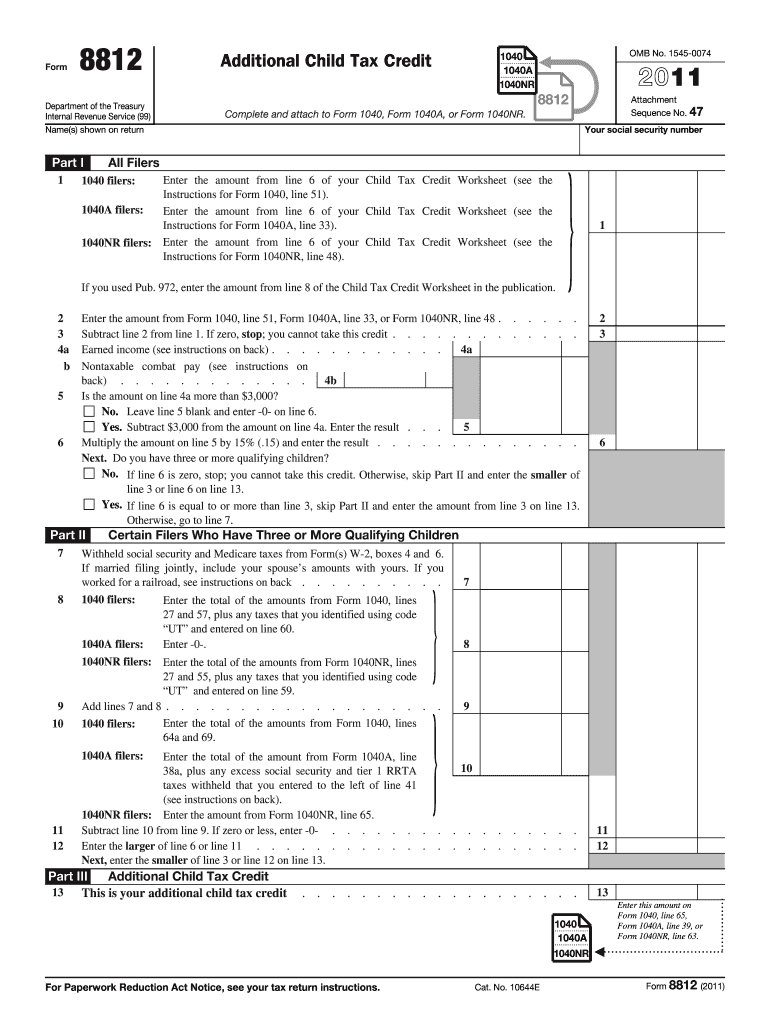

Free 2024 Form 8812 Download: Everything You Need to Know

The IRS Form 8812 is a crucial tax document that can significantly impact your tax liability. It allows you to claim the Credit for Prior Year Minimum Tax Liability. In this comprehensive guide, we will delve into the purpose, eligibility, filing requirements, and potential tax savings associated with Form 8812. We will also provide you with free download links for the 2024 tax year version and answer common FAQs to ensure a seamless filing experience.

Whether you are a tax professional or an individual taxpayer, understanding Form 8812 is essential for optimizing your tax strategy. This guide will provide you with all the necessary information to navigate the complexities of this tax form and maximize your tax savings.

Impact on Tax Liability

Filling out Form 8812 can have a significant impact on your tax liability. By claiming the credit for child and dependent care expenses, you can reduce the amount of taxes you owe.

The credit is calculated based on your income, the number of qualifying children or dependents you have, and the amount of expenses you paid for child or dependent care. The maximum credit is $3,000 for one qualifying child or dependent and $6,000 for two or more qualifying children or dependents.

The following table summarizes the potential tax savings you can receive by claiming the credit:

| Income | Number of Qualifying Children or Dependents | Credit Amount |

|—|—|—|

| $0 – $15,000 | 1 | $1,050 |

| $0 – $15,000 | 2 or more | $2,100 |

| $15,001 – $43,000 | 1 | $1,650 |

| $15,001 – $43,000 | 2 or more | $3,300 |

| $43,001 – $75,000 | 1 | $2,000 |

| $43,001 – $75,000 | 2 or more | $4,000 |

| Over $75,000 | 1 | $2,500 |

| Over $75,000 | 2 or more | $5,000 |

Common Errors and Troubleshooting

When filling out Form 8812, it’s easy to make mistakes. Here are some common errors and how to avoid them:

- Forgetting to sign and date the form. This is a simple error that can be easily avoided. Just make sure to sign and date the form before you mail it in.

- Entering incorrect information. Double-check all of the information you enter on the form, especially your Social Security number and bank account information.

- Not attaching the required documents. If you are claiming a refund, you must attach the required documents to your form. These documents may include proof of income, proof of expenses, and a copy of your tax return.

- Filing the form late. The deadline for filing Form 8812 is April 15th. If you file your form late, you may have to pay penalties and interest.

Troubleshooting Tips

If you encounter any issues while filing Form 8812, here are some troubleshooting tips:

- Contact the IRS. If you have any questions about Form 8812, you can contact the IRS at 1-800-829-1040.

- Use the IRS website. The IRS website has a wealth of information about Form 8812, including instructions, forms, and publications.

- Get help from a tax professional. If you are having trouble filing Form 8812, you can get help from a tax professional.

Additional Resources and Support

Navigating tax matters can be daunting, but fret not, fam! Here’s the lowdown on where to find reliable resources and support for Form 8812.

Whether you’re a tax whizz or a newbie, these resources will help you ace your Form 8812 like a pro.

IRS Resources

- IRS Publication 596: Earned Income Credit (EIC)

- IRS Form 8812 Instructions

- IRS website: Earned Income Tax Credit

Tax Professionals

If you need some extra help, consider reaching out to a tax pro. They can provide personalized guidance and ensure your Form 8812 is filed correctly.

FAQs

Got questions? We’ve got answers! Check out these frequently asked questions about Form 8812:

| Question | Answer |

|---|---|

| What is the deadline to file Form 8812? | April 15th (or the due date of your tax return) |

| Who is eligible for the EIC? | Low- to moderate-income working individuals and families |

| How do I calculate my EIC? | Use the EIC Assistant on the IRS website or refer to the instructions for Form 8812 |

Helpful Answers

Can I file Form 8812 electronically?

Yes, you can file Form 8812 electronically using tax software or through the IRS website.

What is the deadline for filing Form 8812?

The deadline for filing Form 8812 is the same as your income tax return, typically April 15th.

What are the penalties for late filing Form 8812?

Late filing of Form 8812 may result in penalties and interest charges.

Can I amend my Form 8812 after filing?

Yes, you can amend your Form 8812 by filing Form 1040-X, Amended U.S. Individual Income Tax Return.

Where can I find additional resources and support for Form 8812?

You can find additional resources and support for Form 8812 on the IRS website or by contacting a tax professional.