Free 4562 Tax Form Download: A Comprehensive Guide

Navigating the complexities of tax filing can be a daunting task. However, with the advent of free downloadable tax forms, the process has become more accessible and convenient. This guide provides a comprehensive overview of the 4562 tax form, exploring its purpose, benefits, and various methods of obtaining it for free. Whether you’re a seasoned tax filer or a first-timer, this guide will empower you with the knowledge and resources necessary to successfully complete your tax obligations.

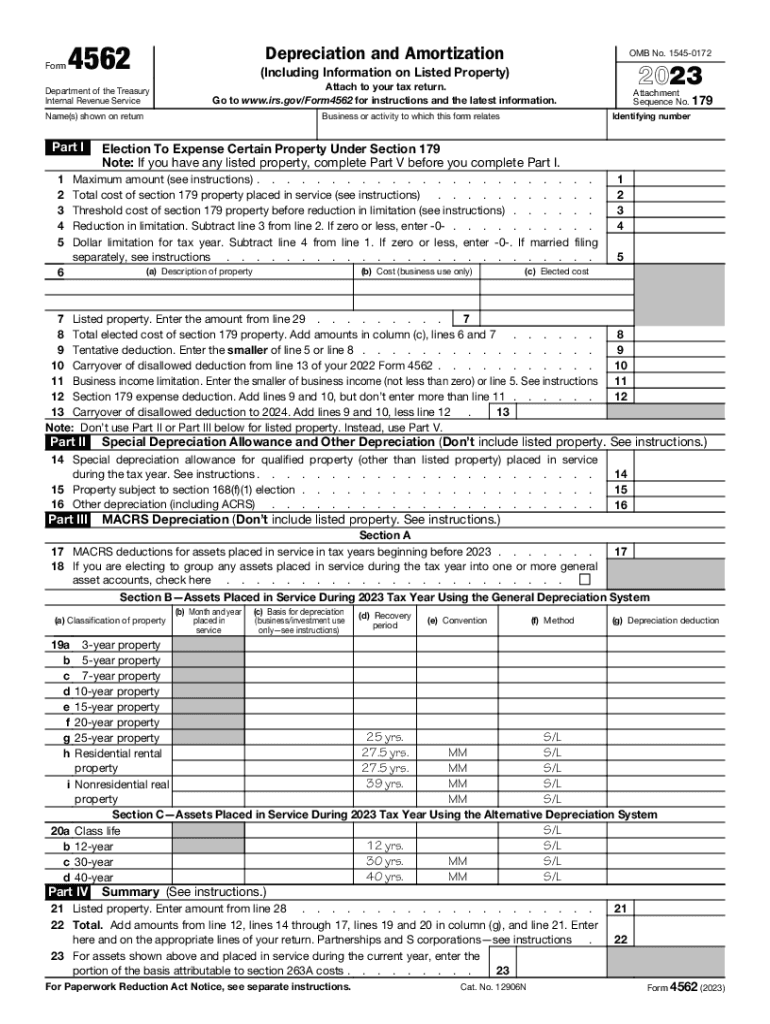

The 4562 tax form, officially known as the Depreciation and Amortization Report, is an essential document for reporting depreciation deductions on business assets. Depreciation is a tax-advantaged accounting method that allows businesses to spread the cost of certain capital assets over their useful lives. By downloading the 4562 tax form for free, you can save on the costs associated with purchasing commercial tax software or hiring a tax preparer.

Free 4562 Tax Form Download Overview

The 4562 tax form is a crucial document used to report the sale or exchange of a principal residence. It’s a vital part of the tax filing process, and downloading it for free can save you time and money.

Downloading the 4562 tax form for free offers several advantages. Firstly, it eliminates the need for costly subscriptions or software purchases. Secondly, it’s readily accessible, allowing you to download the form at your convenience. Lastly, it provides peace of mind knowing you have the official and up-to-date version of the form.

Benefits of Free Download

– Cost-effective: No need for expensive subscriptions or software.

– Convenient: Downloadable at any time, from anywhere.

– Reliable: Ensures access to the official and latest version of the form.

