Free 590 Tax Form Download: Your Guide to Filing Taxes Seamlessly

Navigating the complexities of tax filing can be daunting, but it doesn’t have to be. The 590 Tax Form is a crucial document that plays a pivotal role in ensuring accurate and timely tax submissions. Whether you’re a seasoned taxpayer or just starting your journey, understanding how to access and complete the 590 Tax Form is essential. This comprehensive guide provides a step-by-step approach to downloading and utilizing the 590 Tax Form, empowering you to fulfill your tax obligations with confidence and ease.

In this guide, we’ll delve into the significance of the 590 Tax Form, explore the various platforms where you can download it for free, and provide detailed instructions on how to fill it out accurately. We’ll also address common issues and troubleshooting tips to ensure a seamless tax filing experience. By the end of this guide, you’ll have the knowledge and resources necessary to navigate the 590 Tax Form with ease, ensuring that your tax filing process is efficient and stress-free.

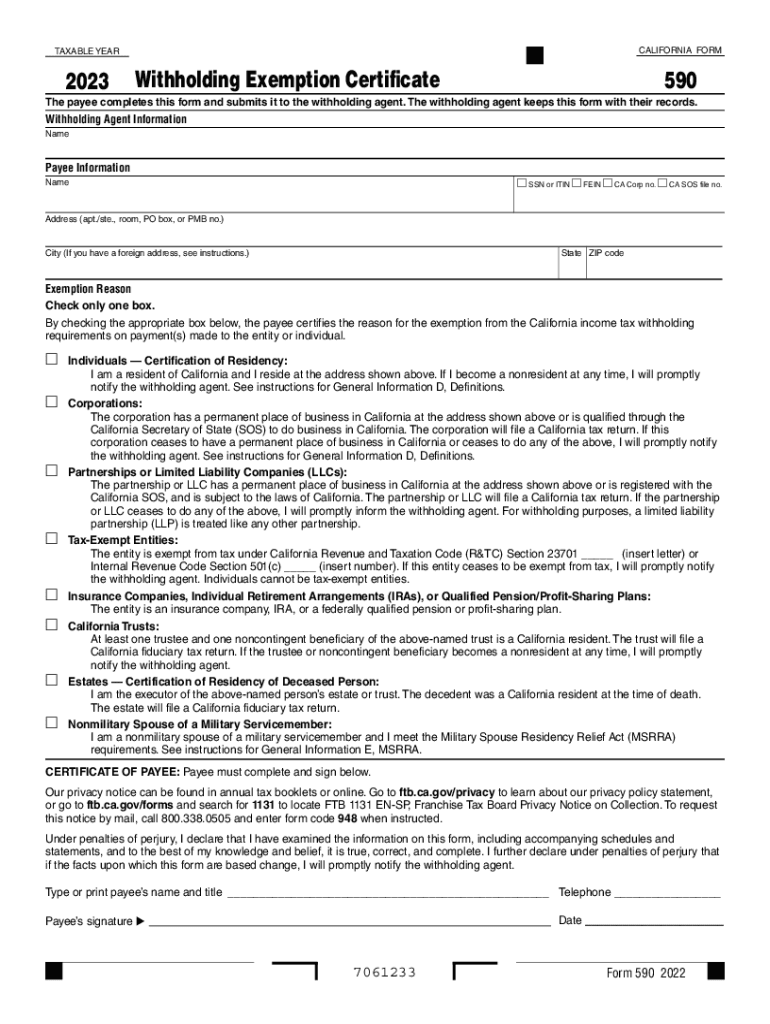

Form Details

The 590 Tax Form is a vital document for individuals or entities in the United Kingdom required to declare their income and calculate their tax liability. It provides a comprehensive framework for reporting income, expenses, and other relevant financial information.

The form comprises various sections, each designed to capture specific details and calculations. These sections include:

Personal Information

This section gathers basic personal information, such as name, address, National Insurance number, and contact details. It helps identify the taxpayer and ensure accurate correspondence.

Income

The income section requires a detailed breakdown of all sources of income, including employment, self-employment, investments, and any other taxable earnings. It’s crucial to disclose all income accurately to calculate the correct tax liability.

