoid when completing the 990-t form?

Common mistakes to avoid include errors in calculations, incomplete or inaccurate information, and missing signatures.