Free 2024 Form 8863 Download: A Comprehensive Guide

Navigating the world of tax forms can be a daunting task, but understanding and completing Form 8863 is essential for many individuals. This guide will provide a comprehensive overview of Form 8863, including its purpose, how to download it for free, and step-by-step instructions for completing and submitting it.

Form 8863, “Education Savings Bond Program (ESBP) Request to Redeem Bonds,” is a crucial document used to redeem U.S. Savings Bonds that have been designated for education expenses. Whether you’re a student, parent, or guardian, understanding the ins and outs of Form 8863 will ensure a smooth and successful redemption process.

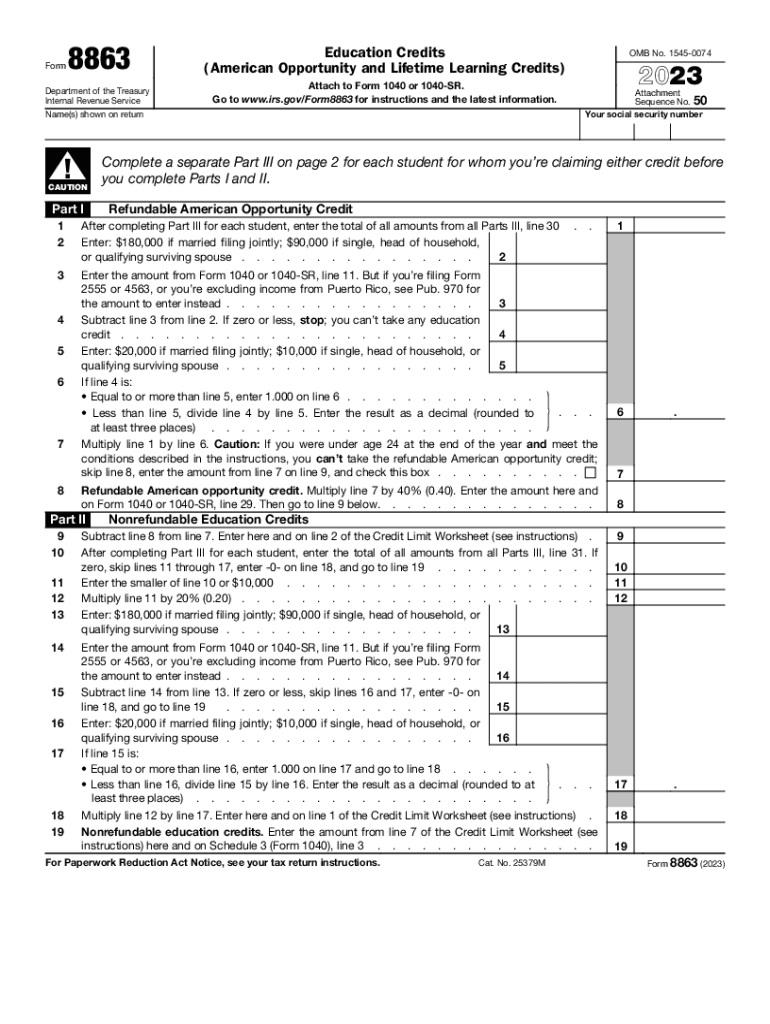

Completing the Form

Filling out the 2024 Form 8863 is a straightforward process. Follow these steps to ensure accuracy and completeness:

