Free 2024 Form 709 Download: Comprehensive Guide and Overview

Navigating the complexities of tax regulations can be daunting, but with the right resources, it doesn’t have to be. In this comprehensive guide, we delve into the intricacies of Form 709, providing you with a clear understanding of its purpose, eligibility criteria, and the benefits of using the free downloadable version. Our step-by-step guide will empower you to download Form 709 seamlessly, while our detailed breakdown of its structure and sections will ensure accurate completion.

Whether you’re a seasoned tax professional or an individual seeking guidance, this guide is your ultimate companion. We’ve anticipated common questions and provided concise answers to empower you with the knowledge you need. By the end of this guide, you’ll be equipped to confidently navigate Form 709, ensuring compliance and maximizing your tax efficiency.

Free 2024 Form 709 Download

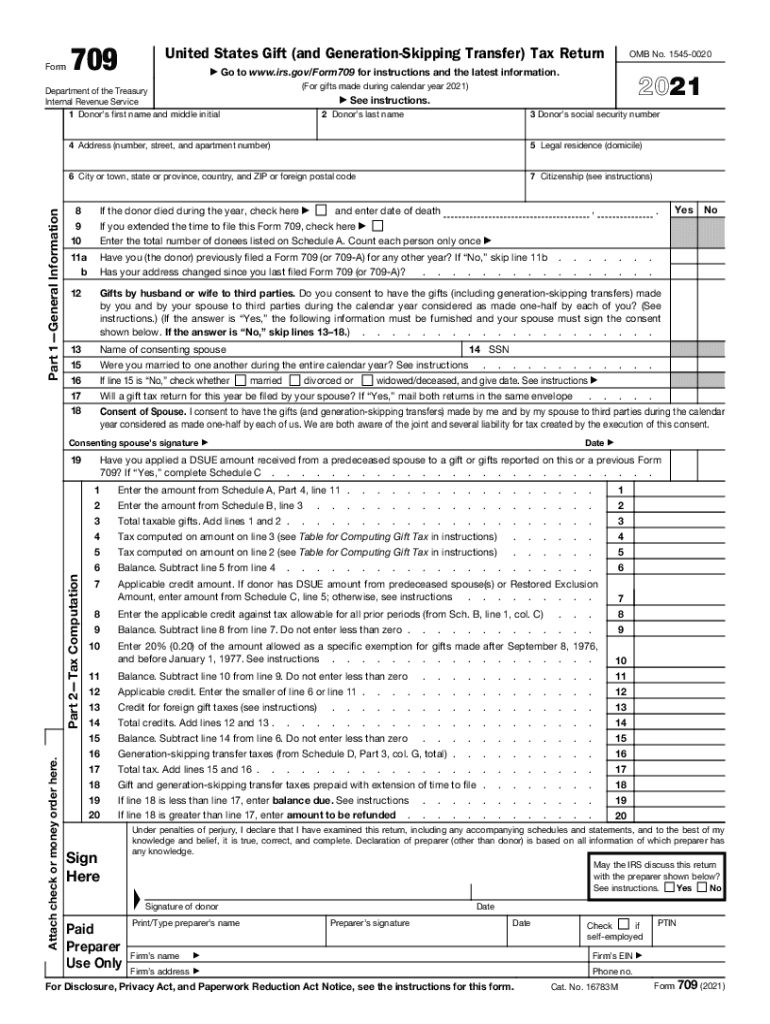

The Form 709, also known as the United States Gift (and Generation-Skipping Transfer) Tax Return, is a tax form filed with the Internal Revenue Service (IRS) to report gifts made during the tax year. The form is used to calculate and pay any gift tax that may be due on the gifts. Filing Form 709 is crucial to avoid penalties and ensure compliance with tax laws.

The free 2024 Form 709 download provides individuals with an accessible and convenient way to obtain the latest version of the form. This downloadable version is identical to the official IRS form, ensuring accuracy and reliability. By utilizing the free download, individuals can save time and resources compared to obtaining the form through traditional methods.

Eligibility Criteria

To be eligible to download the free 2024 Form 709, individuals must meet certain criteria. These criteria include:

- Being a US citizen or resident alien required to file Form 709.

- Having made gifts during the tax year that exceed the annual gift tax exclusion amount.

Benefits of Using the Free Downloadable Version

There are several benefits to using the free downloadable version of Form 709:

- Convenience: The free download allows individuals to access the form anytime, anywhere, without the need for physical copies or mailing.

- Accuracy: The downloadable version is an official IRS form, ensuring accuracy and compliance with tax laws.

- Cost-effective: The free download eliminates the need for purchasing or printing physical copies of the form, saving individuals money.

- Environmentally friendly: Using the free downloadable version reduces paper waste and promotes environmental sustainability.

Guide to Downloading Form 709

Downloading the free 2024 Form 709 is a straightforward process. By following these simple steps, you can quickly access and obtain the necessary form for your tax filing needs.

