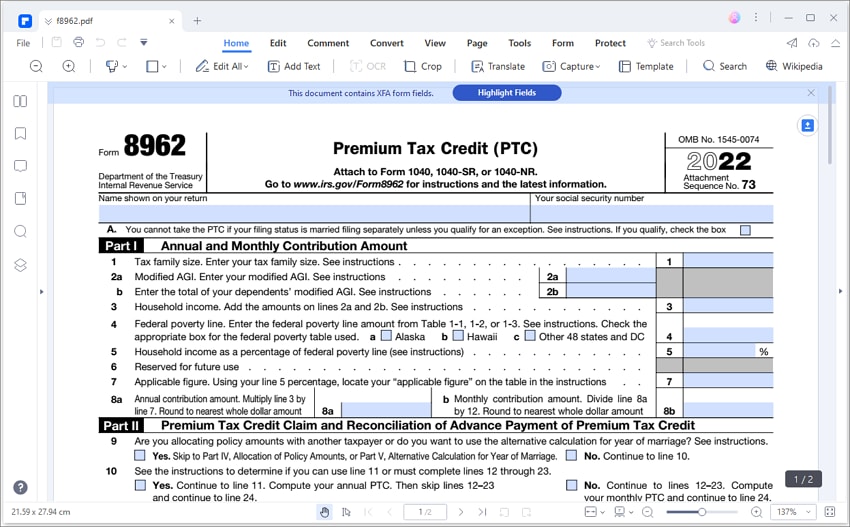

Free 2024 Form 8962 Instructions Download: A Comprehensive Guide

Navigating the complexities of tax season can be daunting, but with the right tools and guidance, it doesn’t have to be. Form 8962, Premium Tax Credit (PTC), is a crucial document that helps individuals claim tax credits for health insurance premiums paid during the year. To ensure accuracy and maximize your tax savings, it’s essential to have access to the most up-to-date instructions. In this comprehensive guide, we provide a step-by-step process for downloading the free 2024 Form 8962 instructions, understanding its contents, completing it accurately, and submitting it seamlessly.

Whether you’re a seasoned tax filer or tackling your taxes for the first time, this guide will empower you with the knowledge and resources you need to navigate Form 8962 with confidence. By following our clear instructions and leveraging the additional resources we provide, you can ensure a smooth and successful tax filing experience.

Obtaining the s

To download the s from the IRS website, follow these steps:

- Go to the IRS website: www.irs.gov.

- Click on the “Forms and Publications” tab.

- In the search bar, type “Form 8962” and press enter.

- Click on the link for “Form 8962, Premium Tax Credit (PTC)”.

- On the Form 8962 page, click on the link for “Instructions for Form 8962”.

- The instructions will be downloaded as a PDF file.

You can also obtain the s by calling the IRS at 1-800-829-3676. The IRS will mail you a copy of the s.

If you are unable to download the s from the IRS website or by calling the IRS, you can also find them at your local library or tax preparation office.

Potential challenges or errors that may occur during the download process:

- The IRS website may be experiencing technical difficulties.

- Your internet connection may be slow or unstable.

- The PDF file may be corrupted.

If you encounter any of these challenges or errors, try again later. If you are still unable to download the s, you can call the IRS at 1-800-829-3676 for assistance.

Understanding the s

The s is a complex document, but it’s important to understand its key sections to make sense of the information it contains.

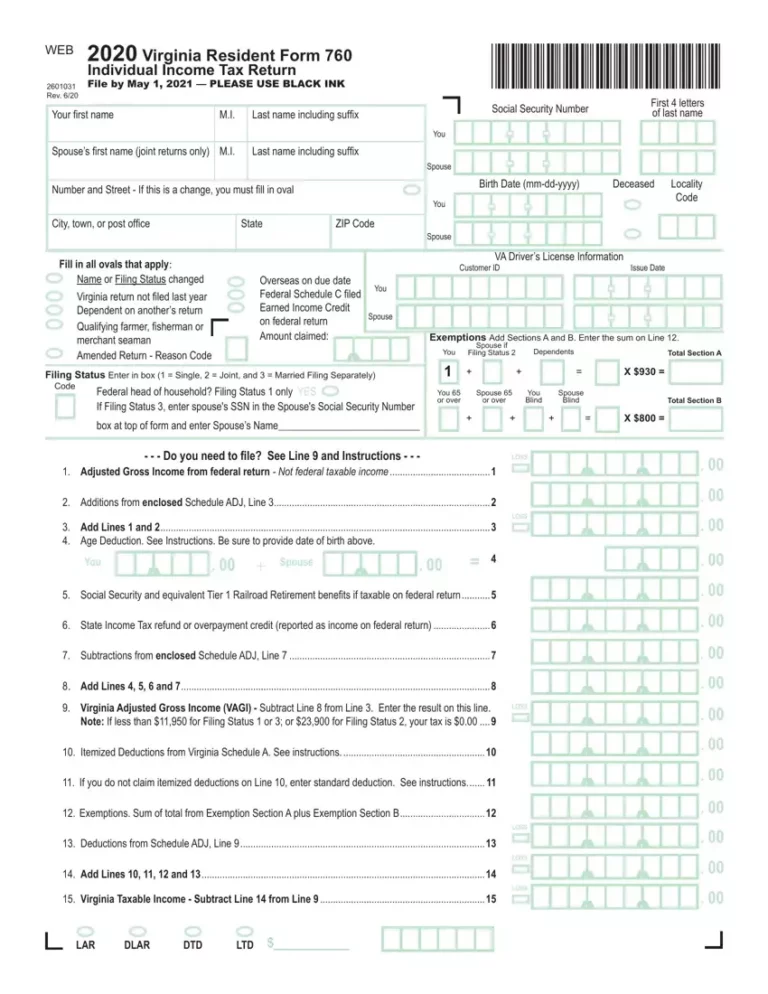

The s is divided into three main sections: the header, the body, and the footer. The header contains basic information about the , such as the name of the , the date it was filed, and the tax year it covers. The body of the contains the details of the ‘s income, deductions, and credits. The footer contains information about the preparer of the , such as their name, address, and phone number.

