Free 8962 Form 2024 Download: A Comprehensive Guide

Navigating the complexities of tax filing can be daunting, but with the right tools, it doesn’t have to be. The 8962 form is a crucial document for reporting passive income and losses. To simplify the process, we’ve compiled this comprehensive guide that provides a free 8962 form download and expert guidance on filling it out accurately.

This guide will not only save you money on professional fees but also empower you with the knowledge to complete the form confidently. So, let’s dive in and make tax season a breeze!

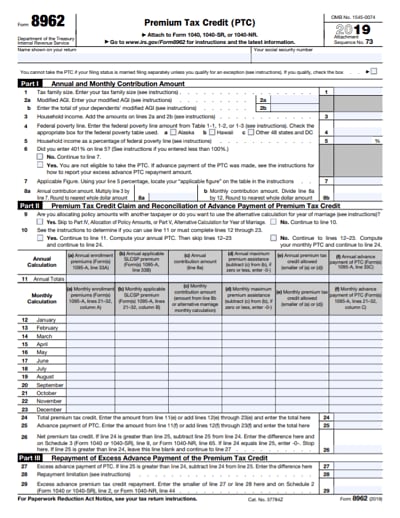

Filling Out Form 8962

Intro paragraph

Form 8962 is a vital document used to report passive foreign investment company (PFIC) income. Filling it out accurately is crucial for compliance and to avoid penalties.

Explanatory paragraph

The form is divided into several sections, each with its own purpose and significance. Understanding these sections and their requirements will help you complete the form correctly.

Part I – Taxpayer Information

– Provides basic identifying information about the taxpayer, including name, address, and Social Security number.

– Ensures the IRS can accurately identify the taxpayer and process the return.

Part II – PFIC Information

– Collects details about the PFICs in which the taxpayer has an interest.

– Includes information such as the PFIC’s name, address, and taxpayer identification number (TIN).

– Helps the IRS track PFIC investments and ensure compliance.

Part III – Income Information

– Reports the taxpayer’s income from PFICs.

– Includes various types of income, such as dividends, interest, and capital gains.

– Provides the basis for calculating the taxpayer’s tax liability.

Part IV – Tax Calculations

– Computes the taxpayer’s tax liability based on the income reported in Part III.

– Considers various factors, such as the taxpayer’s income level and applicable tax rates.

– Determines the amount of tax owed or refunded.

Common Errors or Challenges

– Inaccurate reporting of PFIC income or expenses.

– Misinterpreting the rules for calculating the tax liability.

– Failing to meet the filing deadline.

Tips for Accurate Completion

– Gather all necessary information before starting.

– Refer to the IRS instructions for guidance.

– Use a tax software or consult a tax professional for assistance.

– File on time to avoid penalties.

Using Form 8962

Form 8962 is a crucial document used in various situations. Primarily, it serves as a way to report passive income, such as dividends, interest, and royalties. The form also plays a vital role in claiming tax credits and deductions related to these types of income. By completing and submitting Form 8962, you provide the necessary information to the relevant authorities, ensuring accurate tax calculations and potential benefits.

Submitting Form 8962

Submitting Form 8962 is essential to ensure your tax information is complete and accurate. Attach the completed form to your federal income tax return and mail it to the address provided by the Internal Revenue Service (IRS). Alternatively, you can file electronically using tax preparation software or through the IRS website. Ensure you submit the form on time to avoid potential penalties or delays in processing your return.

Consequences of Incomplete or Inaccurate Form

Submitting an incomplete or inaccurate Form 8962 can lead to various consequences. The IRS may request additional information or documentation, which can delay the processing of your tax return. In some cases, an incomplete or inaccurate form may result in errors in your tax calculations, leading to underpayment or overpayment of taxes. It’s crucial to take the necessary care and attention when completing Form 8962 to avoid these potential issues.

Additional Resources

Need more help with Form 8962? Check out these handy resources:

Tutorials and FAQs

Contact Information

If you have any questions about Form 8962, you can contact the IRS at 1-800-829-1040.

Related Forms and Documents

Form 8962 is related to the following forms and documents:

- Form 1040 (U.S. Individual Income Tax Return)

- Form 1040-SR (U.S. Tax Return for Seniors)

- Publication 554 (Tax Guide for Seniors)

Q&A

Where can I find a reputable website to download the free 8962 form?

You can access the official 8962 form for free download from the Internal Revenue Service (IRS) website.

What are the common errors to avoid when filling out the 8962 form?

Common errors include incorrect calculations, missing information, and using the wrong tax year. Ensure you carefully review your entries before submitting the form.

Can I submit the 8962 form electronically?

Yes, you can submit the 8962 form electronically using tax software or through the IRS website.

What are the consequences of submitting an incomplete or inaccurate 8962 form?

Submitting an incomplete or inaccurate form may result in delays in processing, additional taxes, or penalties.