Free 502 Form Instructions Download: A Comprehensive Guide

Navigating the intricacies of the 502 form can be a daunting task, but with the right guidance, it can be a breeze. This comprehensive guide provides you with everything you need to know about downloading, completing, and submitting the 502 form, ensuring a seamless and accurate process.

Whether you’re a seasoned professional or a first-timer, this guide will empower you with the knowledge and confidence to tackle the 502 form with ease. Dive in and discover the simplified approach to managing this essential document.

Common Mistakes to Avoid When Completing the 502 Form

Filling out the 502 form can be a bit of a pain, but it’s important to get it right. Here are some of the most common mistakes people make when completing the form, and how to avoid them:

Entering Incorrect Personal Information

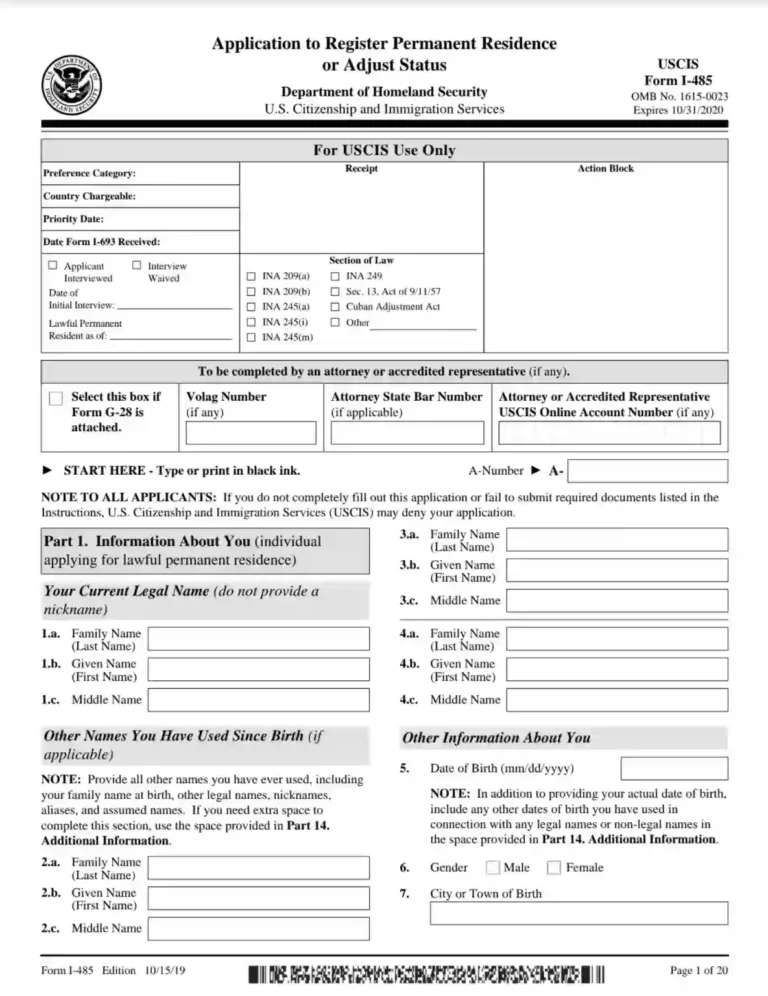

One of the most common mistakes people make is entering incorrect personal information on the form. This can include things like your name, address, or Social Security number. If you make a mistake, it can delay the processing of your form or even cause it to be rejected.

To avoid this mistake, be sure to carefully check all of your personal information before you submit the form. Make sure that your name is spelled correctly, that your address is up-to-date, and that your Social Security number is correct.

Failing to Sign the Form

Another common mistake people make is failing to sign the form. This is a required step, and if you don’t sign the form, it will not be processed.

To avoid this mistake, be sure to sign the form in the space provided before you submit it.

Not Including All Required Documentation

The 502 form requires you to submit certain documentation, such as proof of income and identity. If you do not include all of the required documentation, your form may be delayed or rejected.

To avoid this mistake, be sure to carefully review the instructions on the form and make sure that you have included all of the required documentation.

