Free 2024 Tax Forms Download: A Comprehensive Guide

Tax season can be a daunting time, but it doesn’t have to be. With the advent of free downloadable tax forms, filing your taxes has become easier than ever. In this guide, we’ll provide you with all the information you need to download and use the right tax forms for 2024, ensuring a smooth and stress-free filing process.

We’ll cover the different types of tax forms available, the download process, filing options, and valuable resources to assist you along the way. Whether you’re a seasoned filer or tackling your taxes for the first time, this guide has got you covered.

Forms and s

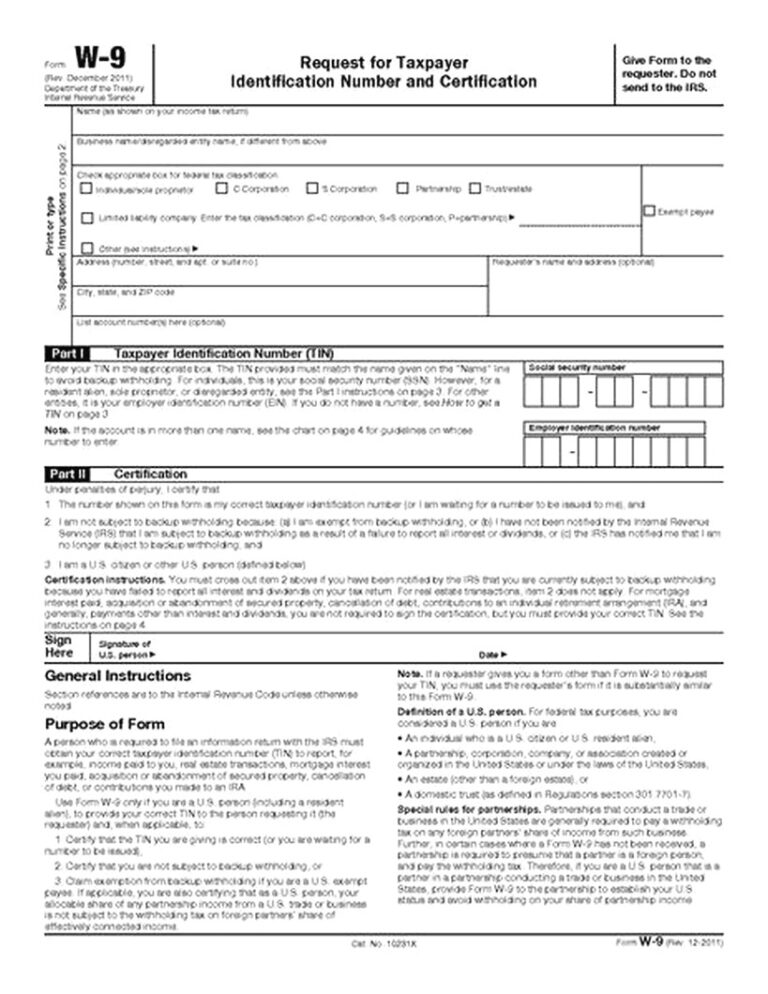

There are a variety of tax forms available for free download, each with its own purpose and use. The most commonly used tax forms include:

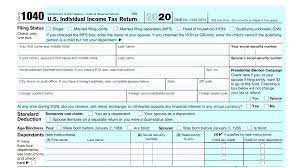

- Form 1040: Used to file individual income taxes.

- Form 1040-EZ: A simplified version of Form 1040 for taxpayers with simple tax situations.

- Form 1040-A: Used to file itemized deductions.