Header

The header of the s contains the following information:

- The name of the

- The date the was filed

- The tax year the covers

- The filing status of the

- The number of dependents the has

- The total income of the

- The total tax liability of the

- The total amount of tax withheld from the ‘s wages

- The total amount of tax refund or tax due

Body

The body of the s contains the details of the ‘s income, deductions, and credits. The income section of the s lists all of the ‘s sources of income, such as wages, salaries, tips, interest, and dividends. The deductions section of the s lists all of the ‘s allowable deductions, such as the standard deduction, the itemized deductions, and the business expenses. The credits section of the s lists all of the ‘s allowable credits, such as the child tax credit, the earned income credit, and the education credits.

Footer

The footer of the s contains information about the preparer of the , such as their name, address, and phone number. The footer also contains a space for the ‘s signature and the date the was signed.

Completing Form 8962

Filling out Form 8962 can be a bit of a chore, but it’s important to do it right. Here’s a quick guide to help you get it done without any hassle.

First, gather all the information you’ll need. This includes your Social Security number, your spouse’s Social Security number (if filing jointly), your income, and any deductions or credits you’re claiming.

Once you have all your information, you can start filling out the form. The form is divided into several sections, so take it one step at a time.

Section 1: Taxpayer Information

This section is pretty straightforward. Just fill in your name, address, and Social Security number.

Section 2: Income

In this section, you’ll need to list all of your income for the year. This includes wages, salaries, tips, interest, dividends, and any other income you received.

Section 3: Deductions and Credits

This section is where you can claim any deductions or credits that you’re eligible for. Some common deductions include the standard deduction, the itemized deduction, and the child tax credit.

Section 4: Tax Calculation

In this section, you’ll calculate your tax liability. This is done by subtracting your deductions and credits from your income.

Section 5: Payment or Refund

In this section, you’ll figure out how much tax you owe or how much of a refund you’re getting.

Once you’ve completed all of the sections, you’re ready to sign and date the form. Then, just mail it to the IRS and you’re all done!

Common Errors to Avoid

Here are a few common errors to avoid when completing Form 8962:

- Entering incorrect information.

- Forgetting to sign and date the form.

- Not attaching all of the necessary documents.

- Filing the form late.

By following these tips, you can help ensure that your Form 8962 is processed quickly and accurately.

Submitting Form 8962

Alright, time to get this form outta your system, bruv.

You’ve got two main options for submitting Form 8962: electronically or by mail. Let’s break ’em down.

Submitting Electronically

- Head over to the IRS website and search for “File Form 8962 Electronically”.

- You’ll need to create an account or log in if you already have one.

- Follow the instructions on the website to complete and submit the form.

Submitting by Mail

- Print out the completed Form 8962.

- Send it to the address provided in the instructions.

- Make sure to include any required attachments.

No matter how you choose to submit the form, make sure you do it by the deadline. If you miss the deadline, you may have to pay a late filing penalty.

Additional Resources

Beyond the guidance provided in these instructions, numerous resources are accessible to assist taxpayers in understanding and completing Form 8962.

These resources include publications, frequently asked questions (FAQs), and online tools provided by the IRS, as well as professional assistance and support.

IRS Publications

- Publication 527, Residential Rental Property

- Publication 946, How to Depreciate Property

IRS FAQs

- FAQs for Form 8962, Passive Activity Loss Limitations

Online Tools

- Passive Activity Loss Calculator

- Rental Real Estate Loss Worksheet

Professional Assistance

Taxpayers may also seek professional assistance from tax preparers, accountants, or attorneys who specialize in tax matters. These professionals can provide personalized guidance and support tailored to individual circumstances.

FAQ Summary

Q: Where can I download the free 2024 Form 8962 instructions?

A: You can download the free 2024 Form 8962 instructions from the IRS website at https://www.irs.gov/forms-pubs/about-form-8962.

Q: What is the purpose of Form 8962?

A: Form 8962 is used to claim the Premium Tax Credit (PTC), which helps reduce the cost of health insurance premiums for eligible individuals and families.

Q: What information do I need to complete Form 8962?

A: To complete Form 8962, you will need information from your health insurance Marketplace, such as your Marketplace ID and the amount of PTC you received. You will also need information from your tax return, such as your income and filing status.

Q: What are some common errors to avoid when completing Form 8962?

A: Some common errors to avoid when completing Form 8962 include: entering incorrect information from your Marketplace or tax return, failing to report all of your household income, and claiming the PTC if you are not eligible.

Q: What are the deadlines for submitting Form 8962?

A: The deadline for submitting Form 8962 is April 15th for most taxpayers. However, if you file an extension, you have until October 15th to file Form 8962.