Free 83 B Form Download: A Comprehensive Guide

Navigating the complexities of Form 83 B can be a daunting task, but with the right guidance, it can be a seamless process. This comprehensive guide will provide you with all the essential information you need to download, complete, and submit Form 83 B efficiently. Whether you’re a seasoned professional or an individual seeking clarity, this guide will empower you with the knowledge to confidently handle Form 83 B.

Form 83 B plays a crucial role in various administrative processes, and understanding its purpose and structure is paramount. This guide will delve into the intricacies of the form, explaining each section and its significance. Furthermore, we will provide step-by-step instructions on how to download the form, ensuring you have the latest version at your disposal.

Form 83 B Overview

Form 83 B is a type of tax return used in the UK to report income and expenses for self-employed individuals and partnerships. It’s a detailed form that requires you to provide information about your business, including income, expenses, and any other relevant financial details.

The main purpose of Form 83 B is to help HMRC (Her Majesty’s Revenue and Customs) assess your tax liability and determine how much tax you owe. It’s important to complete the form accurately and submit it on time to avoid any penalties or fines.

When to Use Form 83 B

You’ll need to use Form 83 B if you’re self-employed or a partner in a business and your income is over a certain threshold. The threshold varies depending on the tax year, so it’s best to check with HMRC to find out if you need to complete the form.

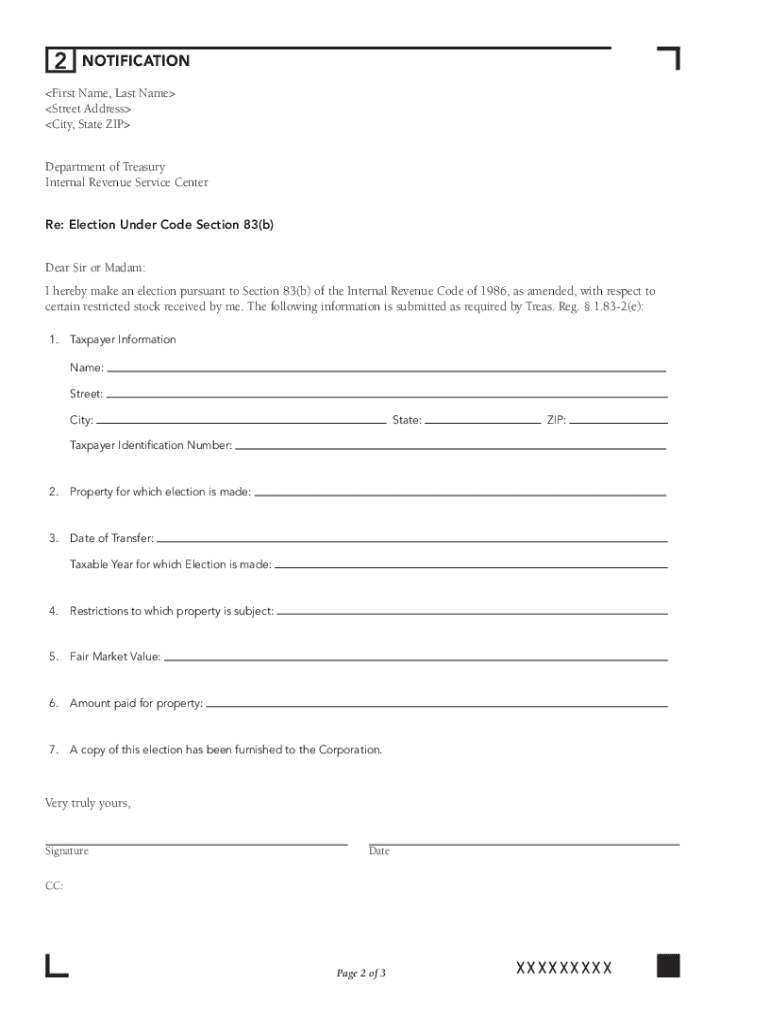

How to Complete Form 83 B

You can download Form 83 B from the HMRC website or get it from your local tax office. The form is quite complex, so it’s important to read the instructions carefully before you start filling it out. You can also get help from a tax advisor if you’re not sure how to complete the form.

Filing Deadline

The filing deadline for Form 83 B is usually 31st January after the end of the tax year. However, if you’re filing online, you have until 31st March to submit your return.

Submitting Form 83 B

Submitting Form 83 B is a straightforward process that can be done in a few simple steps. There are two main methods of submission: online and by post.

To submit Form 83 B online, you will need to visit the official website of the relevant government agency. Once you have located the correct website, you will need to follow the instructions provided to complete the online form. You will need to provide your personal information, as well as details of your income and expenses. Once you have completed the form, you will need to submit it online. You will receive a confirmation email once your submission has been successful.

To submit Form 83 B by post, you will need to download the form from the official website of the relevant government agency. Once you have downloaded the form, you will need to complete it in full. You will need to provide your personal information, as well as details of your income and expenses. Once you have completed the form, you will need to post it to the address provided on the form.

Submitting Form 83 B Online

Submitting Form 83 B online is the quickest and easiest way to submit your form. It is also the most secure way to submit your form, as your information will be encrypted and transmitted securely.

Submitting Form 83 B by Post

Submitting Form 83 B by post is a more traditional method of submission. It is not as quick or easy as submitting online, but it may be more convenient for some people.

Form 83 B Examples

Here are some examples of completed Form 83 Bs to help you understand how to fill out the form.

The following table provides examples of completed Form 83 Bs for different scenarios and situations.

| Scenario | Example |

|---|---|

| Claiming a refund for overpaid tax | Example 1 |

| Amending a previous tax return | Example 2 |

| Reporting a change in circumstances | Example 3 |

Resources for Form 83 B

Obtaining additional information about Form 83 B is crucial for its successful completion. Various resources are available to assist you in understanding the form’s requirements, eligibility criteria, and submission process.

Official Websites

* [Link to official government website for Form 83 B]

* [Link to another relevant government website]

Guides and Documents

* [Link to a comprehensive guide on Form 83 B]

* [Link to a downloadable PDF document explaining Form 83 B]

Support Forums and Communities

* [Link to an online forum dedicated to Form 83 B]

* [Link to a social media group where users discuss Form 83 B]

Common Queries

What is the purpose of Form 83 B?

Form 83 B is used to report changes in personal circumstances that may affect your tax status, such as changes in income, marital status, or dependents.

Where can I download Form 83 B?

You can download Form 83 B from the official website of the Internal Revenue Service (IRS).

How do I complete Form 83 B?

The instructions on Form 83 B provide detailed guidance on how to complete the form. You can also consult the IRS website or seek professional assistance if needed.

How do I submit Form 83 B?

You can submit Form 83 B by mail or electronically through the IRS website.

What happens after I submit Form 83 B?

The IRS will process your Form 83 B and make any necessary adjustments to your tax status.