Free 2024 Schedule C Form Download: A Comprehensive Guide

Navigating the complexities of tax season can be daunting, but understanding and utilizing the Schedule C Form is crucial for self-employed individuals and small business owners. This comprehensive guide will provide you with all the essential information you need to download, understand, complete, and submit your 2024 Schedule C Form with confidence.

The Schedule C Form, officially known as “Profit or Loss from Business,” is a vital document that reports your business income and expenses. By accurately completing this form, you can ensure that your tax liability is calculated correctly and avoid potential penalties.

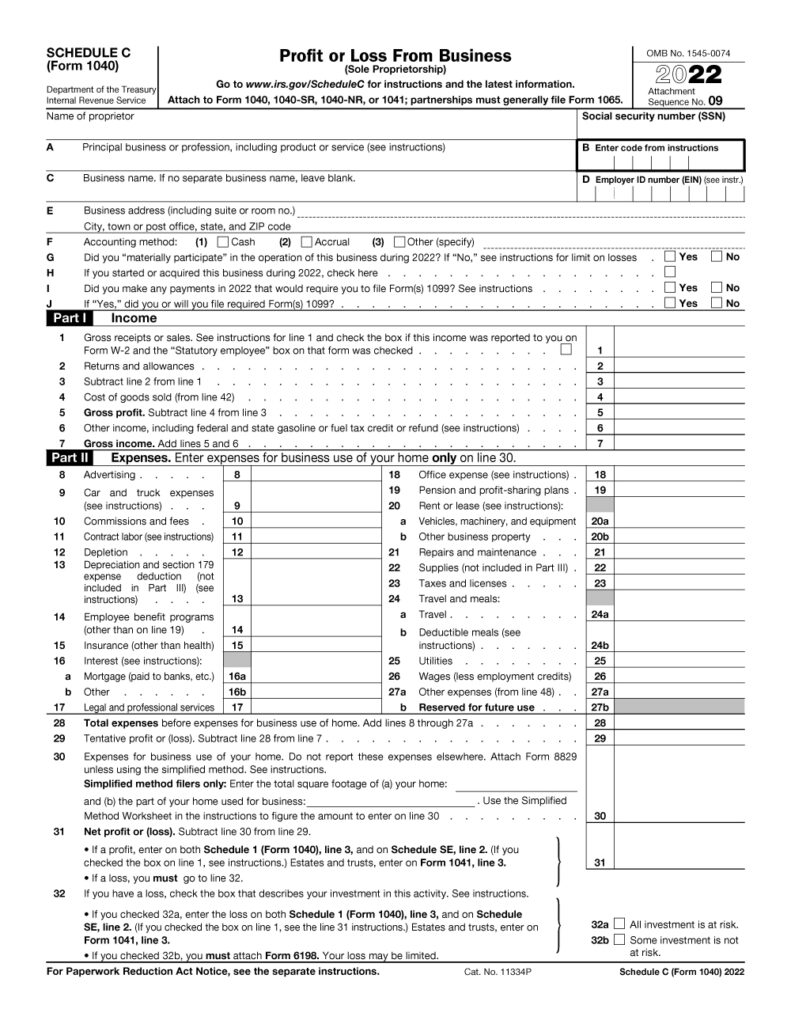

Understanding the Schedule C Form

![]()

The Schedule C Form is an essential document for self-employed individuals and small business owners. It helps you report your business income and expenses to the Internal Revenue Service (IRS) and calculate your tax liability.

The form is divided into several sections, each with its own purpose. Understanding each section is crucial for completing the form accurately and avoiding common mistakes.

Part I: Income

This section captures your business’s total income for the tax year. It includes income from sales, services, and other business activities.

Example: If you own a consulting business and earned £50,000 in consulting fees during the year, you would enter this amount in line 1 of Part I.

Part II: Expenses

This section allows you to deduct eligible business expenses from your income. Common expenses include advertising, rent, utilities, and supplies.

Example: If you spent £10,000 on advertising during the year, you would enter this amount in line 17 of Part II.

Part III: Net Income or Loss

This section calculates your business’s net income or loss for the tax year. It subtracts your total expenses from your total income.

Example: If your total income is £50,000 and your total expenses are £10,000, your net income would be £40,000.

Part IV: Self-Employment Tax

This section calculates your self-employment tax liability. Self-employment tax is a combination of Social Security and Medicare taxes that self-employed individuals must pay.

