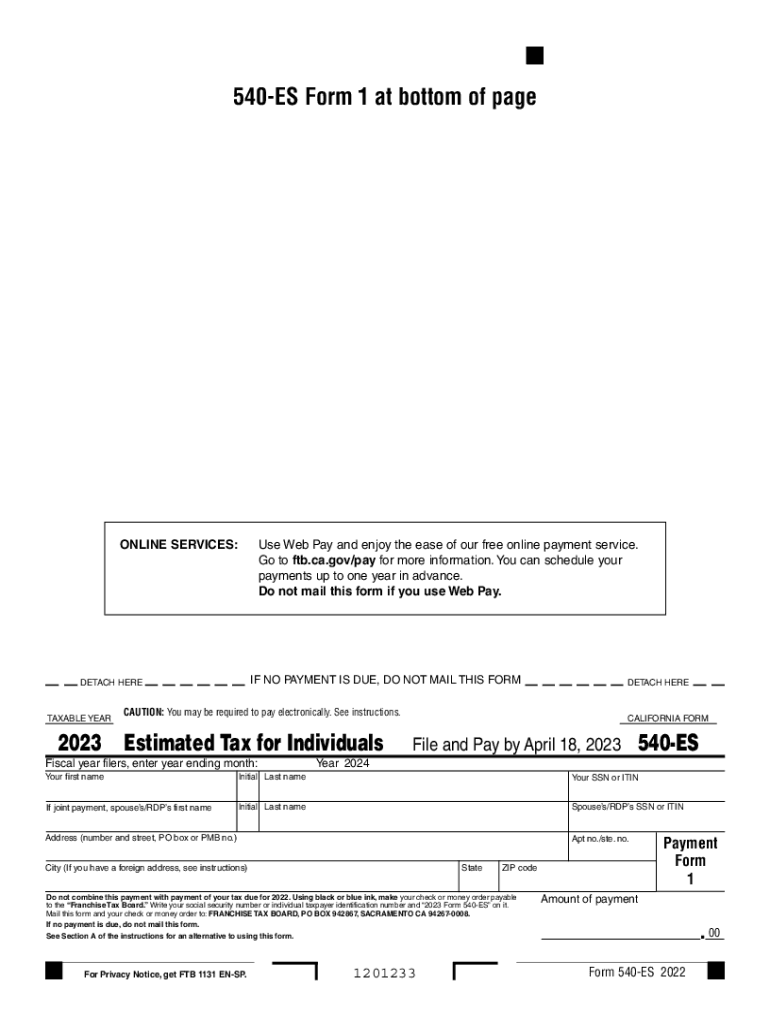

Free 540 Es Form Download: A Comprehensive Guide

Navigating the complexities of tax forms can be daunting, but understanding and completing the Form 540 ES is crucial for individuals seeking to estimate their quarterly tax payments accurately. This comprehensive guide will provide you with all the essential information you need to download, complete, and submit the Form 540 ES seamlessly.

The Form 540 ES is designed to assist taxpayers in calculating and making estimated tax payments throughout the year. By utilizing this form, you can avoid potential penalties associated with underpayment of taxes. Whether you’re a seasoned taxpayer or new to the process, this guide will empower you with the knowledge and resources necessary to navigate the Form 540 ES with confidence.

Downloading Options

To download the Form 540 ES for free, you have two main options: the IRS website or tax preparation software. Both options are legit and provide the latest version of the form.

If you choose to download from the IRS website, you can find the form in PDF format. This format is compatible with most computers and devices, and it allows you to print the form if needed. To download the form from the IRS website, follow these steps:

- Go to the IRS website at www.irs.gov.

- In the search bar, type “Form 540 ES.”

- Click on the link for “Form 540 ES, Estimated Tax for Individuals.”

- On the Form 540 ES page, click on the “Download” button.

- Select the PDF format and click on the “Download” button again.

If you choose to download the form using tax preparation software, you can find it in both PDF and fillable formats. Fillable forms allow you to enter your information directly into the form on your computer, which can save you time and effort. To download the form using tax preparation software, follow these steps:

- Open your tax preparation software.

- Click on the “Forms” tab.

- In the search bar, type “Form 540 ES.”

- Click on the link for “Form 540 ES, Estimated Tax for Individuals.”

- Select the PDF or fillable format and click on the “Download” button.

No matter which option you choose, it is important to make sure that you download the latest version of the form. The IRS updates the form each year, so it is important to have the most up-to-date version to ensure that you are using the correct information.