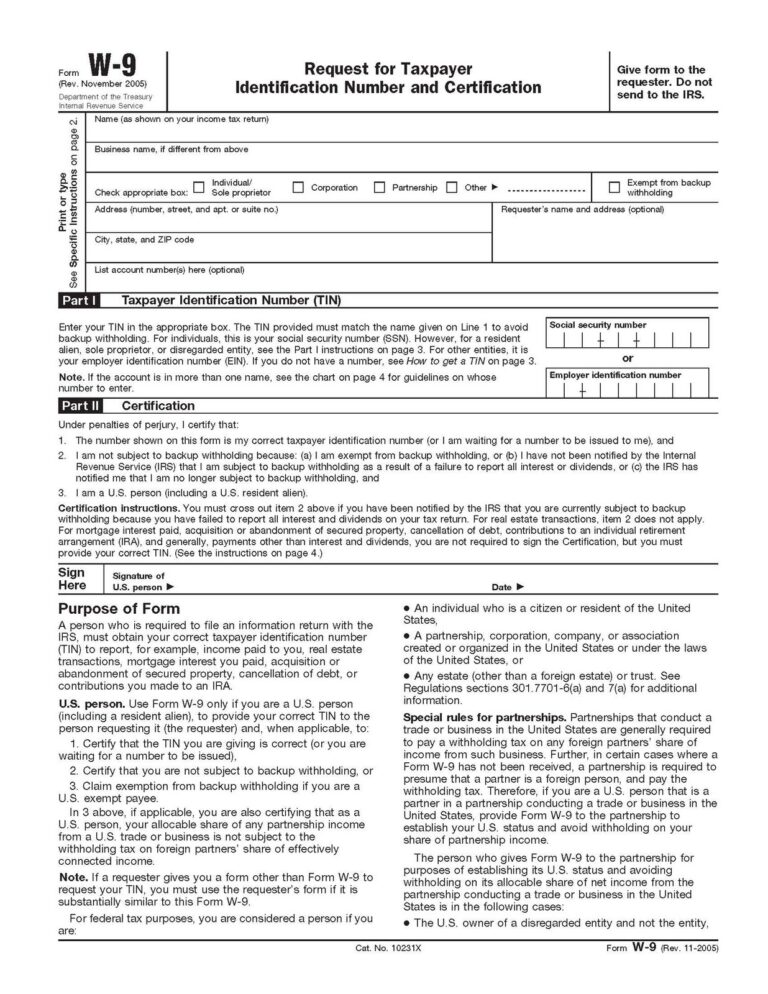

Before you begin, gather the necessary documents, including your Social Security number, income information, and any relevant tax documents.

Part I: Taxpayer Information

- Provide your full name, address, and Social Security number.

- Indicate your filing status (single, married filing jointly, etc.).

Part II: Income

- Enter your total income from all sources, including wages, salaries, dividends, and interest.

- Attach any necessary supporting documents, such as W-2 forms or 1099s.

Part III: Adjustments to Income

- List any eligible adjustments to income, such as contributions to a traditional IRA or student loan interest.

- Use the instructions provided on the form to determine which adjustments apply to you.

Part IV: Taxable Income

- Subtract your adjustments to income from your total income to calculate your taxable income.

- This amount is used to determine your tax liability.

Part V: Tax

- Use the tax table provided on the form or consult the IRS website to determine your tax liability.

- Enter the amount of tax you owe.

Part VI: Payments

- List any estimated tax payments or other payments you have made towards your tax liability.

- Subtract these payments from your total tax liability to determine the amount you still owe.

Part VII: Refund or Amount You Owe

- If your total payments exceed your tax liability, you are entitled to a refund.

- If you owe more tax than you have paid, you will need to make an additional payment.

Part VIII: Signature

- Sign and date the form to certify the accuracy of the information provided.

- Include your daytime phone number in case the IRS needs to contact you.

Submitting the Form

Once you have completed the 2024 Form 8863, you can submit it using either electronic or mail methods.

Electronically

To submit the form electronically, you can use the IRS e-file system. This system allows you to file your form online, and it will be processed by the IRS. To use the e-file system, you will need to have a valid email address and a Social Security number.

By Mail

If you prefer to submit the form by mail, you can mail it to the IRS at the following address:

Internal Revenue Service

Attn: Form 8863

Ogden, UT 84201-0043

Frequently Asked Questions (FAQs)

Form 8863, Education Savings Bonds Program (ESBP) Report, is designed to help taxpayers report their ESBP activities. This form is used to report the sale or redemption of qualified U.S. Savings Bonds that were issued under the ESBP.

Here are some frequently asked questions about Form 8863:

Who needs to file Form 8863?

You need to file Form 8863 if you sold or redeemed qualified U.S. Savings Bonds that were issued under the ESBP.

What information do I need to include on Form 8863?

You will need to include the following information on Form 8863:

- Your name, address, and Social Security number

- The date(s) you sold or redeemed the bonds

- The serial number(s) of the bonds

- The amount of money you received for the bonds

Where can I get Form 8863?

You can get Form 8863 from the IRS website or by calling the IRS at 1-800-TAX-FORM (1-800-829-3676).

When is Form 8863 due?

Form 8863 is due on April 15th of the year following the year in which you sold or redeemed the bonds.

What are the penalties for not filing Form 8863?

If you do not file Form 8863, you may be subject to penalties. The penalties for not filing Form 8863 can be found on the IRS website.

FAQ

Can I download Form 8863 online for free?

Yes, you can download Form 8863 for free from the official IRS website or reputable financial institutions.

What information do I need to provide on Form 8863?

You will need to provide personal information, such as your name, address, and Social Security number, as well as details about the bonds you wish to redeem.

How do I submit Form 8863?

You can submit Form 8863 electronically through the IRS website or by mail to the designated address provided in the instructions.

What is the deadline for submitting Form 8863?

There is no specific deadline for submitting Form 8863, but it is generally recommended to redeem your bonds as soon as possible after they mature.

Can I redeem Education Savings Bonds for expenses other than education?

No, Education Savings Bonds can only be redeemed for qualified education expenses, such as tuition, fees, books, and supplies.