Example: If your net income is £40,000, your self-employment tax liability would be approximately £7,650.

Common Mistakes to Avoid

- Mixing personal and business expenses: Only expenses directly related to your business can be deducted.

- Overestimating income: Accurately reporting your income is crucial to avoid overpaying taxes.

- Underestimating expenses: Deducting all eligible expenses reduces your taxable income.

- Missing deadlines: Filing your Schedule C Form on time is essential to avoid penalties.

Completing the Schedule C Form

Filling out the Schedule C Form can be a daunting task, but it’s crucial to do it accurately and organized to avoid any potential issues with the IRS. Here’s a step-by-step guide to help you navigate the form with ease:

Step 1: Gather Your Information

Before you start filling out the form, make sure you have all the necessary information at hand, such as your business records, receipts, and bank statements. This will help you complete the form quickly and accurately.

Step 2: Understand the Form’s Structure

The Schedule C Form is divided into several sections, each with specific instructions. Familiarize yourself with the form’s layout to ensure you’re filling out the correct sections with the appropriate information.

Step 3: Fill Out the Basic Information

Start by filling out the basic information on the top of the form, including your name, address, Social Security number, and business name. This information is essential for the IRS to identify you and your business.

Step 4: Calculate Your Income

The next section of the form is where you report your business income. This includes income from sales, services, and any other sources related to your business. Make sure to include all income, even if it’s not taxable.

Step 5: Deduct Your Expenses

After calculating your income, you can deduct your business expenses. This includes expenses such as rent, utilities, supplies, and travel. Deducting these expenses will reduce your taxable income.

Step 6: Calculate Your Net Profit or Loss

Once you’ve calculated your income and expenses, you can determine your net profit or loss. This is done by subtracting your expenses from your income. Your net profit or loss will be reported on your tax return.

Step 7: Review and Submit

Once you’ve completed the form, carefully review it for any errors. Make sure all the information is accurate and complete. Then, sign and submit the form to the IRS.

Remember, accuracy and organization are key when completing the Schedule C Form. By following these steps and providing accurate information, you can ensure that your tax filing process is smooth and hassle-free.

