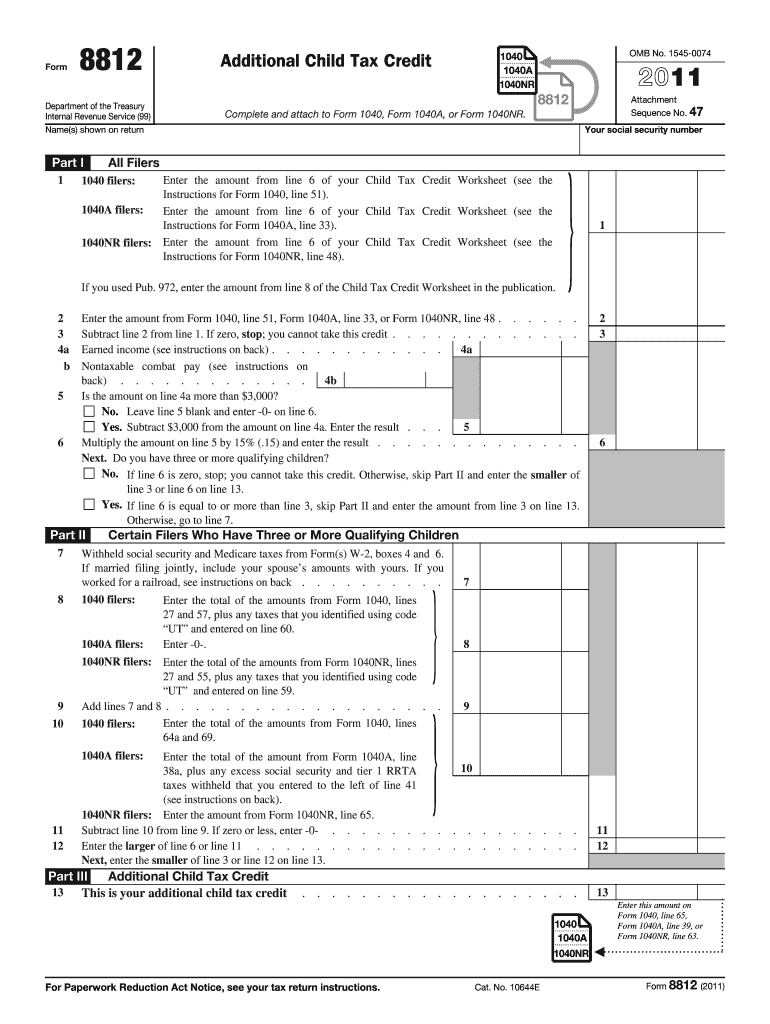

Free 8812 Form 2024 Download: A Comprehensive Guide

Navigating the complexities of tax preparation can be a daunting task, but it doesn’t have to be. With the availability of free downloadable tax forms like Form 8812, you can streamline the process and save yourself both time and effort. In this guide, we’ll explore the purpose, benefits, and steps involved in downloading and using Form 8812 effectively, empowering you to tackle your tax obligations with confidence.

Form 8812, also known as the “Change of Address,” is an essential document for individuals who have recently relocated and need to notify the Internal Revenue Service (IRS) of their new address. By understanding the sections of the form and utilizing the free downloadable version, you can ensure an accurate and timely submission.

Using Form 8812 Effectively

Wagwan fam, let’s get clued up on how to smash Form 8812 like a pro. We’re gonna break it down, blud, and make sure you don’t end up with a dodgy submission.

First up, read the instructions like it’s your nan’s tea leaves. They’ll tell you everything you need to know, like what info to chuck in each box and where to sign on the dotted line. Don’t be a mug and skip ’em, cuz you’ll only end up making a mess of it.

Common Pitfalls to Dodge

- Don’t leave any blanks. Fill in every single box, even if you think it’s not relevant. If it ain’t got nothing to do with you, just write “N/A” or “Not Applicable.”

- Check your spellings and numbers twice. Make sure everything’s spelled correctly and all the numbers add up. A tiny mistake could mean your form gets rejected, so don’t be a donut and rush it.

- Sign and date the form. This is like the icing on the cake, fam. Without it, your form is as useless as a chocolate teapot. Sign and date it in the designated spots.

Tips for a Winning Submission

- Use clear and concise language. Don’t go all Shakespeare on us. Keep it simple and easy to understand. The taxman ain’t got time for your fancy words.

- Be organized. Use the right boxes for the right info and don’t scribble all over the place. A tidy form is a happy form.

- Keep a copy for your records. Once you’ve sent off your form, make sure you keep a copy for yourself. That way, you’ve got proof that you did your bit.

Additional Resources for Tax Preparation

Innit fam, there’s a buncha other resources you can smash to prep your taxes like a pro. Whether you’re a tech wizard or prefer a bit of human touch, we’ve got you covered.

Check out these options and choose the one that vibes with your style:

Tax Software

- TurboTax: A top-rated option with user-friendly interfaces and comprehensive features.

- H&R Block: Known for its guided interviews and step-by-step instructions.

- TaxAct: A budget-friendly option that’s perfect for simple tax returns.

Online Tax Tools

- IRS Free File: A government-sponsored program that offers free tax preparation software to eligible taxpayers.

- United Way’s MyFreeTaxes: Another free online tax preparation service that’s supported by the United Way.

Professional Tax Services

If you’re feeling a bit lost or have a complex tax situation, you might want to consider hiring a professional tax preparer. They can help you navigate the tax code and ensure you’re getting all the deductions and credits you deserve.

FAQs

Q: Where can I find the official Form 8812 for download?

A: The official Form 8812 can be downloaded from the IRS website at https://www.irs.gov/forms-pubs/about-form-8812.

Q: Is there a fee associated with downloading Form 8812?

A: No, Form 8812 is available for free download from the IRS website.

Q: How do I know if I need to file Form 8812?

A: You need to file Form 8812 if you have recently changed your address and want to notify the IRS of your new address.

Q: Can I file Form 8812 online?

A: No, Form 8812 cannot be filed online. It must be mailed to the IRS.

Q: What is the deadline for filing Form 8812?

A: There is no deadline for filing Form 8812, but it is recommended that you file it as soon as possible after you move.