Free 2024 Pa Tax Forms Download: A Comprehensive Guide

Preparing for tax season can be a daunting task, but it doesn’t have to be. With the availability of free 2024 PA tax forms, you can easily navigate the tax filing process and ensure accurate and timely submissions.

This comprehensive guide will provide you with all the necessary information on how to access, download, and utilize the free 2024 PA tax forms. We’ll also cover important aspects such as accessibility, compatibility, and frequently asked questions to ensure a seamless tax filing experience.

Free 2024 PA Tax Forms

Innit, mates! It’s that time of year again, where we all gotta fill out our tax forms. But fear not, cuz we got you covered with a banging list of all the free 2024 PA tax forms you need to get your taxes sorted.

We’ve sorted the forms into different categories, so you can easily find the ones you need. Just scroll down and have a butcher’s at the list below.

Individual Tax Forms

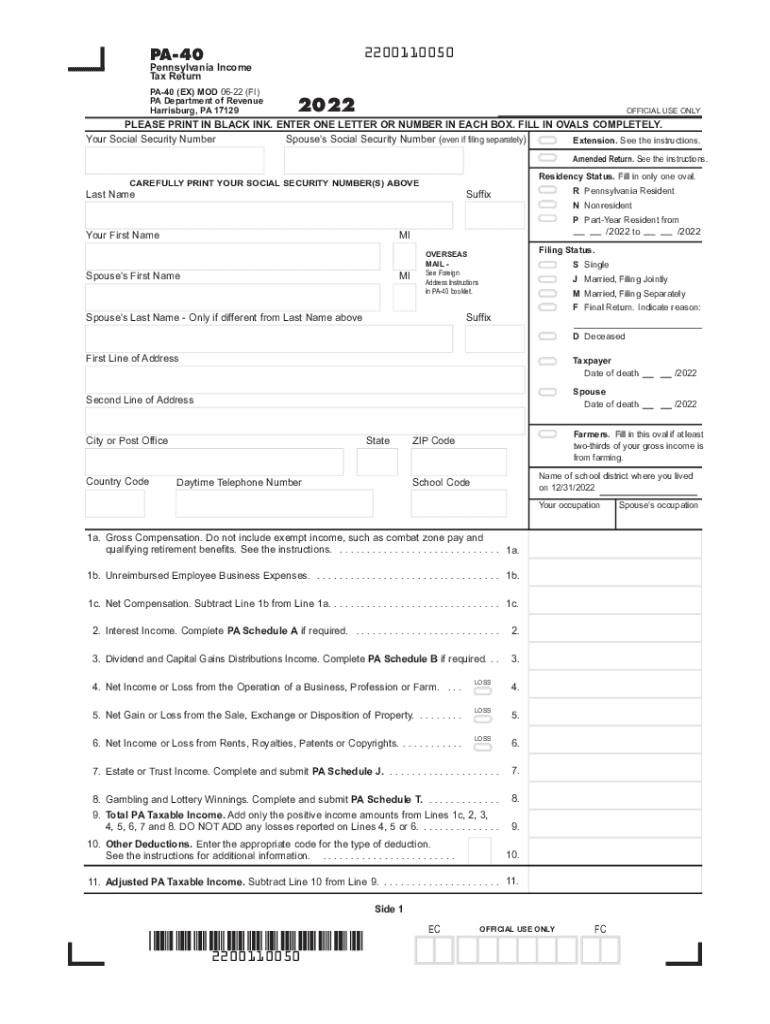

– PA-40 Resident Income Tax Return

– PA-40NR Nonresident Income Tax Return

– PA-40S Short Form Resident Income Tax Return

– PA-40ST Short Form Nonresident Income Tax Return

– PA-40X Amended Resident Income Tax Return

– PA-40XNR Amended Nonresident Income Tax Return

Business Tax Forms

– PA-100 Corporate Income Tax Return

