Free 2024 Form 940 Download: A Comprehensive Guide to Filing Your Annual Unemployment Tax Return

Navigating the complexities of the tax code can be a daunting task, especially when it comes to filing your annual unemployment tax return. Form 940, the official document used to report unemployment taxes, can seem intimidating at first glance. But fear not! This comprehensive guide will provide you with everything you need to know about Form 940, from understanding its purpose to downloading, completing, and submitting it seamlessly.

Whether you’re a seasoned tax professional or a first-time filer, this guide will empower you with the knowledge and confidence to tackle Form 940 with ease. So, let’s dive right in and make this tax season a breeze!

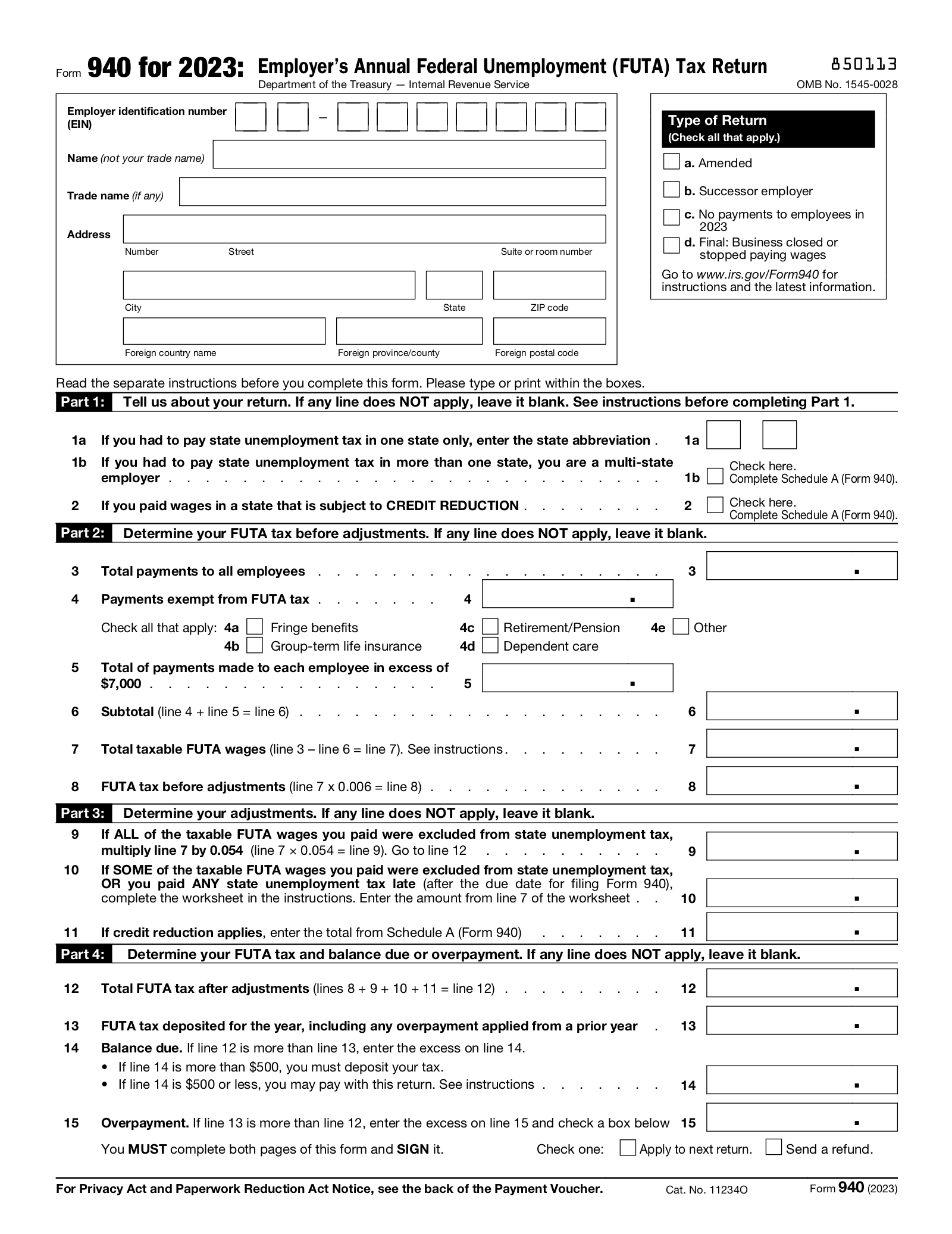

Form 940 Overview

Form 940 is the Annual Return of Withheld Federal Income Tax. Employers use this form to report federal income tax withheld from employees’ wages, as well as their share of Social Security and Medicare taxes.

The information reported on Form 940 includes:

- The employer’s name, address, and EIN

- The total amount of wages paid to employees

- The total amount of federal income tax withheld from employees’ wages

- The employer’s share of Social Security and Medicare taxes

Form 940 is due on January 31st following the end of the calendar year. Employers who file Form 940 late may be subject to penalties.

Downloading Form 940

Blag it, you need to get your mitts on Form 940? You’re in the right gaff, mate. Here’s the lowdown on how to bag it from the IRS website, and other sly ways to get your hands on it.

IRS Website

Head to the IRS website and do this:

- Type “Form 940” into the search bar.

- Click on the first result.

- Select “Download Form 940 (PDF)” from the options.

- Save the PDF file to your computer.

Alternative Methods

If you’re not feeling the IRS website vibes, you can also try these other options:

- Order Form 940 by phone at 1-800-TAX-FORM (1-800-829-3676).

- Download Form 940 from a tax software provider.

- Visit a local IRS office to pick up a copy.

Download Options

Here’s a quick comparison of the different download options:

| Option | File Format | Size |

|---|---|---|

| IRS Website | 1.2 MB | |

| Tax Software Provider | PDF, XML | Varies |

| Local IRS Office | Paper | N/A |

Additional Resources

Check out these resources for more info on Form 940:

The IRS has a bunch of publications and online resources that can help you with Form 940:

- Publication 940: Employer’s Annual Federal Unemployment (FUTA) Tax Return

- IRS Offers Online Help for Form 940 Filers

- About Form 940

IRS Assistance

If you need help with Form 940, you can contact the IRS:

- By phone: 1-800-829-4933

- By mail: Internal Revenue Service, P.O. Box 12000, Covington, KY 41012

- Online: Contact Your Local IRS Office

Q&A

What is the purpose of Form 940?

Form 940 is used to report and pay federal unemployment taxes (FUTA) on wages paid to employees. FUTA taxes fund the unemployment insurance system, which provides temporary income to individuals who have lost their jobs.

When is Form 940 due?

Form 940 is due by January 31st of the year following the calendar year in which the wages were paid. If January 31st falls on a weekend or holiday, the due date is the next business day.

Where can I download Form 940?

You can download Form 940 from the IRS website at www.irs.gov/forms-pubs.

How do I complete Form 940?

The IRS provides detailed instructions on how to complete Form 940 on their website. You can also seek professional help from a tax preparer or accountant if needed.

What are some common errors to avoid when completing Form 940?

Some common errors to avoid when completing Form 940 include:

- Incorrectly calculating taxable wages

- Failing to include all employees on the return

- Making math errors

- Filing the return late