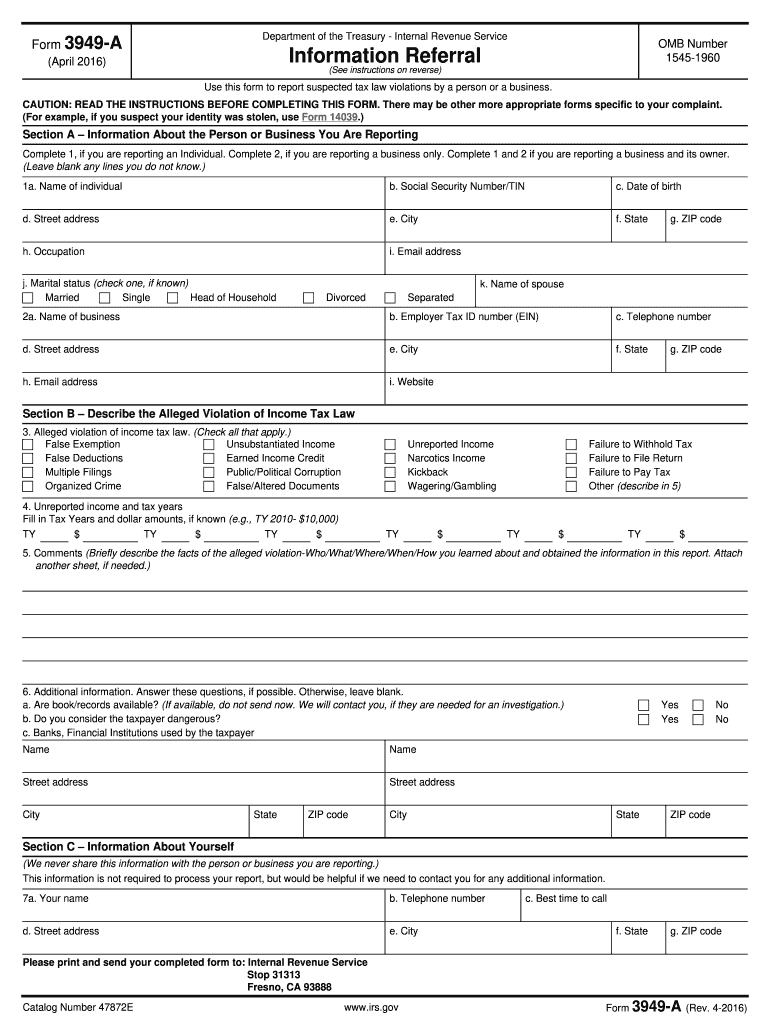

Free 3949a Form Texas Download: A Comprehensive Guide

Navigating the complexities of tax forms can be daunting, especially when dealing with state-specific requirements. If you’re a resident of Texas, understanding and completing Form 3949a is crucial for ensuring accurate tax reporting. This comprehensive guide will provide you with all the essential information you need to download, complete, and file Form 3949a in Texas.

Form 3949a, also known as the Texas Franchise Tax Return, is a crucial document for businesses operating in the state. It’s used to report gross receipts, deductions, and other financial information to the Texas Comptroller of Public Accounts. Filing Form 3949a on time and accurately is not only a legal obligation but also essential for maintaining good standing with the state.

Downloading the Form

Grabbing Form 3949a in Texas is a breeze, blud. Here’s the lowdown on how to bag it:

Boot up your laptop or nick your nan’s phone, and head over to the Texas Comptroller of Public Accounts website: https://comptroller.texas.gov/taxes/property-tax/local-property-tax-forms/.

[detailed content here]

Once you’re there, click on “Property Tax Forms” and then scroll down to “Form 3949a – Application for Appraisal Review”. You’ll see a PDF icon next to it – smash that to start the download. Easy peasy, lemon squeezy!