Submitting the Schedule C Form

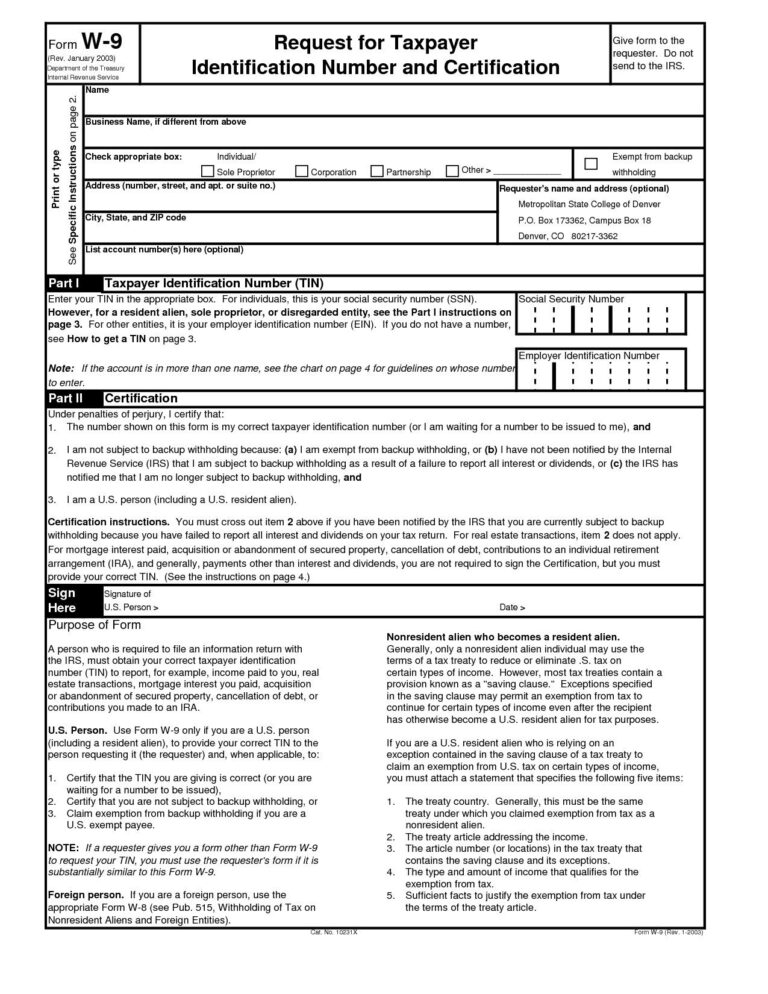

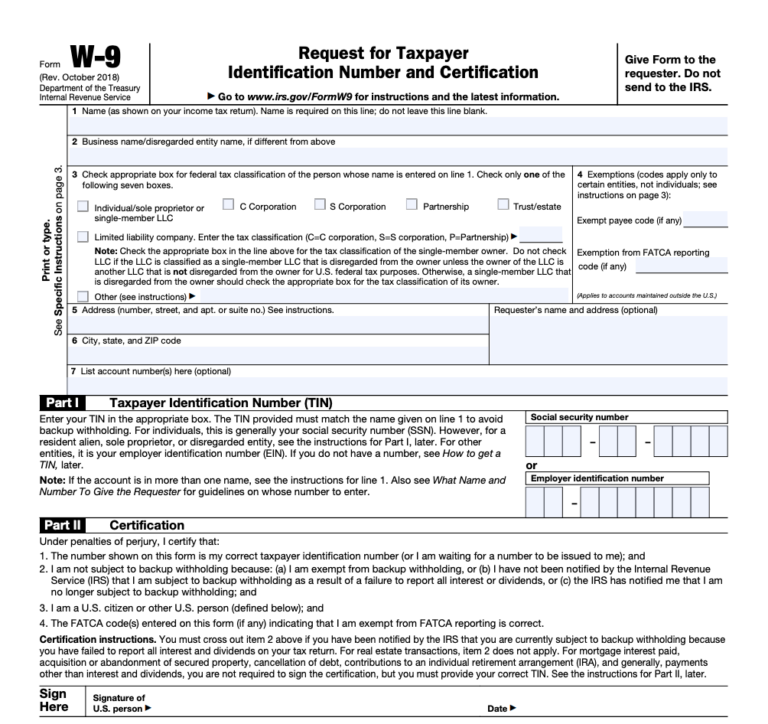

You can submit your Schedule C Form to the IRS in various ways. Each method has its pros and cons, so choose the one that suits you best.

Mailing the Form

To mail your Schedule C Form, you’ll need to fill out a Form 1040 and attach your Schedule C. Make sure you include all necessary supporting documents, such as receipts and invoices. Then, mail your completed forms to the IRS address listed on the Form 1040 instructions.

E-filing the Form

E-filing your Schedule C Form is a convenient and secure way to submit your taxes. You can e-file through the IRS website or use tax preparation software. If you e-file, you’ll need to have a valid Social Security number or Individual Taxpayer Identification Number (ITIN).

Using Tax Preparation Software

Tax preparation software can help you fill out and submit your Schedule C Form. Many software programs offer free or low-cost options. Using tax preparation software can save you time and hassle, and it can help you avoid mistakes.

Deadlines and Consequences for Late Submission

The deadline for submitting your Schedule C Form is the same as the deadline for filing your Form 1040. For most people, this deadline is April 15th. If you file your taxes late, you may have to pay penalties and interest.

Additional Resources

Check out these wicked resources to get your Schedule C sorted:

IRS Publications:

- Publication 334: Tax Guide for Small Business (For Individuals Who Use Schedule C)

- Publication 535: Business Expenses

Tax Preparation Software:

- TurboTax

- H&R Block

- TaxSlayer

Professional Tax Assistance:

If you’re feeling overwhelmed, you can always reach out to a pro. Look for an accountant or tax preparer who specializes in small businesses.

Online Forums and Communities:

Connect with other business owners and tax experts in online forums like:

- Reddit’s r/smallbusiness

- Facebook’s Small Business Owners group

Frequently Asked Questions

Where can I download the official IRS Schedule C Form?

You can download the official IRS Schedule C Form from the IRS website at https://www.irs.gov/forms-pubs/about-form-c.

What are the common mistakes to avoid when completing the Schedule C Form?

Common mistakes include errors in calculating income and expenses, forgetting to include necessary deductions, and failing to keep accurate records. It’s important to carefully review your entries and ensure that all information is correct.

Can I e-file my Schedule C Form?

Yes, you can e-file your Schedule C Form using tax preparation software or through the IRS website.