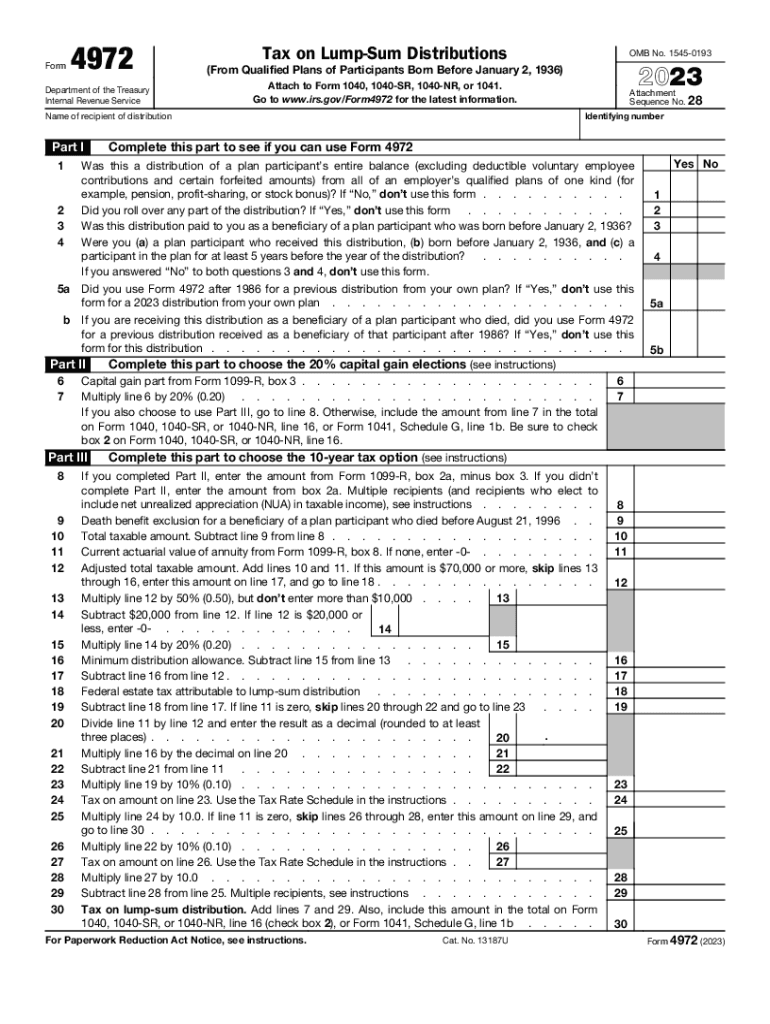

Free 4972 Tax Form Download: A Comprehensive Guide

Navigating the complexities of tax filing can be daunting, but it doesn’t have to be. With the advent of free tax forms like the 4972, individuals and businesses can simplify their tax preparation process without compromising accuracy or completeness.

In this comprehensive guide, we will delve into the world of free 4972 tax form downloads, providing you with a clear understanding of its purpose, benefits, and usage. We will also explore the various options available and offer valuable tips to ensure a smooth and error-free tax filing experience.

Tax Form Options

When it comes to getting your taxes done, you have a few different options to choose from. You can use a free tax form, a paid tax form, or hire a tax professional. Each option has its own advantages and disadvantages, so it’s important to weigh your options before making a decision.

Free Tax Forms

Free tax forms are available from the IRS website. These forms are easy to use and can be filed electronically or by mail. However, free tax forms do not include any instructions or support, so you may need to do some research on your own to make sure you’re filling out the forms correctly.

Paid Tax Forms

Paid tax forms are available from a variety of different software companies. These forms typically include instructions and support, which can be helpful if you’re not sure how to fill out the forms correctly. However, paid tax forms can be expensive, so it’s important to weigh the cost against the benefits before making a decision.

Hiring a Tax Professional

Hiring a tax professional is the most expensive option, but it can also be the most convenient. A tax professional can help you fill out your tax forms correctly and ensure that you’re getting all of the deductions and credits that you’re entitled to. However, it’s important to do your research before hiring a tax professional to make sure you’re getting a qualified and experienced professional.

Factors to Consider When Choosing a Tax Form

When choosing a tax form, there are a few factors to consider, including:

* Your income and tax situation

* Your comfort level with filing taxes

* Your budget

If you have a simple tax situation and are comfortable filing taxes, then a free tax form may be a good option for you. However, if you have a more complex tax situation or are not comfortable filing taxes, then you may want to consider using a paid tax form or hiring a tax professional.

Tax Filing Tips

Filing your Form 4972 accurately is crucial to avoid potential issues with the tax authorities. Here are some tips to help you complete the form correctly and efficiently:

First and foremost, gather all the necessary information and documents before you start filling out the form. This includes your personal and financial data, as well as any relevant tax documents.

Pay close attention to the instructions provided on the form. If you’re unsure about anything, don’t hesitate to seek clarification from a tax professional.

Common Mistakes to Avoid

- Incorrectly calculating your foreign tax credit. Ensure you use the correct tax rates and exchange rates.

- Failing to include all of your foreign income. This includes income from all sources, even if it was already taxed in the foreign country.

- Deducting expenses that are not eligible for the foreign tax credit. Only certain expenses can be deducted, so make sure you understand the rules.

- Missing the filing deadline. The deadline for filing Form 4972 is April 15th. If you file late, you may be subject to penalties.

Seeking Assistance

If you need help with completing Form 4972, there are several resources available to you:

- The IRS website provides detailed instructions and helpful tips.

- You can also consult with a tax professional who can guide you through the process.

- The IRS also offers free tax preparation assistance for low-income taxpayers.

Helpful Answers

What is the purpose of Form 4972?

Form 4972 is used to report certain types of distributions from retirement plans, such as IRAs and 401(k) plans.

Who needs to file Form 4972?

Individuals who receive distributions from retirement plans are required to file Form 4972 if the distribution is taxable.

Where can I download a free Form 4972?

You can download a free Form 4972 from the IRS website.

What are the benefits of using a free Form 4972?

Using a free Form 4972 can save you time and money, and it is easy to use.