Free 83b Tax Form Download: A Comprehensive Guide

Navigating the complexities of tax filing can be daunting, but it doesn’t have to be. This comprehensive guide will provide you with all the essential information you need to download and complete Form 83b effortlessly. Whether you’re a seasoned tax filer or just starting out, this guide will empower you with the knowledge and resources to ensure accurate and timely tax submissions.

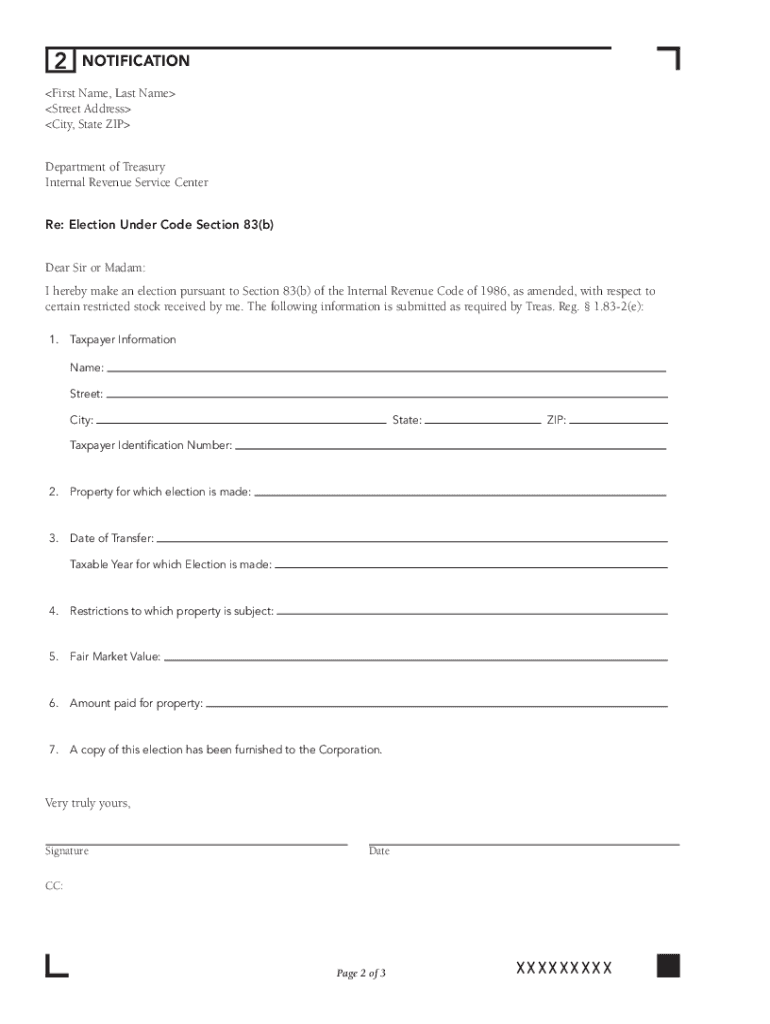

Form 83b plays a crucial role in reporting income and expenses related to certain business activities. Understanding its purpose and significance is key to ensuring proper tax calculations and compliance. This guide will delve into the different sections of the form, explaining each field and its corresponding tax implications. By the end of this guide, you’ll have a thorough understanding of Form 83b and the confidence to complete it accurately.

Form Completion

Filling out the 83b tax form can be a breeze, fam. Just follow these sick steps and you’ll be golden:

Personal Information

- Start by dropping your personal deets, like name, addy, and NI number, in the top section.

Employment Income

- Next up, spill the beans on your employment income. List all your jobs, and don’t forget to include the tax you’ve already paid.

- If you’ve got any other income, like from investments or property, pop that in too.

Deductions and Allowances

- Time to claim your deductions and allowances. These are expenses you can knock off your taxable income, like pension contributions or charitable donations.

Tax Calculation

- Now comes the tricky part: calculating your tax. Don’t worry, the form will do most of the heavy lifting. Just make sure you double-check your numbers.

