Free 2024 Form W-3 Download: A Comprehensive Guide for Employers and Employees

Navigating the complexities of tax reporting can be a daunting task, but understanding and accurately completing Form W-3 is crucial for both employers and employees. This comprehensive guide will provide you with the most up-to-date information on the 2024 Form W-3, its significance, and how to download and complete it seamlessly.

Form W-3, Wage and Tax Statement, plays a vital role in ensuring accurate tax reporting and withholding. It serves as a record of wages paid and taxes withheld for each employee, forming the basis for calculating income tax liability. By providing a clear understanding of Form W-3, we aim to empower you with the knowledge and resources to fulfill your tax obligations efficiently.

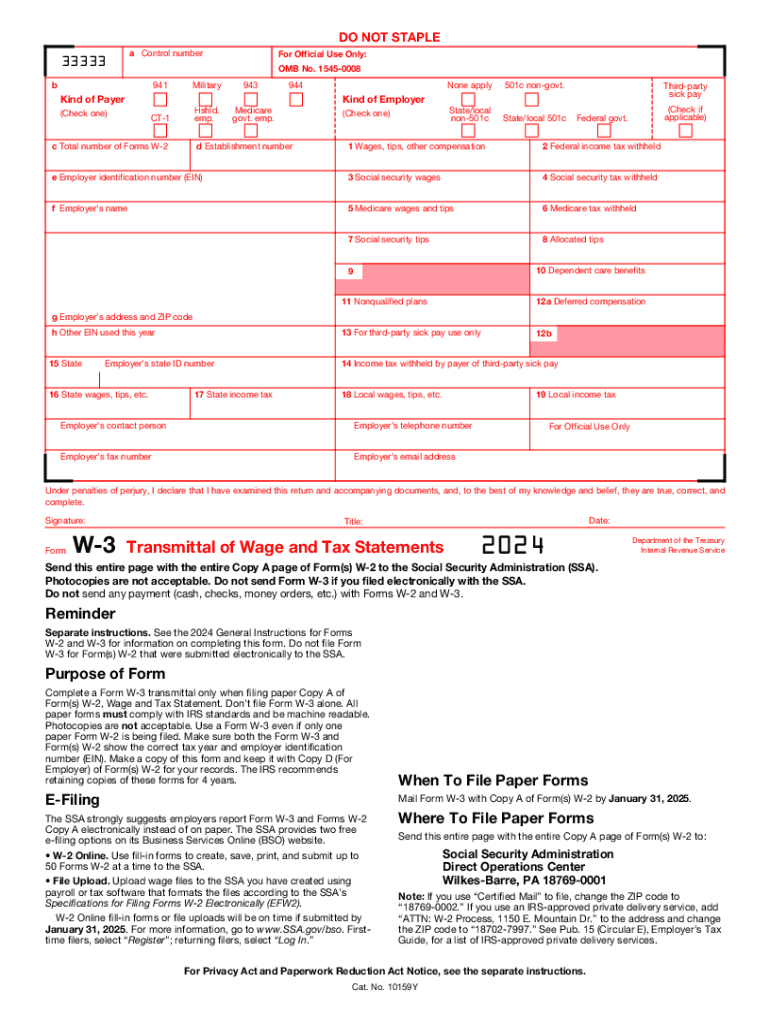

Free 2024 Form W-3 Download

The Form W-3, Wage and Tax Statement, is a document used by employers to report wages and taxes withheld from employees. The form is used to calculate the employee’s federal income tax liability and is also used by the employee to claim tax credits and deductions.

The 2024 Form W-3 is now available for download from the Internal Revenue Service (IRS) website. The form has been updated to reflect the changes in the tax laws for 2024. The most significant change is the increase in the standard deduction for 2024.

The Different Sections and Fields of the Form

The Form W-3 is divided into three sections. The first section contains information about the employee, including their name, address, and Social Security number. The second section contains information about the employer, including their name, address, and Employer Identification Number (EIN). The third section contains information about the employee’s wages and taxes withheld.

- Employee Information: This section includes the employee’s name, address, and Social Security number. It also includes a box where the employee can indicate their filing status for the year.

- Employer Information: This section includes the employer’s name, address, and Employer Identification Number (EIN). It also includes a box where the employer can indicate the type of business they are.

- Wage and Tax Information: This section includes information about the employee’s wages and taxes withheld. It also includes boxes where the employee can indicate any tax credits or deductions they are claiming.

Importance of Form W-3

Form W-3 is a crucial document in the tax reporting process. It plays a pivotal role in ensuring accurate and efficient tax administration for both employers and employees.

The primary purpose of Form W-3 is to provide the Social Security Administration (SSA) with information about employees’ wages and taxes withheld. This information is used to calculate and distribute Social Security benefits, including retirement, disability, and survivors’ benefits.

Employer’s Responsibilities

Employers are required to file Form W-3 along with their employees’ Form W-2, which reports the employee’s wages and taxes withheld. The information on Form W-3 is used to verify the accuracy of the information reported on Form W-2 and to ensure that the correct amount of Social Security taxes has been withheld.

Employee’s Responsibilities

Employees are not required to file Form W-3 directly with the SSA. However, they should review the information on their Form W-2 to ensure that it is accurate and that the correct amount of Social Security taxes has been withheld.

Consequences of Not Filing Form W-3 Accurately

Failing to file Form W-3 accurately or on time can have serious consequences for both employers and employees. Employers may face penalties for late or incorrect filings, while employees may have their Social Security benefits delayed or reduced if the information on Form W-3 is incorrect.

Additional Resources

Get more info on Form W-3 and related topics with these helpful resources.

For questions, contact the Internal Revenue Service (IRS) at 1-800-829-1040 or visit their website at www.irs.gov.

Frequently Asked Questions (FAQs)

- What is Form W-3 used for?

Form W-3 is used to transmit wage and tax data from employers to the Social Security Administration (SSA).

- Who needs to file Form W-3?

Employers who are required to file Form W-2 must also file Form W-3.

- When is Form W-3 due?

Form W-3 is due on or before February 28th of the year following the calendar year for which the wages were paid.

- Where can I get help with Form W-3?

You can get help with Form W-3 from the IRS website, by calling the IRS at 1-800-829-1040, or by speaking with a tax professional.

Questions and Answers

Where can I download the official 2024 Form W-3?

You can download the official 2024 Form W-3 directly from the Internal Revenue Service (IRS) website at www.irs.gov.

What is the deadline for filing Form W-3?

Form W-3 does not have a specific filing deadline. However, employers are required to provide copies of Form W-3 to their employees by January 31st of the following year.

What are the penalties for not filing Form W-3 accurately?

Failure to file Form W-3 accurately can result in penalties and interest charges from the IRS. The specific penalties will depend on the nature and extent of the errors.

Can I use tax software to complete Form W-3?

Yes, many tax software programs offer features that can assist you in completing Form W-3. These programs can help you calculate withholding amounts, fill out the form accurately, and generate electronic copies for filing.