Free 940 Federal Form Download: A Comprehensive Guide

Navigating the complexities of federal tax forms can be daunting, but with the 940 Federal Form, you can streamline the process of reporting unemployment taxes and wages. This free and accessible form plays a crucial role in ensuring compliance and accuracy in tax reporting. In this guide, we will delve into the significance of the 940 Federal Form, explore the various methods for downloading it, and provide expert tips for completing it effortlessly.

Whether you’re a business owner, an individual filer, or simply seeking a deeper understanding of the 940 form, this comprehensive guide has everything you need to know. From understanding its structure to troubleshooting common issues, we’ve got you covered. So, let’s dive right in and make tax season a breeze!

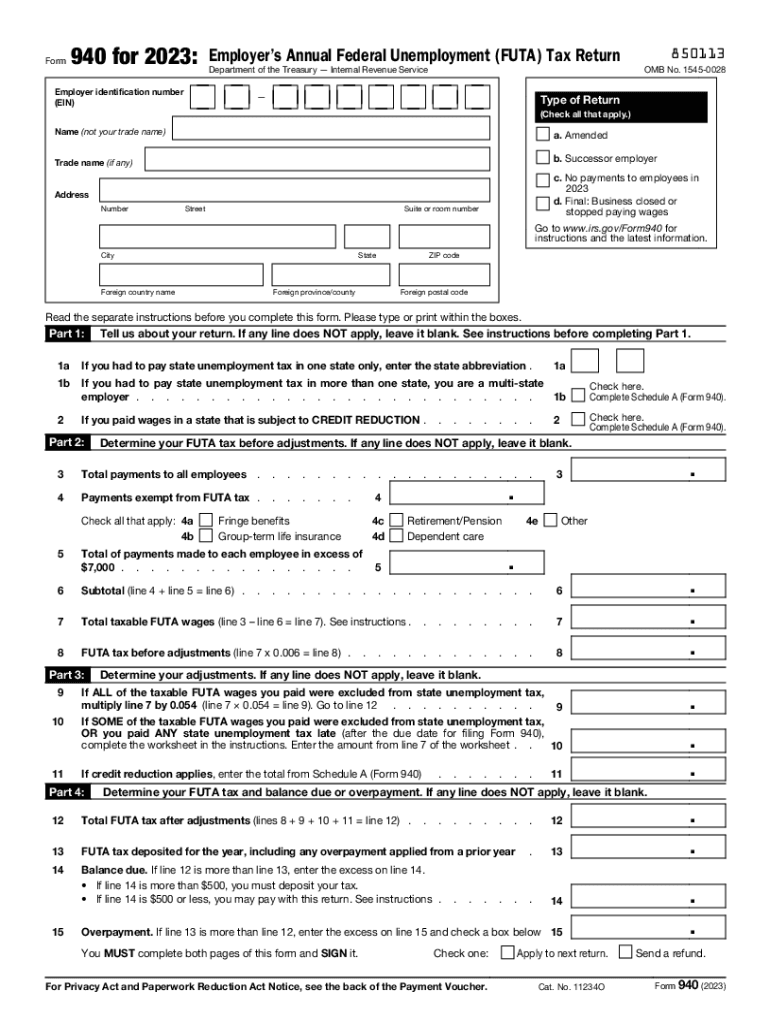

Applications and Uses of the 940 Federal Form

Fam, the 940 Federal Form is a right handy tool that’s used to report unemployment taxes and wages. It’s like a lil’ tax assistant that helps businesses and peeps stay on top of their tax responsibilities.

But hold up, there’s more to it than just taxes. The 940 Form is also a way for businesses to show how much they’ve paid their employees and how much they owe in unemployment taxes. It’s like a snapshot of a company’s payroll situation.

Reporting Unemployment Taxes

When a business hires peeps, it’s their responsibility to pay unemployment taxes. These taxes help support peeps who’ve lost their jobs and are looking for new ones. The 940 Form is how businesses report these taxes to the government.

The form is broken down into four quarters, so businesses need to file it four times a year. They need to report how much they paid their employees and how much they owe in taxes for each quarter.

Reporting Wages

The 940 Form also collects data on how much businesses pay their employees. This info is used by the government to track employment trends and make sure businesses are paying their fair share of taxes.

Businesses need to report the total amount of wages they paid their employees during each quarter. They also need to report the number of employees they had on their payroll.

Benefits for Businesses and Individuals

Using the 940 Federal Form can be a real lifesaver for businesses and individuals. Here’s the lowdown on how it can help:

- Businesses: The 940 Form helps businesses stay compliant with tax laws. It also provides them with a record of their payroll expenses and unemployment tax payments.

- Individuals: The 940 Form can help individuals track their unemployment benefits. It can also be used to prove income when applying for loans or other financial assistance.

Troubleshooting and Support for 940 Federal Form Download

Blag it, mate! If you’re having a right mare downloading the 940 Federal Form, don’t fret. This cheeky guide will help you sort it out in no time.

First off, check your internet connection. If it’s dodgy, you’ll have a right old laugh trying to download anything. Make sure you’re connected to a decent Wi-Fi signal or ethernet cable.

File Not Downloading

- Try downloading the form again. Sometimes, it can take a few goes to get it right.

- Check the file size. If it’s tiny, it might be corrupt. Try downloading it again.

- Make sure you’re using the right browser. Some browsers might not be compatible with the download.

Form Not Opening

- Make sure you have the right software to open the form. It’s usually a PDF file, so you’ll need a PDF reader like Adobe Acrobat.

- Try downloading the form again and saving it to a different location.

- If you’re still having trouble, contact the IRS for help.

Other Issues

- If you’re getting an error message, check the IRS website for more information.

- You can also contact the IRS by phone or email for support.

FAQ Summary

Can I download the 940 Federal Form from third-party websites?

Yes, while the official government website is the most reliable source, there are reputable third-party websites that offer free downloads of the 940 Federal Form. However, it’s important to verify the authenticity of the form before submitting it to ensure accuracy.

What are the common errors to avoid when filling out the 940 Federal Form?

Common errors include incorrect calculations, missing or incomplete information, and using an outdated version of the form. Carefully review your entries, ensure all required fields are filled out, and always refer to the most recent version of the form to avoid any discrepancies.

Where can I find support if I encounter issues while downloading or completing the 940 Federal Form?

The Internal Revenue Service (IRS) provides comprehensive support through its website, toll-free helpline, and local offices. Additionally, tax professionals and software providers offer assistance with form preparation and filing.