Completing the Form

To ensure an accurate and complete Form 3949a, follow these steps carefully:

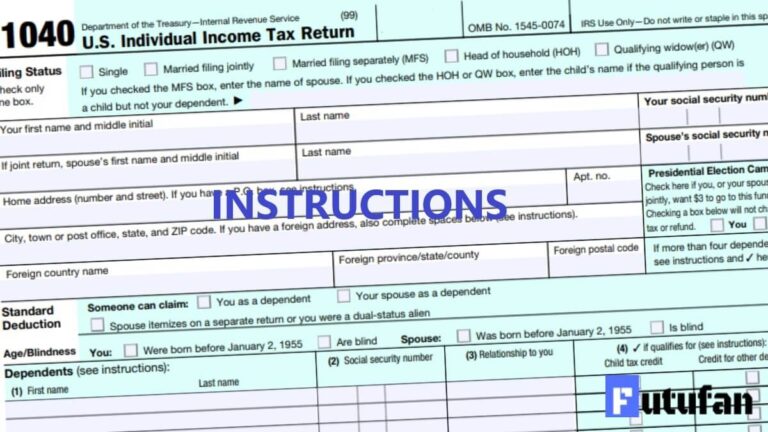

Review the instructions provided with the form thoroughly before you begin filling it out.

Applicant Information

Provide your personal information, including your full name, address, phone number, and email address. Ensure that the information matches your official identification documents.

Business Information

Provide details about your business, such as the business name, address, phone number, and email address. If you have a business license or registration number, include that information as well.

Type of Application

Indicate the type of application you are submitting, whether it’s for a new license, renewal, or amendment.

Background Information

Provide a brief description of your business activities and any relevant experience or qualifications you possess.

Financial Information

Provide details about your business’s financial status, including revenue, expenses, and assets. This information may be required to support your application.

Supporting Documents

Attach any supporting documents that are required with the application, such as financial statements, business plans, or licenses.

Filing and Submission

Filing Form 3949a in Texas is crucial for reporting and paying your franchise tax. Here’s a breakdown of the process:

Deadlines and Submission Methods:

- Due Date: Form 3949a is due on or before May 15th of each year.

- Submission Options: You can file the form online, by mail, or through an authorized tax preparer.

Necessary Documentation:

- Business Information: Provide your business name, address, and taxpayer ID number.

- Financial Information: Report your gross receipts, taxable income, and any deductions or credits claimed.

- Payment Information: Calculate your franchise tax liability and submit the required payment.

Consequences of Late or Incomplete Filings:

- Penalties: Late filings may incur penalties and interest charges.

- Loss of Franchise: Failure to file or pay your franchise tax can result in the forfeiture of your business franchise.

Common Questions and Troubleshooting

If you encounter any difficulties while dealing with Form 3949a, refer to the following frequently asked questions and troubleshooting tips for guidance and solutions.

Below are some common questions and troubleshooting tips to help you resolve any issues you may encounter.

Where can I find Form 3949a?

You can download Form 3949a from the official website of the Texas Comptroller of Public Accounts.

What is the purpose of Form 3949a?

Form 3949a is used to report the sale or use of motor vehicles, trailers, and watercraft in Texas.

Who is required to file Form 3949a?

Any person who sells or uses a motor vehicle, trailer, or watercraft in Texas is required to file Form 3949a.

When is Form 3949a due?

Form 3949a is due within 30 days of the sale or use of the motor vehicle, trailer, or watercraft.

What happens if I file Form 3949a late?

If you file Form 3949a late, you may be subject to penalties and interest.

How can I get help with Form 3949a?

If you need help with Form 3949a, you can contact the Texas Comptroller of Public Accounts at 1-800-252-5555.

Common Queries

What is the purpose of Form 3949a?

Form 3949a is used to report gross receipts, deductions, and other financial information to the Texas Comptroller of Public Accounts.

How do I download Form 3949a?

You can download Form 3949a from the Texas Comptroller of Public Accounts website.

What are the filing deadlines for Form 3949a?

The filing deadline for Form 3949a is May 15th for calendar-year filers and 75 days after the end of the fiscal year for fiscal-year filers.

What are the penalties for late or incomplete filings?

Late or incomplete filings may result in penalties and interest charges.