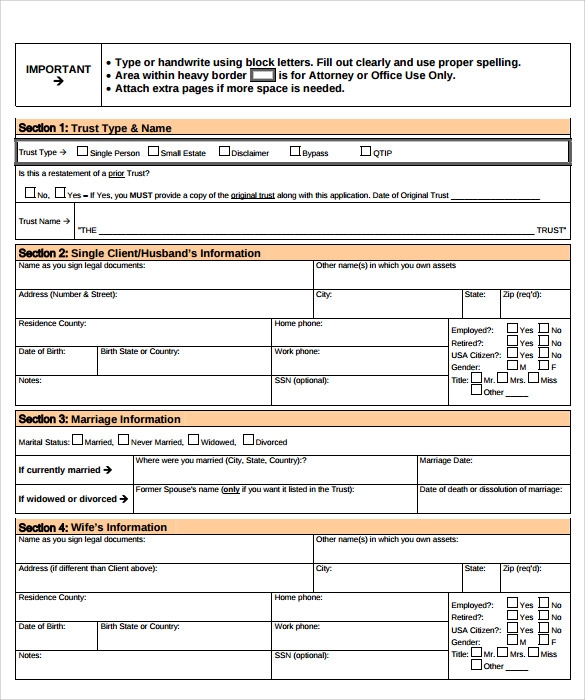

Filling Out the Form

Filling out the Form 540 ES accurately is crucial to ensure a smooth and successful application process. Here’s a comprehensive guide to help you navigate the form effectively, avoiding common pitfalls and ensuring precision.

The form is divided into several sections, each requiring specific information. Let’s delve into each section, providing examples and best practices to guide you through the completion process.

Personal Information

- Enter your full name, address, and contact details meticulously.

- Double-check your spelling and ensure the information matches your official documents.

Employment and Income

- List all your employment details, including the names and addresses of your employers.

- Accurately report your income from each source, including wages, salaries, and any other taxable income.

Deductions and Allowances

- Claim any eligible deductions or allowances that reduce your taxable income.

- Examples include pension contributions, charitable donations, and work-related expenses.

Tax Calculations

- Calculate your tax liability based on your income and deductions.

- Use the provided tax tables or consult with a tax professional for assistance.

Common Mistakes to Avoid

- Inaccurate or incomplete information.

- Miscalculations in tax calculations.

- Missing or incorrect supporting documents.

Tips for Accuracy

- Gather all necessary documents before starting the form.

- Take your time and read the instructions carefully.

- Seek professional advice if you encounter any complexities.

Additional Resources

If you need further assistance with Form 540 ES, here are some useful resources:

Check out these links for more information:

Support Services

If you have any questions or need support with Form 540 ES, you can contact the IRS at 1-800-829-1040.

FAQs

Here are some frequently asked questions (FAQs) about Form 540 ES:

- What is Form 540 ES? Form 540 ES is an estimated tax payment voucher that individuals can use to pay their estimated income tax.

- Who needs to file Form 540 ES? You need to file Form 540 ES if you expect to owe more than $1,000 in taxes for the year.

- When is Form 540 ES due? Form 540 ES is due on April 15, June 15, September 15, and January 15 of the following year.

- How do I file Form 540 ES? You can file Form 540 ES online, by mail, or by phone.

Updates and Changes

The IRS has made some changes to Form 540 ES for 2023. These changes include:

- The due date for the first estimated tax payment has been changed from April 15 to April 18.

- The amount of estimated tax that you need to pay has been increased.

- The instructions for Form 540 ES have been revised.

Q&A

Can I download the Form 540 ES in multiple languages?

Yes, the Form 540 ES is available in English, Spanish, Chinese, Korean, Vietnamese, and Russian. You can download the form in your preferred language from the IRS website.

What is the deadline for submitting the Form 540 ES?

The deadlines for submitting the Form 540 ES vary depending on your income and filing status. Generally, the deadlines are April 15, June 15, September 15, and January 15 of the following year.

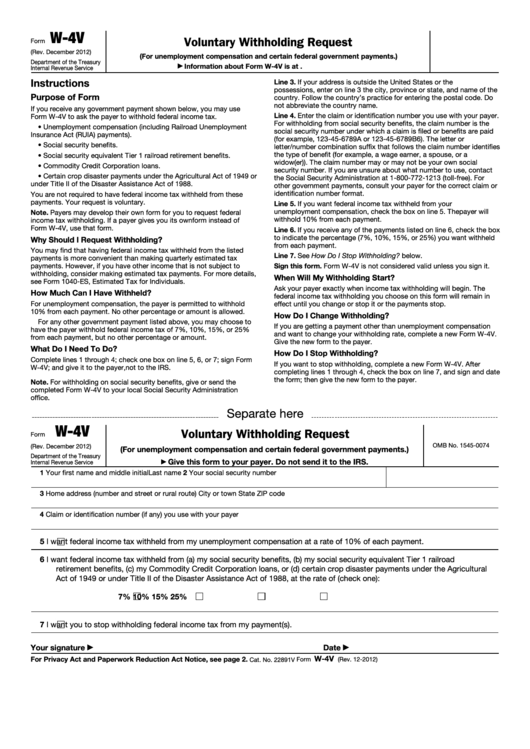

Can I make estimated tax payments online?

Yes, you can make estimated tax payments online through the IRS website or through a third-party tax payment processor.