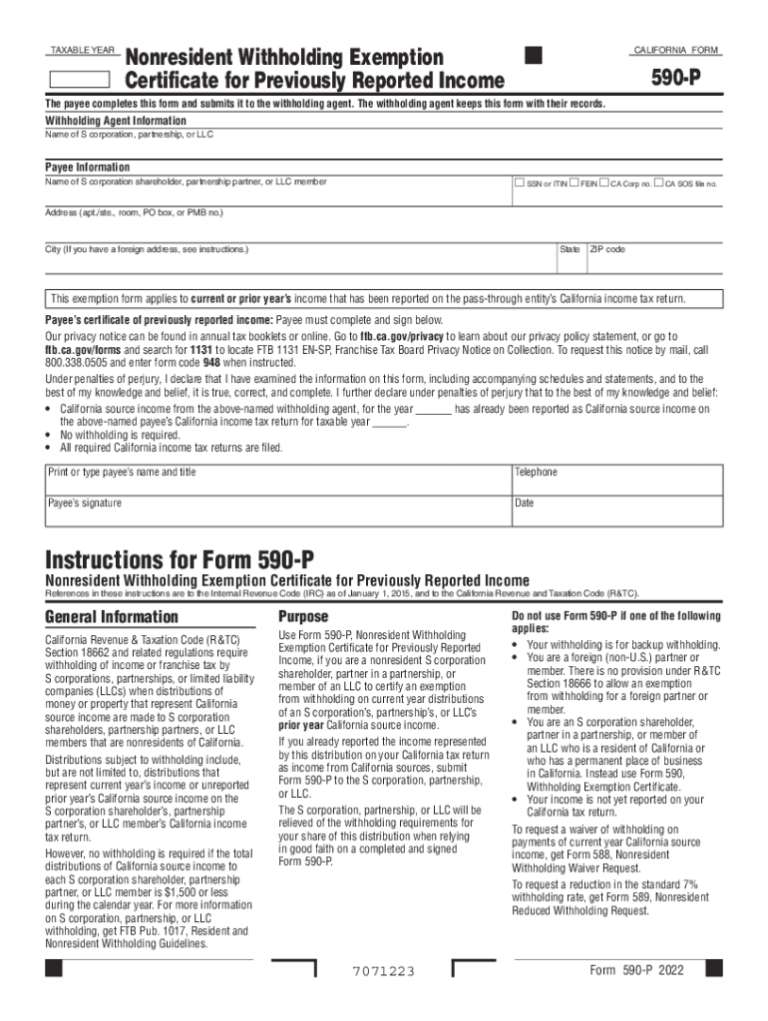

- Form 1040-NR: Used to file income taxes for non-resident aliens.

- Form 1040-X: Used to amend a previously filed tax return.

These forms are available for free download from the IRS website.

Purpose and Use of Each Form

Each tax form has a specific purpose and use. Form 1040 is the most common tax form and is used to file individual income taxes. Form 1040-EZ is a simplified version of Form 1040 and is designed for taxpayers with simple tax situations. Form 1040-A is used to file itemized deductions, which are deductions that are not included in the standard deduction. Form 1040-NR is used to file income taxes for non-resident aliens, and Form 1040-X is used to amend a previously filed tax return.

Download Process

Downloading free tax forms is a simple process that can be completed in a few minutes. There are two main methods of downloading tax forms: online portals and mail order.

Online Portals

Online portals are the most convenient way to download tax forms. The IRS website offers a free online portal where you can download all of the tax forms you need. You can also download tax forms from other websites, such as H&R Block and TurboTax.

- Advantages:

- Convenient and easy to use

- Can download forms in a variety of formats

- Can access forms 24/7

- Disadvantages:

- May require a computer and internet access

- May not be able to download all of the forms you need

Mail Order

You can also order tax forms by mail. To do this, you will need to contact the IRS and request a tax form order form. You can then fill out the order form and mail it to the IRS. The IRS will then mail you the tax forms you requested.

- Advantages:

- Can order forms by mail

- Can get forms in a variety of formats

- Can access forms 24/7

- Disadvantages:

- May take longer to receive forms

- May not be able to order all of the forms you need

Resources and Support

Individuals seeking assistance with tax forms can access a range of resources and support options. These resources provide guidance, assistance, and support to help individuals navigate the tax filing process and ensure accuracy.

The Internal Revenue Service (IRS) is the primary government agency responsible for tax administration in the United States. The IRS offers a comprehensive range of resources and support, including online tools, publications, and guidance. The IRS website provides a wealth of information on tax forms, including instructions, frequently asked questions (FAQs), and downloadable forms.

IRS Assistance

- Online Tools: The IRS website provides a range of online tools to help individuals prepare and file their taxes. These tools include the IRS Free File Program, which offers free tax software to low- and moderate-income taxpayers, and the Interactive Tax Assistant, which provides personalized guidance on tax issues.

- Publications: The IRS publishes a variety of publications that provide guidance on tax forms and tax-related issues. These publications are available online and at local IRS offices.

- Telephone Assistance: The IRS offers telephone assistance to taxpayers who have questions or need help with their tax returns. Taxpayers can call the IRS at 1-800-829-1040 for assistance.

Other Organizations

In addition to the IRS, several other organizations provide resources and support to individuals seeking assistance with tax forms. These organizations include:

- Taxpayer Advocate Service: The Taxpayer Advocate Service (TAS) is an independent organization within the IRS that provides assistance to taxpayers who have problems with the IRS. TAS can help taxpayers resolve tax issues, including disputes over tax bills and audits.

- Volunteer Income Tax Assistance (VITA): VITA is a program that provides free tax preparation assistance to low- and moderate-income taxpayers. VITA volunteers are trained by the IRS and provide free tax preparation services at community centers, libraries, and other locations.

- Tax Counseling for the Elderly (TCE): TCE is a program that provides free tax preparation assistance to elderly taxpayers. TCE volunteers are trained by the IRS and provide free tax preparation services at senior centers and other locations.

FAQs

Q: Where can I download free tax forms for 2024?

A: You can download free tax forms from the IRS website (irs.gov) or order them by mail.

Q: What is the difference between manual and electronic filing?

A: Manual filing involves filling out and mailing paper tax forms, while electronic filing allows you to submit your tax return online.

Q: What resources are available to help me with my taxes?

A: The IRS provides a wealth of resources, including online assistance, publications, and contact information for local offices.