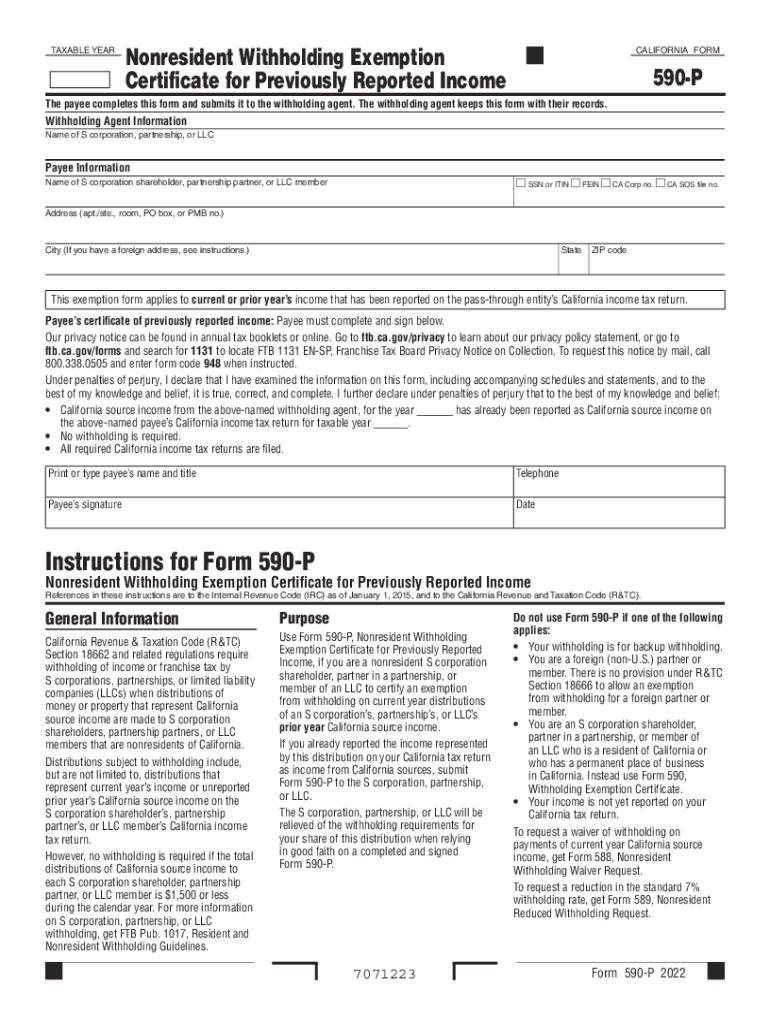

Free 590 Form 2024 Download: A Comprehensive Guide

Navigating the complexities of tax forms can be a daunting task, but understanding and utilizing Form 590 can significantly simplify the process. This comprehensive guide will provide you with an overview of Form 590, its key features, benefits, and best practices for completion. By the end of this guide, you’ll have a thorough understanding of this essential form and be equipped to download and use it effectively.

Form 590 is an IRS tax form used to report certain types of income and expenses. It is commonly used by individuals who are self-employed or have rental properties. Understanding the purpose and significance of Form 590 is crucial for accurate tax reporting and compliance.

Additional Resources

Need more help understanding Form 590? Check out these helpful resources:

Websites

- IRS website: Form 590 – Official IRS website with information and instructions for Form 590.

- TaxAct website: Form 590 – Tax preparation software provider’s guide to Form 590.

Articles

- Kiplinger article: Form 590: IRA Distributions – Article explaining how to fill out Form 590 for IRA distributions.

- Investopedia article: Form 590 – Investopedia’s definition and overview of Form 590.

Videos

- YouTube video: How to Fill Out Form 590 – Step-by-step video guide to filling out Form 590.

- IRS video: Understanding Your IRA – IRS video explaining IRAs and how Form 590 is used.

FAQ Summary

What is the purpose of Form 590?

Form 590 is used to report self-employment income and expenses for federal income tax purposes.

Who should use Form 590?

Individuals who are self-employed or have rental properties are required to use Form 590.

Where can I download Form 590?

You can download Form 590 from the IRS website or from reputable tax software providers.

What are the benefits of using Form 590?

Form 590 helps you organize and track your self-employment income and expenses, making tax filing easier and more accurate.

What are some tips for completing Form 590?

Be sure to use the latest version of the form, gather all necessary documentation, and complete the form accurately and on time.