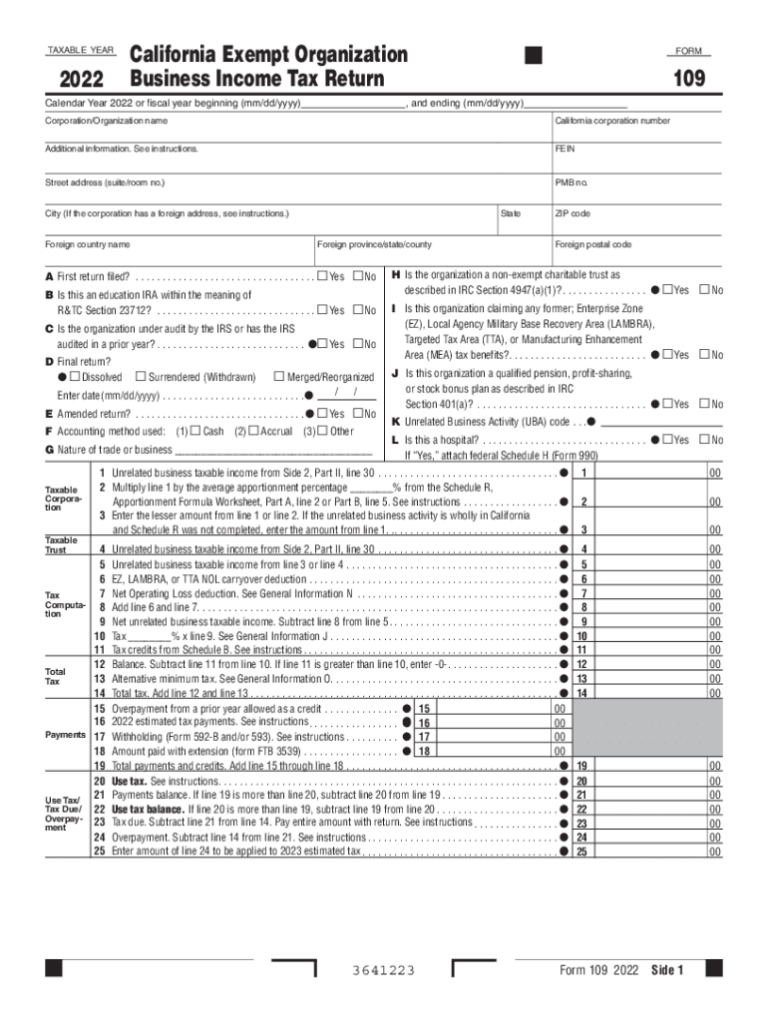

Making Math Errors

The 502 form requires you to do some math, such as calculating your income and expenses. If you make a math error, it can delay the processing of your form or even cause it to be rejected.

To avoid this mistake, be sure to carefully check all of your math before you submit the form. Use a calculator if necessary, and double-check your work.

Submitting the Form Late

The 502 form has a deadline, and if you submit it late, it may not be processed. To avoid this mistake, be sure to submit the form on time.

Submitting the 502 Form

Submitting the 502 Form can be done through various methods, each with its own set of advantages and disadvantages. Understanding the nuances of each submission method will help you choose the one that best suits your needs.

Online Submission

Online submission is the most convenient and widely used method. It allows you to submit the form directly from the comfort of your home or office, without the need for physical mailing or faxing.

Pros:

– Instant submission

– No need for postage or fax costs

– Automatic validation of form data

Cons:

– Requires a stable internet connection

– May not be accessible to everyone

– Potential security concerns

How to Submit Online:

1. Visit the official website of the relevant government agency.

2. Locate the online submission portal for the 502 Form.

3. Fill out the form accurately and completely.

4. Review your submission before submitting it.

5. Click the “Submit” button to complete the process.

Troubleshooting Common Issues with the 502 Form

Encountering glitches while filling out the 502 form is a right pain in the neck. Here’s the lowdown on the most common issues folks face and how to sort them out like a pro:

Can’t Open the Form

This could be because:

- Outdated browser: Make sure you’re using the latest version of your browser.

- Slow internet: Check your connection or try again later when the internet’s less chocka.

- Form server down: The form might be temporarily unavailable. Try again later.

Form Not Saving Changes

This could be because:

- Unsaved changes: Hit the “Save” button to make sure your changes stick.

- Browser cookies disabled: Cookies help the form remember your changes. Enable them in your browser settings.

- Form session expired: If you’ve been on the form for a while without saving, your session might have timed out. Start a new session and try again.

Submitting Form Errors

This could be because:

- Missing required fields: Check that you’ve filled out all the mandatory sections.

- Invalid data: Make sure you’ve entered the correct information in the right format.

- System error: Sometimes, the form system can glitch. Try again later or contact the form provider.

Download Errors

This could be because:

- Outdated browser: Update your browser to the latest version.

- Pop-up blocker: Disable pop-up blockers to allow the download to start.

- File not found: The file you’re trying to download might not be available anymore. Check with the form provider.

Helpful Answers

Where can I download the free 502 form?

The free 502 form can be downloaded from the official website of the Internal Revenue Service (IRS) at www.irs.gov.

What are the prerequisites for downloading the 502 form?

You will need a stable internet connection and a PDF reader installed on your computer or device to download the 502 form.

How do I avoid common mistakes when completing the 502 form?

To avoid common mistakes, ensure you carefully read and understand the instructions, provide accurate and complete information, and double-check your entries before submitting the form.

What are the different ways to submit the 502 form?

You can submit the 502 form electronically through the IRS website or by mail using the provided address.