Methods to Obtain the 4562 Tax Form

Innit, need to get your hands on that 4562 tax form, bruv? Don’t fret, it’s a doddle. Check out these banging methods to download it for free:

Official IRS Website

The IRS website is the ultimate crib for all things tax-related. Head over there and search for “Form 4562” to download the form in a jiffy.

Tax Software Providers

If you’re using tax software like TurboTax or H&R Block, they’ll usually have the 4562 form built right in. No need to go hunting elsewhere.

Online Tax Preparation Services

Plenty of online tax prep services like TaxAct or TaxSlayer offer the 4562 form as part of their services. It’s like having a tax wizard at your fingertips, innit?

Advantages of Using a Free 4562 Tax Form

There are several advantages to using a free 4562 tax form, including cost savings, accessibility, and ease of use.

Cost savings

One of the main advantages of using a free 4562 tax form is that it can save you money. Commercial tax preparation software and services can cost anywhere from $20 to $100 or more, but you can download a free 4562 tax form from the IRS website. This can save you a significant amount of money, especially if you are on a tight budget.

Accessibility

Another advantage of using a free 4562 tax form is that it is easily accessible. You can download the form from the IRS website or from a variety of other websites. This means that you can get the form you need whenever you need it, without having to wait for it to be mailed to you.

Ease of use

Free 4562 tax forms are also relatively easy to use. The forms are designed to be user-friendly, and they include instructions that can help you fill out the form correctly. If you have any questions, you can always contact the IRS for help.

Step-by-Step Guide to Downloading the 4562 Tax Form

The 4562 tax form is a depreciation and amortization schedule that is used to report the depreciation and amortization of your business assets. You can download the 4562 tax form for free from the IRS website.

To download the 4562 tax form, you will need to visit the IRS website and navigate to the Forms and Publications section. Once you have found the 4562 tax form, you can click on the “Download” button to download the form to your computer.

Step-by-Step Guide

| Step | Action | Screenshot (optional) | Description |

|---|---|---|---|

| 1 | Visit the IRS website |  |

Go to www.irs.gov |

| 2 | Navigate to the Forms and Publications section |  |

Click on the “Forms and Publications” link in the top menu |

| 3 | Find the 4562 tax form |  |

In the search bar, type “4562” and click on the “Search” button |

| 4 | Click on the “Download” button |  |

Click on the “Download” button to download the form to your computer |

Alternatives to Free 4562 Tax Form Download

Innit, there’s more ways to cop the 4562 tax form than just downloading it for free. You can either:

Requesting a Physical Copy from the IRS

If you’re more of an old-school type, you can request a physical copy of the 4562 tax form from the IRS by:

- Calling the IRS at 1-800-TAX-FORM (1-800-829-3676).

- Writing to the IRS at the following address:

Internal Revenue Service

P.O. Box 25866

Richmond, VA 23289

Using a Paid Tax Preparation Service

If you’re not feeling up to the task of doing your taxes yourself, you can always use a paid tax preparation service. These services will charge a fee, but they can take care of all the paperwork and calculations for you.

Additional Resources for Tax Form 4562

Need a bit of extra help wrapping your noggin’ around the 4562 tax form? Check out these sick resources that’ll have you sorted in no time, innit?

IRS Website

The big cheese when it comes to tax forms, the IRS website is your go-to for all things 4562. You can grab the form, get your questions answered, and even file it online, no sweat.

Tax Preparation Software

If you’re not keen on doing your taxes by hand, tax preparation software can be a lifesaver. These programs will walk you through the 4562 form step-by-step, making it a breeze to complete.

Tax Professionals

If you’re really stuck, don’t be afraid to reach out to a tax professional. They can help you understand the 4562 form and make sure you’re filing it correctly.

FAQ Summary

Can I use the free 4562 tax form even if I don’t have a business?

No, the 4562 tax form is specifically designed for businesses to report depreciation deductions on business assets.

What is the difference between depreciation and amortization?

Depreciation is used for tangible assets, such as equipment or buildings, while amortization is used for intangible assets, such as patents or trademarks.

Where can I find additional support if I have questions about completing the 4562 tax form?

You can refer to the IRS website, consult with a tax professional, or utilize tax preparation software that provides guidance and support.