To begin, navigate to the official website or platform where the form is available. Once there, locate the section dedicated to tax forms and publications. Within this section, you will find a search bar or a list of available forms.

Step 1: Locate the Form

Use the search bar to enter “Form 709” or browse through the list of forms until you find it. Once located, click on the link to access the form’s download page.

Step 2: Select the Download Option

On the download page, you will typically find multiple options for downloading the form. Choose the option that best suits your needs, whether it’s a PDF, fillable PDF, or other available format.

Step 3: Save the Form

Once you have selected the desired download option, click the appropriate button to initiate the download process. Save the form to a convenient location on your computer or device for future use.

Step 4: Complete and File the Form

After downloading the form, you can proceed to complete and file it as per the instructions provided by the relevant tax authorities. Ensure that you provide accurate and complete information on the form to avoid any potential delays or issues during the processing of your tax return.

Understanding Form 709

Form 709 is a crucial document used to report the value of certain assets and trusts for federal gift and generation-skipping transfer (GST) tax purposes. Grasping the structure and sections of this form is essential to ensure accurate reporting and avoid any potential pitfalls.

Form 709 is divided into several sections, each with specific fields and requirements. Understanding the purpose and significance of each section is key to completing the form correctly.

Structure and Sections of Form 709

The structure of Form 709 is designed to gather detailed information about the assets and transfers subject to gift and GST taxes. The form is divided into the following main sections:

- Part 1: Donor Information – This section collects basic information about the donor, including their name, address, and taxpayer identification number.

- Part 2: Gifts – This section details all gifts made during the tax year, including the date of the gift, the recipient’s name and address, and the value of the gift.

- Part 3: Generation-Skipping Transfers (GSTs) – This section reports any GSTs made during the tax year, including the date of the transfer, the transferee’s name and address, and the value of the transfer.

- Part 4: Tax Computation – This section calculates the gift and GST taxes owed, based on the information provided in Parts 2 and 3.

- Part 5: Signatures – This section includes the signatures of the donor and, if applicable, the donor’s spouse.

Each section of Form 709 contains specific fields and instructions that guide the donor in providing the necessary information. Understanding the purpose and significance of each field is crucial to ensure accurate reporting and avoid common errors.

Common Errors to Avoid

Filling out Form 709 can be complex, and it’s important to avoid common errors that could lead to delays in processing or penalties. Some common pitfalls to watch out for include:

- Incomplete or inaccurate information – Ensure that all fields are completed accurately and thoroughly. Missing or incorrect information can cause delays in processing and potential penalties.

- Incorrect valuation of gifts and GSTs – The value of gifts and GSTs must be determined accurately based on fair market value. Incorrect valuations can result in underpayment or overpayment of taxes.

- Failure to report all gifts and GSTs – All gifts and GSTs made during the tax year must be reported, regardless of their value. Failure to report all transfers can result in penalties.

- Missing signatures – Both the donor and, if applicable, the donor’s spouse must sign the form. Missing signatures can delay processing and could invalidate the return.

By carefully reviewing the instructions and avoiding common errors, donors can ensure that Form 709 is completed accurately and submitted on time.

Additional Resources and Support

Seeking additional guidance or support with Form 709? Look no further! We’ve got you covered with a plethora of resources and channels to assist you.

If you encounter any difficulties or have burning questions, don’t hesitate to reach out to our dedicated support team. They’re standing by, ready to lend a helping hand and guide you through the Form 709 maze.

FAQs

To quench your thirst for knowledge, we’ve compiled a list of frequently asked questions (FAQs) and their answers. Dive in and get your questions answered in a jiffy!

- Q: Where can I find the official Form 709?

A: Head on over to the official government website for the latest and greatest version of Form 709. - Q: Who should fill out Form 709?

A: If you’re the executor or administrator of an estate, it’s your duty to complete Form 709. - Q: What happens if I make a mistake on Form 709?

A: Don’t panic! Simply make the necessary corrections and resubmit the form. No biggie. - Q: How do I contact the support team?

A: You can reach our friendly support team via email, phone, or live chat. They’re all ears and ready to help.

FAQs

What is the purpose of Form 709?

Form 709 is used to report the generation-skipping transfer tax (GST) on certain types of transfers, such as gifts or inheritances, that may be subject to GST.

Who is eligible to download the free 2024 Form 709?

Anyone who needs to file Form 709 for the 2024 tax year is eligible to download the free version from the IRS website.

What are the benefits of using the free downloadable version of Form 709?

The free downloadable version of Form 709 is easy to access, convenient to use, and ensures that you have the most up-to-date version of the form.

How do I download the free 2024 Form 709?

You can download the free 2024 Form 709 from the IRS website by following the instructions provided in the guide.

What are some common errors or pitfalls to avoid when filling out Form 709?

Some common errors to avoid when filling out Form 709 include failing to report all taxable transfers, incorrectly calculating the GST exemption, and using outdated versions of the form.