– PA-100S Corporate Income Tax Return for S Corporations

– PA-100W Corporate Income Tax Return for Water or Gas Utilities

– PA-101 Partnership Income Tax Return

– PA-102 Limited Liability Company Income Tax Return

– PA-103 Business Income Tax Return

– PA-104F Fiduciary Income Tax Return

– PA-106 Information Return for Estates and Trusts

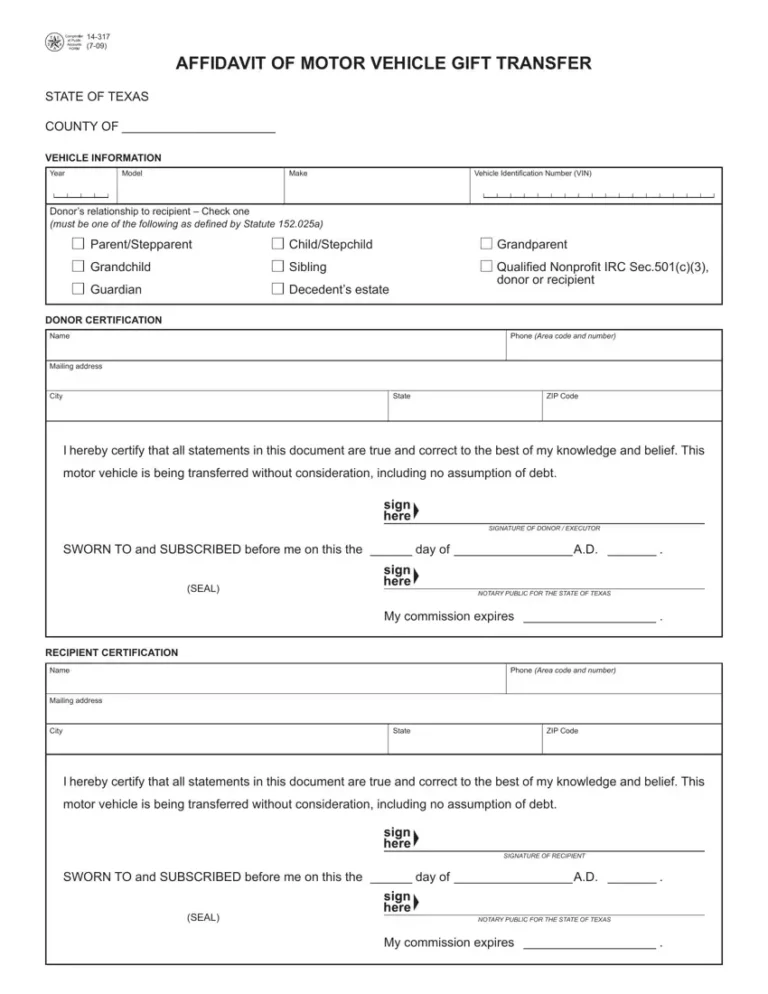

Other Tax Forms

– PA-456 Property Tax/Rent Rebate Application

– PA-600 Estimated Tax Voucher

– PA-600-ES Estimated Tax Payment for Individuals

– PA-600-ES-X Estimated Tax Payment Voucher for Individuals

– PA-600-EZ Estimated Tax Payment for Individuals

– PA-600-EZ-X Estimated Tax Payment Voucher for Individuals

– PA-600-W Estimated Tax Payment for Withholding Agents

– PA-600-W-X Estimated Tax Payment Voucher for Withholding Agents

Downloading s

Grabbing those free 2024 PA tax forms is a doddle. You can do it online or offline, innit.

Online:

- Hit up the Pennsylvania Department of Revenue website.

- Scroll down and click on “Forms” in the left-hand menu.

- Find the “2024 Tax Forms” section and select the forms you need.

- Click “Download” and save the forms to your computer.

Offline:

- Visit your local PA Department of Revenue office.

- Ask for the tax forms you need.

- They’ll give you the forms for free.

