Free 2024 Form 941 Pdf Download: A Comprehensive Guide

Navigating the complexities of tax filing can be daunting, but with the right resources, it doesn’t have to be. This guide provides a comprehensive overview of Form 941, a crucial document for businesses and individuals, and offers a step-by-step approach to downloading, completing, and filing the form accurately and efficiently.

Form 941 is an essential tax form used to report quarterly federal income tax, Social Security tax, and Medicare tax liabilities. Understanding the purpose, target audience, and recent updates to the form is vital before delving into the details of downloading and completing it.

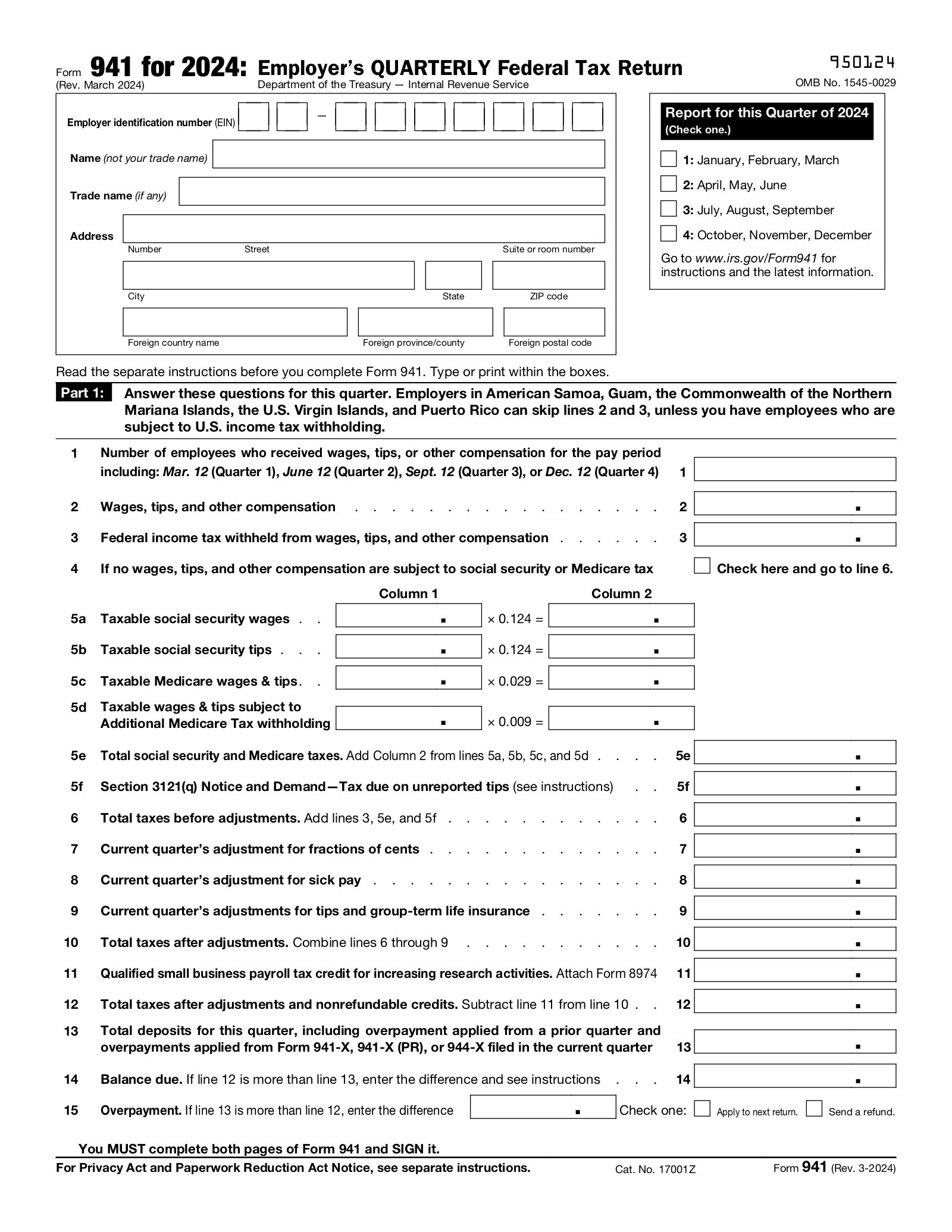

Overview of 2024 Form 941

Form 941 is a crucial tax document that employers must file with the Internal Revenue Service (IRS) to report federal income tax, Social Security tax, and Medicare tax withheld from employees’ wages. It serves as a vital tool for ensuring compliance with tax laws and helps the IRS track and collect taxes owed by businesses.

The target audience for Form 941 includes employers of all sizes, including individuals, partnerships, corporations, and non-profit organizations. Employers who are required to file Form 941 are those who have employees and are subject to federal employment taxes.

Form 941 has undergone several revisions over the years to reflect changes in tax laws and regulations. The 2024 version of Form 941 incorporates updates and modifications to ensure it remains aligned with the latest tax requirements.

Downloading the Free 2024 Form 941 PDF

Innit, it’s easy as pie to download the 2024 Form 941 PDF. Just follow these bangin’ steps:

- Blaze over to the official IRS website: https://www.irs.gov/forms-pubs/about-form-941.

