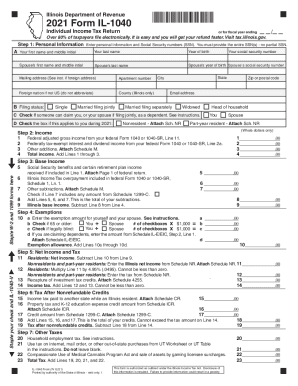

Free 2024 Form IL-1040 Download: A Comprehensive Guide

Preparing your taxes can be a daunting task, but it doesn’t have to be. With the availability of free and accessible resources like Form IL-1040, filing your Illinois state taxes can be a breeze. This comprehensive guide will provide you with all the information you need to download, complete, and file Form IL-1040 with ease.

Form IL-1040 is the official state income tax return form for Illinois residents. It is used to report your income, deductions, and credits to the Illinois Department of Revenue. Whether you’re a seasoned tax filer or new to the process, understanding the ins and outs of Form IL-1040 is crucial for ensuring an accurate and timely tax filing.

s and Guidance

The downloadable Form IL-1040 includes comprehensive s and guidance to assist taxpayers in completing the form accurately. These s and guidance provide detailed instructions, explanations, and examples to clarify the various sections and calculations involved in the tax filing process.

Specific Sections and Resources

The s and guidance accompanying the Form IL-1040 highlight specific sections and resources that can be particularly helpful for taxpayers. These include:

- Line-by-line instructions: Step-by-step instructions for each line on the form, explaining what information should be entered and how to calculate the amounts.

- Examples and worksheets: Sample calculations and worksheets to illustrate the application of tax rules and to assist taxpayers in understanding complex computations.

- Glossary of terms: Definitions of key tax terms and concepts used in the form to help taxpayers understand the terminology.

- Online resources: Links to the Illinois Department of Revenue website and other online resources where taxpayers can access additional information and support.

By carefully reviewing the s and guidance, taxpayers can gain a clear understanding of the tax filing requirements and ensure that their Form IL-1040 is completed accurately and on time.

Filing Options

Filing your IL-1040 tax return is a crucial step in fulfilling your tax obligations. There are multiple filing options available, each with its own advantages and deadlines. This section will guide you through the different methods and their specific requirements.

Electronic Filing

Electronic filing is a convenient and efficient way to submit your tax return. You can use tax software or online platforms to prepare and file your return electronically. This method is generally faster than mailing your return and allows you to track the status of your refund or payment.

Deadlines: Electronic filing deadlines are typically the same as mail-in filing deadlines.

Requirements: To file electronically, you will need a valid Social Security number, a bank account for direct deposit or payment, and a compatible tax software or online platform.

Mail-in Filing

Mail-in filing is a traditional method of submitting your tax return. You can obtain the necessary forms from the Illinois Department of Revenue website or by visiting a local tax office. After completing your return, you will need to mail it to the address provided on the form.

Deadlines: The mail-in filing deadline for the IL-1040 is typically April 15th.

Requirements: To file by mail, you will need to have the completed IL-1040 form, any necessary supporting documents, and a check or money order for any taxes owed.

Drop-off Locations

In some cases, you may be able to drop off your tax return in person at designated locations. These locations may include tax offices or local libraries. Contact your local tax office for information on available drop-off locations and hours.

Deadlines: Drop-off deadlines are typically the same as mail-in filing deadlines.

Requirements: To drop off your return, you will need to have the completed IL-1040 form and any necessary supporting documents.

Support and Resources

Getting assistance with your tax questions or issues doesn’t have to be a headache. Here’s where you can find the support you need:

Contact Information

- Illinois Department of Revenue:

– Phone: 1-800-732-8866

– Website: https://www2.illinois.gov/rev/Pages/default.aspx

FAQ Section

Q: Where can I download Form IL-1040 for free?

A: You can download Form IL-1040 for free from the Illinois Department of Revenue website or various online platforms like tax preparation software providers.

Q: Is Form IL-1040 compatible with all devices and software?

A: Yes, Form IL-1040 is generally compatible with most devices and software. However, it’s recommended to check the specific requirements for the platform or software you intend to use.

Q: Are there any accessibility features available for individuals with disabilities?

A: Yes, the Illinois Department of Revenue provides accessible versions of Form IL-1040 in alternative formats like Braille, large print, and audio upon request.

Q: What filing options are available for Form IL-1040?

A: You can file Form IL-1040 electronically, by mail, or at designated drop-off locations. Each method has specific deadlines and requirements.

Q: Where can I get help with Form IL-1040?

A: You can contact the Illinois Department of Revenue or seek assistance from tax professionals, software providers, or community organizations for guidance and support.