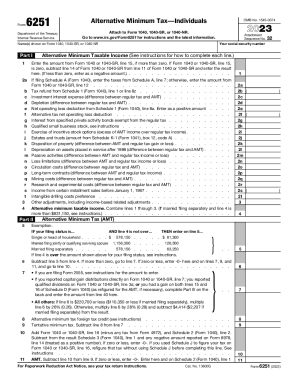

Free 2024 Form 6251 Download: Everything You Need to Know

Filing taxes can be a daunting task, but it doesn’t have to be. With the right tools and resources, you can navigate the process with ease. One essential tool for many taxpayers is Form 6251. This form is used to calculate the Alternative Minimum Tax (AMT), which ensures that high-income taxpayers pay their fair share of taxes.

If you’re required to file Form 6251, you can download it for free from the IRS website. In this guide, we’ll walk you through the eligibility requirements, the download process, and the different filing options available. We’ll also provide answers to some frequently asked questions to help you complete Form 6251 accurately and on time.

Downloading Process

Wanna bag yourself a copy of Form 6251 for free, blud? No stress, fam. Here’s the lowdown on how to get it sorted:

Head over to the official IRS website and type “Form 6251” into the search bar. It’s like a treasure hunt, but instead of gold, you’re after a tax form.

Locating the Form

- Click on the first result that pops up, which should be a PDF document.

- If you don’t have a PDF reader like Adobe Acrobat, you can download one for free from their website.

Downloading the Form

- Once you’ve got your PDF reader sorted, click on the “Download” button.

- Choose a location on your computer to save the file, like your desktop or downloads folder.

- Hit “Save” and you’re golden. Form 6251 will be chilling in your chosen folder, ready for you to fill out.

Filing Options

Filing Form 6251 can be done electronically or by mail. Electronic filing is the preferred method as it’s quicker and more secure. To file electronically, you’ll need to use tax software that supports e-filing. You can also file by mail by sending the completed form to the address provided in the instructions.

Mailing the Form

If you choose to mail the form, make sure to include all the required attachments and supporting documentation. The form should be mailed to the following address:

Internal Revenue Service

P.O. Box 932500

Cincinnati, OH 45293-2500

Common Mistakes to Avoid

Filling out Form 6251 can be a bit of a minefield, so it’s best to be aware of the common pitfalls. Here are a few things to watch out for:

Not including all of your income. This is a big one. If you forget to include any income, it could result in you paying more taxes than you owe.

Making math errors. Another common mistake is making math errors. This could lead to you paying too much or too little in taxes.

Not signing and dating the form. This is a simple mistake, but it could result in your return being rejected.

Filing the wrong form. There are different versions of Form 6251 for different situations. Make sure you’re filing the correct form for your situation.

Not filing on time. The deadline for filing Form 6251 is April 15th. If you file late, you could be subject to penalties and interest.

If you’re not sure how to fill out Form 6251, there are plenty of resources available to help you. You can find instructions on the IRS website, or you can get help from a tax professional.

Additional Resources

If you need further assistance or have specific inquiries regarding Form 6251, here are some helpful resources:

Official IRS Website:

- Visit the IRS website for official information, updates, and the latest version of Form 6251.

Contact Information:

- For general inquiries or assistance with Form 6251, contact the IRS at 1-800-829-1040.

Frequently Asked Questions

Who is eligible to download Form 6251 for free?

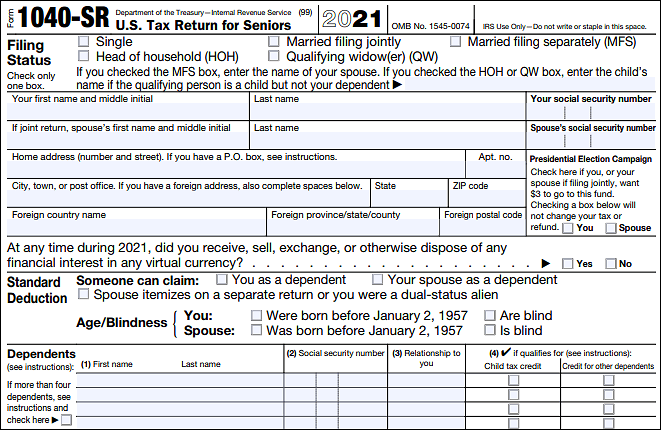

You are eligible to download Form 6251 for free if you meet the following criteria:

- Your taxable income is less than $75,000 if you are filing as a single taxpayer.

- Your taxable income is less than $112,500 if you are filing as a married couple filing jointly.

What documents do I need to prove my eligibility?

You will need to provide a copy of your most recent tax return to prove your eligibility.

How do I download Form 6251?

You can download Form 6251 for free from the IRS website. To do so, visit the IRS website and search for “Form 6251.” Click on the link to the form and follow the instructions to download it.

How do I file Form 6251?

You can file Form 6251 electronically or by mail. To file electronically, you will need to use tax software that is approved by the IRS. To file by mail, you will need to print out the form and mail it to the IRS.