- Click on the link for “Form 941 (2024)”.

- Hit the “Download” button to save the PDF to your comp.

Boom! You’re sorted.

Heads up: If you’re having a mare downloading the PDF, make sure you’ve got a stable net connection and that your browser is up to scratch. Still stuck? Give the IRS a bell on 1-800-829-1040.

Completing the 2024 Form 941

Yo, listen up! Filling out the 2024 Form 941 might seem like a right pain in the neck, but it’s a piece of cake with us guiding you. Let’s break it down, blud.

The form’s got a bunch of sections, so let’s get stuck into them one by one. First up, we’ve got the “Employer Identification Number” box. Make sure you’ve got your EIN handy, ’cause you’ll need to pop it in there.

Next, you’ve got the “Tax Period Covered by this Return” section. This is where you tell ’em what dates your return covers. Simple as that, mate.

Part 1: Wages, Tips, Other Compensation, and Taxable Fringe Benefits

Here’s where you dish out the details about how much your employees got paid and what they owe in taxes. Start by filling in the “Total Wages, Tips, Other Compensation, and Taxable Fringe Benefits” box. Then, break it down into different categories like “Medicare Taxable Wages and Tips” and “Social Security Taxable Wages and Tips.”

Remember to keep an eye on the “Control Number” box. If you’ve got a previous return that’s still being processed, you’ll need to write down its control number here.

Part 2: Taxes

This is where the real fun begins. You’ll need to calculate how much your employees owe in taxes, including income tax, Social Security tax, and Medicare tax. Use the handy tables provided to figure out the right amounts.

Once you’ve got those figures, fill ’em in the appropriate boxes. Don’t forget to check the “Tax Liability” box to see how much you owe in total.

Part 3: Advance Earned Income Credit Payments

If you’ve made any advance earned income credit payments to your employees, you’ll need to report ’em here. Just pop the amounts in the “Advance Earned Income Credit Payments” box.

Part 4: Deposits and Payments

Here’s where you show ’em how much you’ve already paid in taxes. Fill in the “Total Deposits” box and the “Total Payments” box with the amounts you’ve sent to the IRS.

Part 5: Signature

Last but not least, don’t forget to sign and date the form. This shows the IRS that you’re the real deal and that you’re taking responsibility for the information you’ve provided.

There you have it, mate. Filling out the 2024 Form 941 doesn’t have to be a headache. Just follow these steps and you’ll be done in no time.

Filing and Submission Options

There are several methods you can use to file your 2024 Form 941. The most convenient option is to file electronically through the IRS website or an authorized e-file provider. Electronic filing is fast, secure, and allows you to track the status of your return.

You can also mail your return to the IRS. The address is:

Internal Revenue Service

P.O. Box 12613

Philadelphia, PA 19180-0613

The deadline for filing Form 941 is April 30, 2025. If you file electronically, you have until May 15, 2025 to file. If you mail your return, it must be postmarked by April 30, 2025.

It is important to file your return on time. If you file late, you may have to pay penalties and interest.

Electronic Filing

Electronic filing is the fastest and most convenient way to file your Form 941. You can e-file through the IRS website or an authorized e-file provider.

To e-file through the IRS website, you will need to create an account. Once you have an account, you can log in and follow the instructions to file your return.

To e-file through an authorized e-file provider, you will need to find a provider that offers Form 941 e-filing. Once you have found a provider, you can create an account and follow the instructions to file your return.

Mail-in Options

You can also mail your Form 941 to the IRS. The address is:

Internal Revenue Service

P.O. Box 12613

Philadelphia, PA 19180-0613

Your return must be postmarked by April 30, 2025. If you file late, you may have to pay penalties and interest.

Additional Resources and Support

If you need further assistance with completing and submitting your 2024 Form 941, there are several resources available to help you.

The IRS provides a variety of online guides, tutorials, and FAQs that can help you understand the form and its requirements. You can also contact the IRS directly by phone or email if you have any questions or need additional support.

Online Resources

- IRS website: https://www.irs.gov/

- IRS Form 941 instructions: https://www.irs.gov/forms-pubs/about-form-941

- IRS FAQs: https://www.irs.gov/help/ita/how-do-i-get-help-with-my-tax-question

Official Support Channels

- IRS phone number: 1-800-829-1040

- IRS email: [email protected]

Assistance Programs and Tax Professionals

If you need additional help, you may want to consider reaching out to a tax professional. Tax professionals can help you prepare and file your Form 941, and they can also provide advice on tax-related matters.

Answers to Common Questions

What is the purpose of Form 941?

Form 941 is used to report quarterly federal income tax, Social Security tax, and Medicare tax liabilities.

Who is required to file Form 941?

Businesses and individuals with employees or who pay self-employment taxes are required to file Form 941.

Where can I download the Free 2024 Form 941 PDF?

The official website of the Internal Revenue Service (IRS) provides a free PDF download of Form 941.

What are the common errors to avoid when completing Form 941?

Common errors include incorrect calculations, missing information, and filing after the deadline.