Free 3508 S Form Download: A Comprehensive Guide

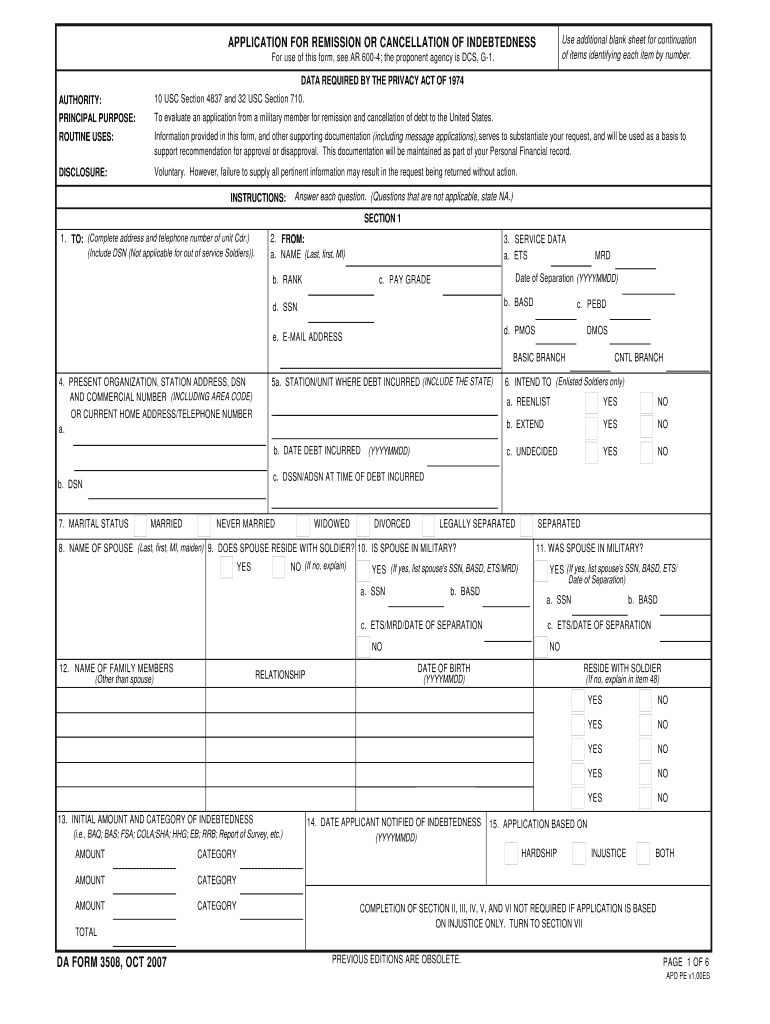

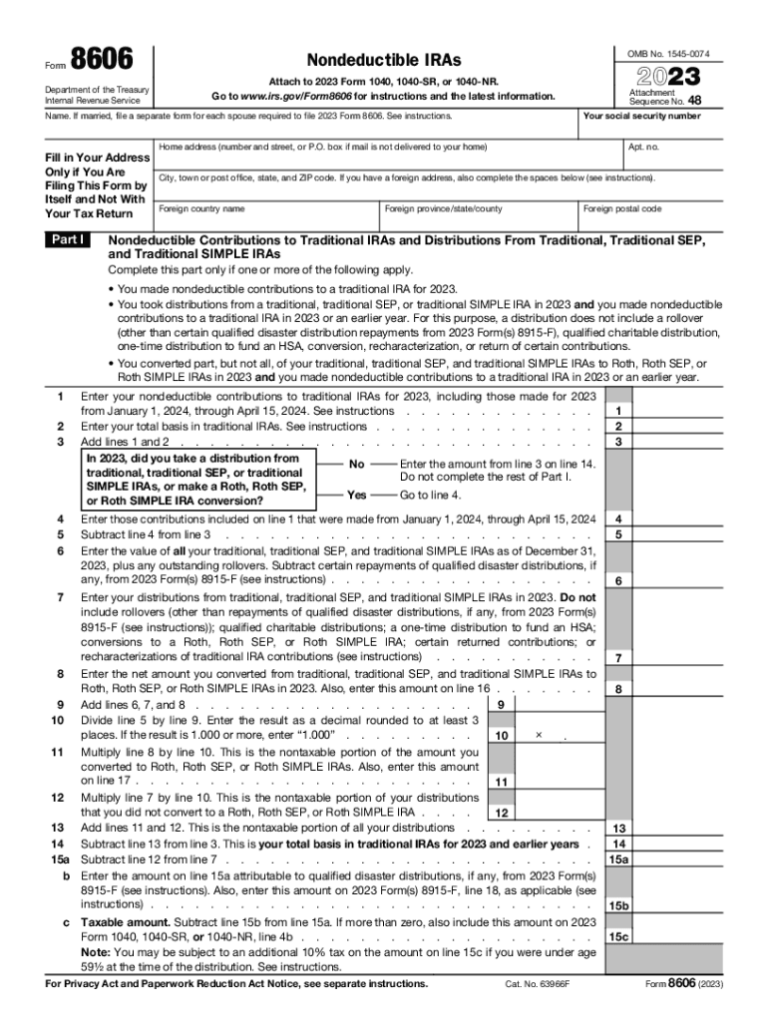

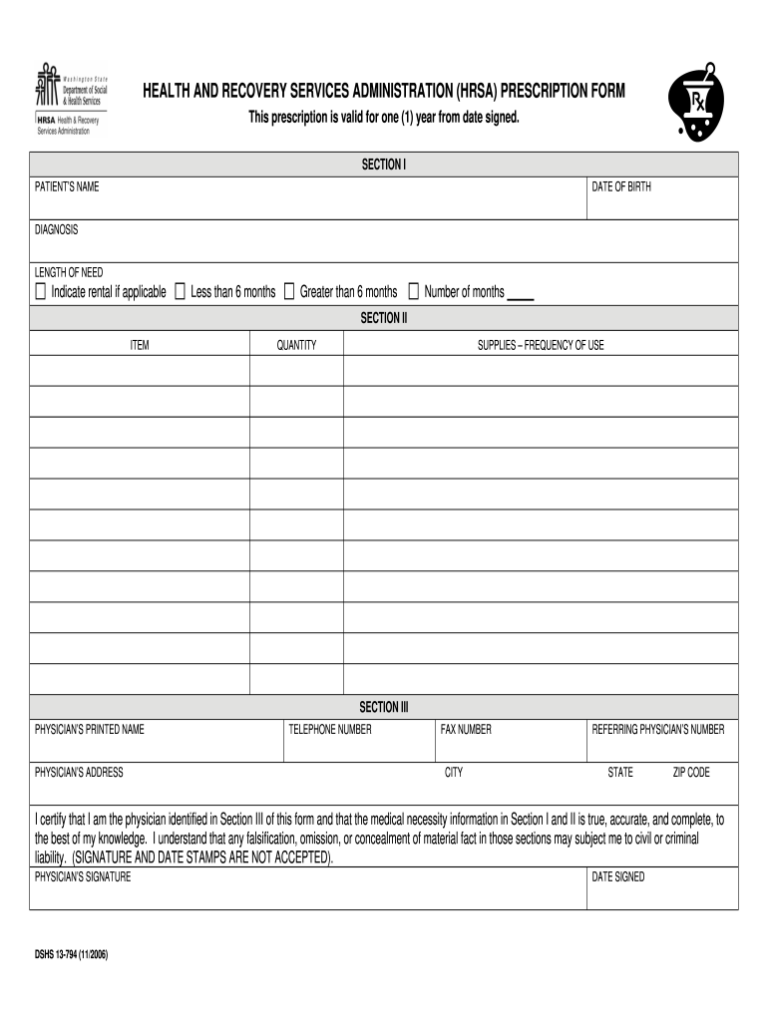

The 3508 S Form is an essential document for individuals and businesses seeking to claim tax credits or deductions. It provides a streamlined and convenient way to report expenses and other relevant information to the Internal Revenue Service (IRS). In this guide, we will delve into the purpose, significance, and usage of the Free 3508 S Form. We will also provide step-by-step instructions on how to download, fill out, and submit the form, ensuring a seamless and accurate process.