Deductions

Deductions represent expenses or allowances that can be subtracted from income before calculating tax. The 590 Tax Form includes various allowable deductions, such as pension contributions, charitable donations, and certain business expenses. Claiming eligible deductions reduces the taxable income and, consequently, the tax liability.

Tax Calculation

This section involves calculating the tax liability based on the income and deductions reported. It applies the appropriate tax rates and allowances to determine the amount of tax owed to HM Revenue and Customs (HMRC).

Payments and Refunds

The final section covers payments made towards tax liability and any potential refunds due to overpayment. It provides a summary of tax payments, including direct debits, online payments, or any other methods used. Refunds are issued if the taxpayer has overpaid their tax liability.

s for Use

Blag it! This guide’s gonna spill the beans on how to fill out that 590 Tax Form like a pro. It’s easy as pie, so don’t be a tit and get stuck in.

First off, you’ll need to gather your bits and bobs, like your P60, payslips, and any other bits that show how much dough you’ve been raking in. Once you’ve got your ducks in a row, it’s time to dive in.

Section 1: Personal Details

This bit’s a breeze. Just bung in your name, address, and National Insurance number. If you’re feeling fancy, you can even add your phone number and email address.

Section 2: Income

Here’s where you show off how much bread you’ve been buttering. Enter your wages, salaries, and any other income you’ve had in the tax year. Don’t forget to include any benefits or perks you’ve received, like a company car or health insurance.

Section 3: Allowances and Reliefs

This is where you can claim back some of the tax you’ve paid. You can get an allowance for things like personal tax, blind person’s allowance, and marriage allowance. There are also reliefs for things like pension contributions and charitable donations.

Section 4: Tax Calculation

This is where the magic happens. HMRC will use the information you’ve provided to calculate how much tax you owe. Don’t worry, they’ll do all the heavy lifting for you.

Section 5: Payment

If you owe any tax, you can pay it online, by phone, or by post. HMRC will send you a reminder if you forget, so don’t fret.

Common Issues and Troubleshooting

There be a few probs you might run into when downloading or filling out the 590 Tax Form. Don’t sweat it, fam, we got you covered. Here’s the lowdown on the most common issues and how to sort ’em out.

If you’re having trouble downloading the form, check your internet connection and make sure you’re using a stable browser. Still no luck? Try a different browser or download the form directly from the HMRC website.

Can’t open the form

If you can’t open the form after downloading it, make sure you have the right software installed. You’ll need a PDF reader like Adobe Acrobat Reader or Foxit Reader to open the form.

Form not filling out properly

If you’re having trouble filling out the form, check that you’re using the correct version of the form. The HMRC website has the latest version of the form available for download.

Also, make sure you’re filling out the form in the correct format. The HMRC website has a guide that shows you how to fill out the form correctly.

Questions and Answers

What is the purpose of the 590 Tax Form?

The 590 Tax Form is a document used to report income and expenses for self-employed individuals and small businesses. It is a vital component of the tax filing process, as it provides the necessary information for calculating tax liability and ensuring compliance with tax regulations.

Where can I download the 590 Tax Form for free?

You can download the 590 Tax Form for free from various platforms, including the official website of the Internal Revenue Service (IRS), tax software providers, and online document repositories. Refer to the ‘Download Options’ section of this guide for a comprehensive list of platforms and their respective download links.

What information is required to fill out the 590 Tax Form?

To fill out the 590 Tax Form accurately, you will need to gather information such as your personal details, business income and expenses, deductions, and tax credits. The form is divided into sections, each requiring specific information. Refer to the ‘Form Details’ and ‘Instructions for Use’ sections of this guide for a detailed breakdown of the form’s structure and the information required for each section.

What are some common issues that may arise while filling out the 590 Tax Form?

Some common issues that may arise while filling out the 590 Tax Form include incorrect calculations, missing information, and errors in reporting income or expenses. To avoid these issues, ensure that you have all the necessary information before you begin filling out the form, double-check your calculations, and carefully review the instructions provided in this guide.