Payment and Declaration

- Finally, figure out how much tax you owe and how you’re gonna pay it. You can spread it out over the year or pay it all in one go.

- Don’t forget to sign and date the form before you send it off. That’s your official declaration that everything you’ve said is legit.

And there you have it, filling out the 83b tax form is as easy as pie. Just remember to take your time, check your work, and you’ll be sorted.

Filing Procedures

Alright bruv, let’s talk about how you can get your 83b tax form sorted. There are a few different ways you can do it, so let’s break it down for you.

You can file your 83b tax form online, by post, or in person. If you’re feeling tech-savvy, you can head to the HMRC website and fill it out there. If you’re more of an old-school type, you can download the form from the HMRC website and send it in the post. And if you’re feeling sociable, you can always pop into your local tax office and hand it in there.

Submission

No matter how you choose to file your form, you’ll need to make sure you get it in on time. The deadline for filing your 83b tax form is usually the 31st of January, but it’s always worth checking the HMRC website to make sure you’ve got the latest info.

If you miss the deadline, you might have to pay a penalty. So, don’t be a donut and get it done on time, yeah?

Consequences of Late Filing

If you file your 83b tax form late, you could face a penalty. The amount of the penalty will depend on how late you are and how much tax you owe.

Here’s a breakdown of the penalties you could face:

- If you file your tax return up to 3 months late, you’ll have to pay a £100 penalty.

- If you file your tax return more than 3 months late, you’ll have to pay a £100 penalty, plus an additional £10 for each day that your return is late.

- If you file your tax return more than 6 months late, you could be charged a penalty of up to £3,000.

So, don’t be a slacker and get your 83b tax form filed on time, or you could end up paying a hefty fine.

Common Errors and Solutions

Avoid common pitfalls and ensure accuracy when completing your 83b tax form. Read on for potential challenges and practical solutions.

Many taxpayers face common errors when completing their 83b tax forms. Understanding these errors and implementing solutions can save you time, effort, and potential penalties.

Mistakes in Personal Information

Inaccurate personal information, such as incorrect name, address, or National Insurance number, can delay processing and lead to errors in calculations.

- Double-check all personal details to ensure they match official documents.

- If any changes have occurred since your last submission, update them promptly.

Errors in Income Reporting

Misreporting income, whether unintentional or deliberate, can have significant consequences.

- Review all income sources, including wages, self-employment income, and investments.

- Use payslips, bank statements, and other relevant documents to verify amounts.

Deductions and Allowances

Incorrectly claiming deductions or allowances can reduce your tax liability, leading to potential penalties.

- Understand the eligibility criteria for each deduction or allowance.

- Keep records of expenses and receipts to support your claims.

Calculation Errors

Mathematical errors can occur during calculations, resulting in incorrect tax liability.

- Use a calculator or online tools to ensure accuracy.

- Review your calculations carefully before submitting the form.

Late Filing

Submitting your 83b tax form late can result in penalties and interest charges.

- Mark the deadline on your calendar and set reminders.

- If you cannot file on time, contact HMRC to discuss possible extensions.

FAQs

Where can I download Form 83b for free?

You can download Form 83b for free from the official website of the Internal Revenue Service (IRS): https://www.irs.gov/forms-pubs/about-form-83b.

What are the common mistakes to avoid when filling out Form 83b?

Some common mistakes to avoid when filling out Form 83b include: incorrect calculation of expenses, missing or incomplete information, and filing the form late. It’s important to carefully review your form before submitting it to ensure accuracy.

Can I file Form 83b electronically?

Yes, you can file Form 83b electronically using the IRS’s e-file system. This option is available to both individuals and businesses. E-filing can save you time and reduce the risk of errors.

What are the penalties for filing Form 83b late?

Filing Form 83b late can result in penalties and interest charges. The amount of the penalty will depend on how late the form is filed and the amount of tax owed. It’s important to file your form on time to avoid any additional charges.

Where can I get help completing Form 83b?

If you need assistance completing Form 83b, you can consult with a tax professional, such as a certified public accountant (CPA) or enrolled agent (EA). They can provide personalized guidance and ensure that your form is completed accurately.