The Free 3508 S Form offers numerous advantages, including its accessibility, user-friendliness, and the ability to save time and effort. Whether you are a seasoned tax professional or an individual navigating the complexities of tax reporting, this guide will empower you with the knowledge and resources you need to effectively utilize the Free 3508 S Form.

Filling Out the Free 3508 S Form

Blud, filling out this form is easy as pie, so don’t sweat it. Just follow these sick steps, and you’ll be sorted in no time.

Make sure you’re giving us the lowdown straight up, innit? Clear and concise info is the key to getting this sorted, fam.

Personal Information

- Chuck your name in the box like it’s hot.

- Don’t forget your crib address, even if it’s a right dive.

- Pop in your date of birth, don’t be shy.

Employment Details

- Tell us what you’re grafting at and who you’re working for, mate.

- Don’t forget your National Insurance number, it’s like your secret code.

- Give us the heads-up on how much dough you’re raking in, we won’t judge.

Financial Situation

- Let us know if you’re getting any benefits, whether it’s the dole or sick pay.

- If you’ve got any savings or investments, spill the beans.

- Don’t forget to mention any debts you’re carrying, even if they’re as big as a house.

Submitting the Free 3508 S Form

Intro paragraph

Once you’ve filled out the Free 3508 S Form, you can submit it to the IRS in a few different ways.

Explanatory paragraph

You can mail it in, submit it electronically, or use a tax professional to file it for you.

Mailing the Form

The mailing address for the IRS is:

Internal Revenue Service

Ogden, UT 84201

Submitting Electronically

You can submit the Free 3508 S Form electronically using the IRS’s e-file system. To e-file, you will need to use tax software that is approved by the IRS.

Processing Time

The IRS typically processes Free 3508 S Forms within 6 weeks of receipt. Once your form has been processed, you will receive a confirmation letter from the IRS.

Follow-up Procedures

If you have not received a confirmation letter from the IRS within 6 weeks of submitting your form, you should contact the IRS to follow up.

Using the Free 3508 S Form in Practice

The Free 3508 S Form is a valuable tool for individuals and businesses alike. Here are a few examples of how this form is used in real-world situations:

- Example 1: A small business owner uses the Free 3508 S Form to report the sale of a piece of equipment. This allows the business owner to track the sale and ensure that the appropriate taxes are paid.

- Example 2: An individual uses the Free 3508 S Form to report the sale of a personal vehicle. This allows the individual to document the sale and provide proof of the transaction to the buyer.

- Example 3: A non-profit organization uses the Free 3508 S Form to report the sale of donated goods. This allows the organization to track the sale and ensure that the proceeds are used for charitable purposes.

The Free 3508 S Form is a versatile document that can be used for a variety of purposes. It is a valuable tool for individuals and businesses alike.

FAQ

What is the purpose of the Free 3508 S Form?

The Free 3508 S Form is used to report certain expenses and other information to the IRS. It is commonly used to claim tax credits or deductions, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit (CTC).

Where can I download the official Free 3508 S Form?

You can download the official Free 3508 S Form from the IRS website: https://www.irs.gov/forms-pubs/about-form-3508.

Do I need to provide original documents when submitting the Free 3508 S Form?

No, you do not need to provide original documents when submitting the Free 3508 S Form. However, you should keep copies of all supporting documentation for your records.

What is the processing time for the Free 3508 S Form?

The processing time for the Free 3508 S Form can vary depending on the time of year and the IRS workload. Generally, you can expect to receive your refund or notice of any changes within 6 to 8 weeks of submitting the form.