Free 4835 Irs Form Download: A Comprehensive Guide

Navigating the complexities of tax forms can be daunting, but understanding and utilizing Form 4835 is crucial for ensuring accurate tax reporting. This guide will provide a comprehensive overview of Form 4835, from its purpose and sections to downloading, completing, and submitting it effectively. Whether you’re a seasoned taxpayer or filing for the first time, this resource will empower you with the knowledge and tools to handle Form 4835 with confidence.

This guide will delve into the intricacies of Form 4835, providing step-by-step instructions, clear explanations, and practical examples to simplify the process. By the end of this guide, you’ll have a thorough understanding of Form 4835 and be equipped to navigate its complexities with ease.

Submitting Form 4835

Submitting Form 4835 to the Internal Revenue Service (IRS) is crucial to initiate the request for an extension of time to file your tax return. There are several ways to submit the form, each with its own advantages and considerations.

Mailing the Form

Mailing Form 4835 is the most traditional method of submission. You can send the completed form to the IRS at the following address:

Internal Revenue Service

Attn: Extension Request

Cincinnati, OH 45999

Ensure that you mail the form well in advance of the original tax filing deadline to avoid any potential delays or issues.

Faxing the Form

Faxing Form 4835 is a convenient option if you need to submit the form quickly. The IRS accepts faxes at the following number:

(859) 669-5760

When faxing the form, be sure to include a cover page with your name, address, and contact information.

E-filing the Form

E-filing Form 4835 is the fastest and most efficient method of submission. You can e-file the form using authorized tax software or through the IRS website. E-filing allows you to receive immediate confirmation of receipt and ensures that the IRS processes your request promptly.

Timelines for Submitting Form 4835

It is essential to submit Form 4835 before the original tax filing deadline to avoid penalties. The IRS typically grants an automatic 6-month extension, but you may request an additional extension if necessary. However, it’s important to note that extensions do not extend the time to pay any taxes you may owe.

Resources for Form 4835

Innit, there are loads of resources available to give you a hand with filling out Form 4835. We’ve put together a list of helpful stuff to get you started.

- Online tutorials: These tutorials will walk you through the form step-by-step, so you can be sure you’re doing it right.

- Webinars: Webinars are live online events where you can learn about Form 4835 from an expert.

- Other helpful resources: The IRS website has a bunch of other helpful resources, like FAQs and publications, that can help you with Form 4835.

Contact IRS Support

If you need help with Form 4835, you can contact the IRS by phone at 1-800-829-1040. They’re open Monday through Friday from 7am to 7pm.

FAQ Corner

What is the purpose of Form 4835?

Form 4835 is used to apply for an extension of time to file your individual income tax return.

How do I download Form 4835?

You can download Form 4835 from the IRS website at www.irs.gov.

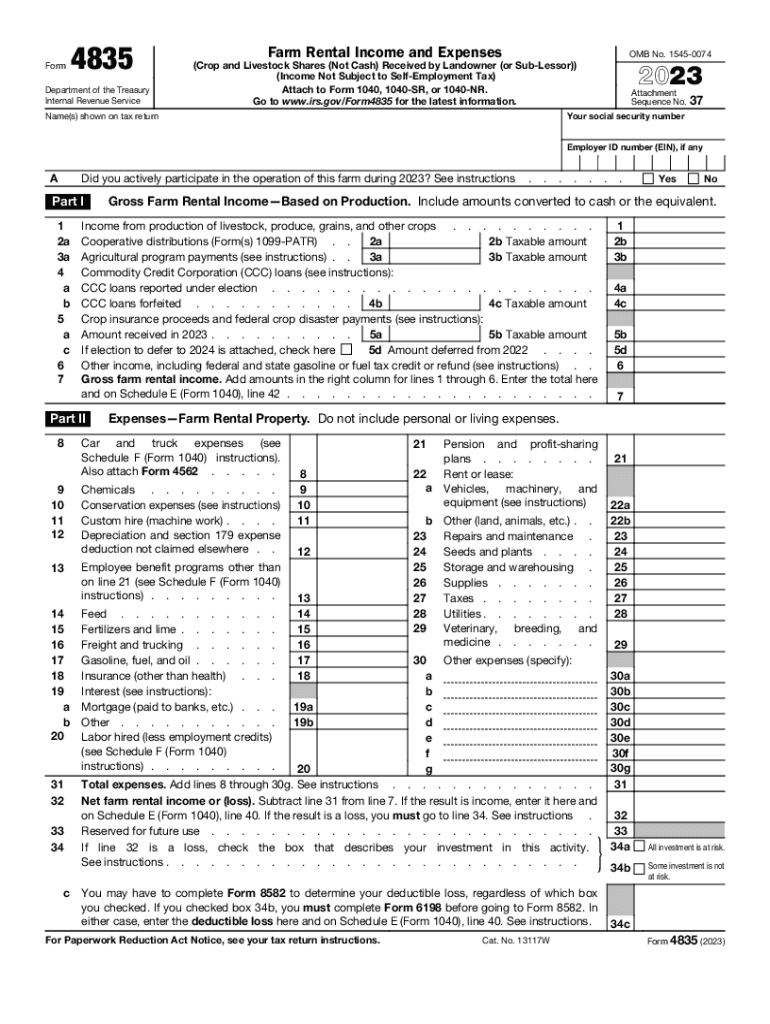

What are the different sections of Form 4835?

Form 4835 has three sections: Part I – Taxpayer Information, Part II – Extension of Time to File, and Part III – Signature.

How do I complete Form 4835?

You can complete Form 4835 by following the instructions on the form. You will need to provide your personal information, tax year, and the reason for requesting an extension.

How do I submit Form 4835?

You can submit Form 4835 by mail or fax. The mailing address is: Internal Revenue Service, P.O. Box 121502, Cincinnati, OH 45212-1502. The fax number is: (859) 669-5740.