Free 8814 Irs Form Download: A Comprehensive Guide

Navigating the complexities of tax reporting can be a daunting task. However, the Internal Revenue Service (IRS) provides Form 8814 to assist individuals and businesses in accurately reporting their tax-related transactions. This guide will delve into the purpose, benefits, and proper usage of IRS Form 8814, empowering you to fulfill your tax obligations with confidence.

Whether you’re a seasoned tax professional or an individual seeking to understand the intricacies of tax reporting, this comprehensive guide will provide valuable insights into the significance of IRS Form 8814. Stay tuned as we explore its various sections, common pitfalls to avoid, and step-by-step instructions for downloading the form from the official IRS website.

IRS Form 8814 Overview

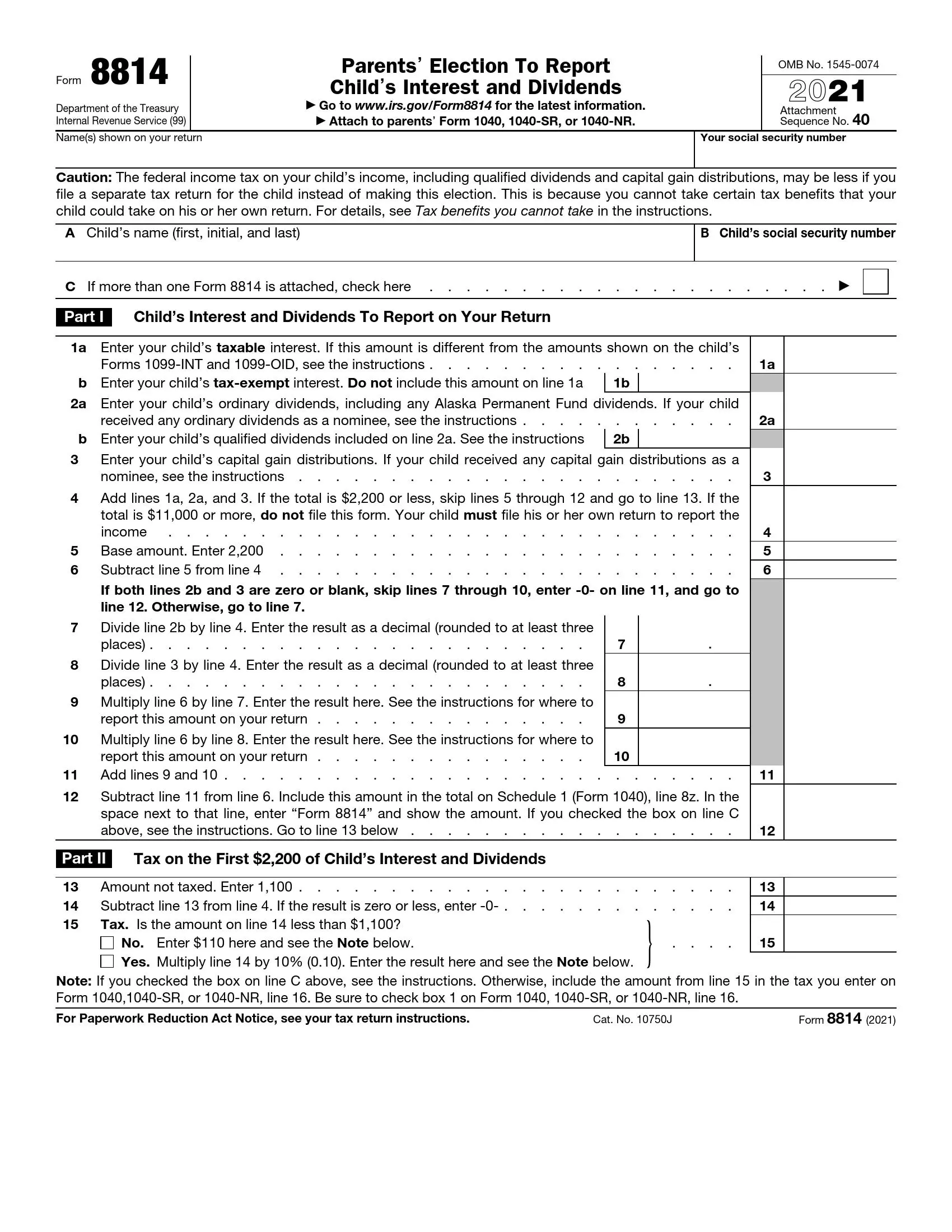

IRS Form 8814, Parents’ Election To Report Child’s Interest and Dividends, is a tax form used to report a child’s income from interest and dividends on the parents’ tax return. This is typically done when the child’s income is below a certain threshold and the parents want to avoid having the child file a separate tax return.

