Free 2024 Form 720 Download: Essential Guide to Reporting Foreign Trusts and Assets

Navigating the complexities of international finance can be daunting, but understanding and utilizing Form 720 is crucial for individuals with foreign trusts and assets. This comprehensive guide will delve into the nuances of Form 720, providing a step-by-step approach to downloading, completing, and filing this important document.

Form 720, Report of Foreign Trust and Reporting of Foreign Bank and Financial Accounts, plays a vital role in ensuring compliance with U.S. tax laws. By understanding its purpose and significance, you can proactively manage your international financial affairs and avoid potential penalties.

Introduction

The “Free 2024 Form 720 Download” is an official document released by the UK government that provides a standardized format for individuals and businesses to report their overseas income and assets.

This form is crucial as it helps the government ensure compliance with tax regulations, track international financial activities, and combat tax evasion.

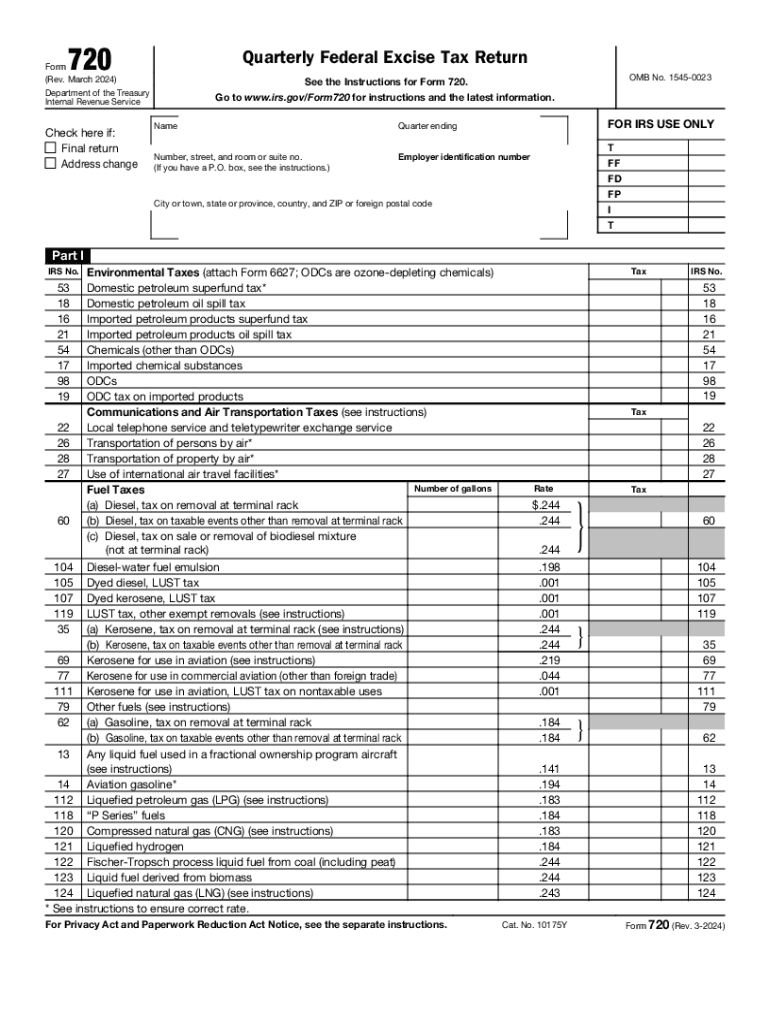

Understanding Form 720

Form 720 is a tax return that you need to file if you have a foreign bank account or other foreign financial assets. The form is used to report your foreign financial assets to the IRS, and it’s important to file it correctly to avoid penalties.

The form is divided into several sections, each of which asks for different information about your foreign financial assets. Here’s a brief overview of each section:

Part I: Taxpayer Information

This section asks for basic information about you, including your name, address, and Social Security number. You’ll also need to provide your occupation and the name and address of your employer or business.

Part II: Foreign Financial Assets

This section asks for information about your foreign financial assets, including the name of the institution where the account is held, the account number, and the balance of the account as of the end of the tax year.

Part III: Exemptions and Exclusions

This section asks for information about any exemptions or exclusions that you may be eligible for. For example, you may be exempt from filing Form 720 if you have a foreign bank account that is used exclusively for personal purposes and the balance of the account is less than $50,000.

Part IV: Penalties

This section provides information about the penalties that may be imposed if you fail to file Form 720 or if you file it incorrectly. The penalties can be significant, so it’s important to make sure that you file the form correctly.

Part V: Signature and Verification

This section asks for your signature and the date. You’ll also need to provide the name and address of the person who prepared the return.

Downloading Form 720

Intro paragraph

Getting your mitts on Form 720 is a doddle. Here’s the lowdown on how to bag it from the official website:

Step-by-step Guide

- Blaze over to the HMRC website: https://www.gov.uk/government/publications/form-720-declaration-of-cross-border-arrangements

- Scroll down and click on the link to download the form.

- Save the PDF file to your computer.

- Bob’s your uncle, you’ve got the form.

Using Form 720

Using Form 720, you can report any foreign trusts and assets you own. Fill out the form and send it to HMRC by the deadline to avoid penalties.

Make sure you fill out the form correctly. Common mistakes include:

- Not including all of your foreign trusts and assets

- Making errors in the values of your assets

- Not signing the form

Filing Form 720

Filing Form 720 is a legal requirement for businesses that have overseas financial accounts. Failure to file the form on time can result in penalties and interest charges. It’s important to be aware of the deadlines and penalties associated with filing Form 720, and to follow the instructions carefully when completing and submitting the form.

Filing Deadlines

The deadline for filing Form 720 is April 15th of each year. However, if you are unable to file by the deadline, you can request an extension by filing Form 8868.

Penalties for Late Filing

If you file Form 720 late, you may be subject to penalties. The penalty for late filing is $10,000 per year, per account. However, the penalty may be reduced if you can show that you had reasonable cause for not filing on time.

Filing Electronically

The easiest way to file Form 720 is electronically. You can file electronically through the IRS website.

Filing by Mail

If you are unable to file electronically, you can file Form 720 by mail. You can download the form from the IRS website or you can request a copy by calling the IRS at 1-800-TAX-FORM (1-800-829-3676).

Resources and Support

Need a helping hand with Form 720? Check out these top-notch resources and get all the support you need.

Whether you’re a dab hand at tax or a total newbie, there’s something here for you. Dig in and get the lowdown on Form 720.

Helpful Resources

- IRS Website: The official source for all things Form 720. Find everything from instructions to FAQs.

- IRS Helpline: Got a burning question? Give the IRS a bell on 1-800-829-1040.

- Tax Professionals: If you’re feeling overwhelmed, consider hiring a tax pro to guide you through the Form 720 maze.

FAQs

Is Form 720 mandatory for all U.S. citizens?

No, Form 720 is only required for U.S. citizens or residents who meet specific criteria, such as having an interest in a foreign trust or maintaining foreign financial accounts with an aggregate value exceeding $50,000.

Can I file Form 720 electronically?

Yes, you can file Form 720 electronically through the IRS website using the FIRE system (Foreign Information Return Electronic Filing).

What are the penalties for failing to file Form 720?

Penalties for failing to file Form 720 can be substantial, ranging from $10,000 to $50,000 per year for which the form was not filed.

Where can I find additional resources on Form 720?

The IRS website provides comprehensive information on Form 720, including instructions, FAQs, and contact information for assistance.