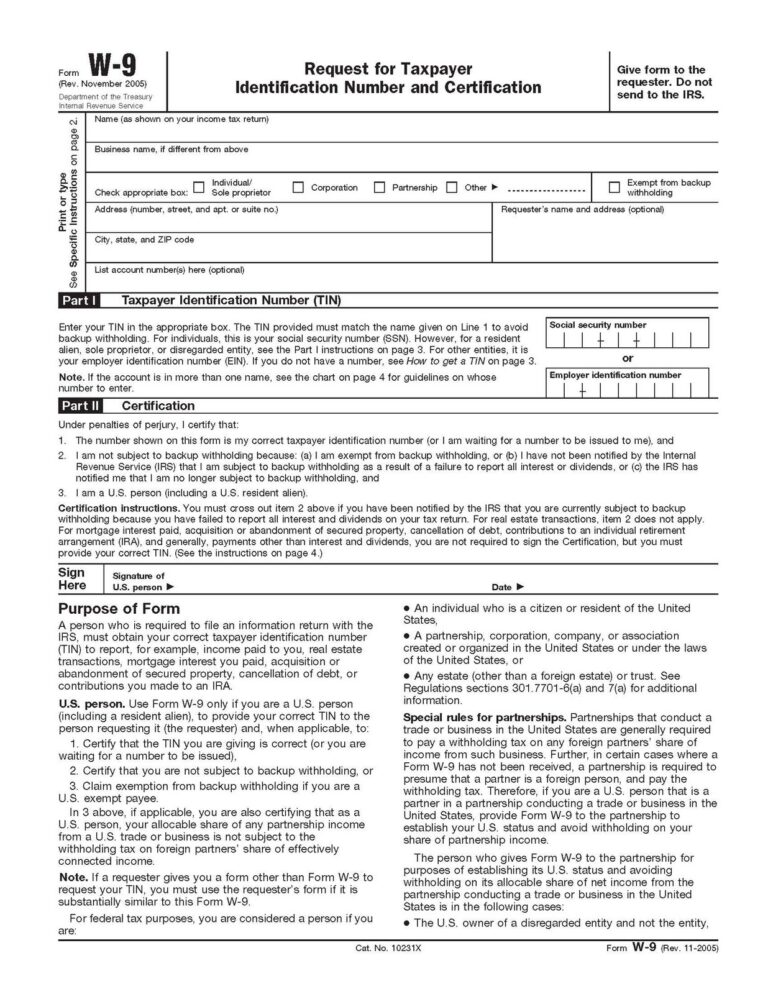

Accessibility and Compatibility

The free 2024 PA tax forms are designed to be accessible to individuals with disabilities.

The forms are available in a variety of formats, including:

- HTML

- Large print

- Braille

The forms are also compatible with a variety of software and devices, including:

- Screen readers

- Magnification software

- Speech recognition software

Form Updates and Revisions

There are currently no announced updates or revisions to the 2024 PA tax forms.

For the latest information on tax form updates and revisions, visit the Pennsylvania Department of Revenue website or consult with a tax professional.

Staying Informed

- Check the Pennsylvania Department of Revenue website regularly for announcements and updates.

- Subscribe to the Department of Revenue’s email list to receive notifications of changes.

- Consult with a tax professional who can provide up-to-date information on tax form changes.

Frequently Asked Questions

This section addresses common questions about the free 2024 PA tax forms, including form availability, download issues, and filing deadlines.

For additional assistance, please refer to the official website of the Pennsylvania Department of Revenue or consult with a tax professional.

Form Availability

- The 2024 PA tax forms will be available for download on the Pennsylvania Department of Revenue website from early January 2024.

- You can also request physical copies of the forms by mail or phone.

Download Issues

- If you encounter any issues downloading the forms, ensure that you have a stable internet connection and that your browser is up to date.

- Try using a different browser or clearing your browser’s cache and cookies.

Filing Deadlines

The filing deadline for Pennsylvania state income taxes is April 15, 2025. If you file electronically, the deadline is extended to April 18, 2025.

Additional Resources

The Pennsylvania Department of Revenue provides various resources to assist taxpayers in completing their tax forms. These resources include tax preparation software, online tax assistance, and local tax offices.

Tax Preparation Software

- TurboTax: Provides user-friendly tax preparation software for individuals and businesses.

- H&R Block: Offers a range of tax software options tailored to different tax situations.

- TaxAct: Delivers affordable and comprehensive tax software solutions.

Online Tax Assistance

- Pennsylvania Department of Revenue website: Provides access to online tax forms, instructions, and frequently asked questions.

- IRS website: Offers comprehensive tax information and resources for both individuals and businesses.

- Taxpayer Advocate Service: Provides free assistance to taxpayers who are experiencing problems with the IRS.

Local Tax Offices

- County Treasurer’s Offices: Offer in-person tax assistance and can provide tax forms.

- Taxpayer Service Centers: Provide free tax assistance and can answer questions about tax forms.

- Community Action Agencies: May offer free tax preparation assistance to low-income individuals.

Frequently Asked Questions

Where can I find the free 2024 PA tax forms?

You can access the free 2024 PA tax forms through the Pennsylvania Department of Revenue website or by visiting your local tax office.

How do I download the tax forms?

Downloading the tax forms is easy. Simply visit the Pennsylvania Department of Revenue website, select the forms you need, and click the download button.

Are the tax forms compatible with different software and devices?

Yes, the tax forms are compatible with various software and devices. You can use a computer, laptop, tablet, or smartphone to access and complete the forms.

How do I stay informed about updates or revisions to the tax forms?

To stay informed about updates or revisions to the tax forms, visit the Pennsylvania Department of Revenue website or subscribe to their email updates.

What if I need assistance completing the tax forms?

If you need assistance completing the tax forms, you can seek help from a tax professional, visit a local tax assistance center, or utilize online tax preparation software.