Who Should Consider Using Form 8814?

Parents should consider using Form 8814 if their child meets the following criteria:

- The child is under the age of 19 at the end of the tax year.

- The child’s gross income from interest and dividends is less than $1,100.

- The child does not have any other taxable income, such as wages, self-employment income, or capital gains.

- The child’s parents are filing a joint tax return.

s for Downloading IRS Form 8814

Fetching IRS Form 8814 from the official IRS website is a doddle. Follow these rad steps, and you’ll have it sorted in no time.

Navigating the IRS Website

Head over to the IRS website (www.irs.gov). In the top-right corner, you’ll spot a search bar. Type in “Form 8814” and hit enter.

Locating the Form

The search results will show you a list of links. Click on the one that says “Form 8814 – Parents’ Election To Report Child’s Interest and Dividends.” This will take you to the form’s download page.

Downloading the Form

On the download page, you’ll see a blue button that says “Download PDF.” Click on it, and the form will start downloading to your computer.

Once the download is complete, open the PDF file and print it out. You can now fill out the form and submit it to the IRS.

Understanding the Sections of IRS Form 8814

IRS Form 8814 is designed with specific sections to help you organize and report the necessary information for your Parental Kidnap Prevention Act (PKPA) case. Let’s break down each section and its purpose:

Part I: Child Information

This section is all about the child involved in the PKPA case. You’ll need to provide basic details like their name, date of birth, and current address.

Part II: Petitioner Information

Here, you’ll fill in your personal information as the petitioner, including your name, address, and contact details.

Part III: Other Party Information

In this section, you’ll provide information about the other party involved in the case, such as the child’s other parent or legal guardian.

Part IV: Certification

This section is where you’ll sign and date the form, certifying that the information you’ve provided is true and accurate.

Part V: Additional Information

If you have any additional information or supporting documents that are relevant to your case, you can include them in this section.

Common Mistakes to Avoid When Using IRS Form 8814

When filling out IRS Form 8814, there are a few common pitfalls that you should be aware of. Making mistakes on this form can lead to delays in processing your tax return, or even an audit. Here are some of the most common mistakes to avoid:

- Not attaching all required documentation. Form 8814 requires you to attach certain documents, such as a copy of your driver’s license or passport, and a copy of your birth certificate or naturalization papers. If you do not attach all of the required documentation, your return may be delayed or rejected.

- Entering incorrect information. It is important to make sure that all of the information you enter on Form 8814 is correct. This includes your name, address, Social Security number, and income information. If you make any mistakes, your return may be delayed or rejected.

- Not signing the form. You must sign Form 8814 before you mail it in. If you do not sign the form, your return may be delayed or rejected.

By avoiding these common mistakes, you can help ensure that your tax return is processed quickly and accurately.

Q&A

Q: What is the purpose of IRS Form 8814?

A: IRS Form 8814, Parents’ Election to Report Child’s Interest and Dividends, is used to report a child’s interest and dividend income on the parent’s tax return.

Q: Who should use IRS Form 8814?

A: Parents or guardians of children under the age of 18 who have unearned income, such as interest and dividends, should consider using IRS Form 8814.

Q: Where can I download IRS Form 8814?

A: You can download IRS Form 8814 from the official IRS website at https://www.irs.gov/forms-pubs/about-form-8814.

Q: Are there any common mistakes to avoid when using IRS Form 8814?

A: Yes, some common mistakes to avoid include entering incorrect Social Security numbers, omitting required information, and making mathematical errors.

Q: What are the benefits of using IRS Form 8814?

A: Using IRS Form 8814 can help parents simplify tax reporting, reduce the risk of errors, and ensure compliance with tax regulations.