Free 2024 Form 590 Download: Essential Guide for Tax Preparation

Navigating the complexities of tax preparation can be a daunting task. However, with the right tools and resources, you can simplify the process and ensure accuracy. One such tool is Form 590, an essential document for various tax-related purposes. In this comprehensive guide, we will provide you with the official link to download the free 2024 Form 590, explore its significance, and delve into the benefits of utilizing it for your tax preparation.

Form 590 is a crucial document that plays a vital role in tax preparation. It serves as a tool for reporting distributions from individual retirement arrangements (IRAs) and other retirement plans. By understanding the sections and fields included in Form 590, you can ensure that you are completing it accurately and thoroughly. We will also discuss common mistakes to avoid when filling out Form 590, empowering you with the knowledge to maximize its effectiveness.

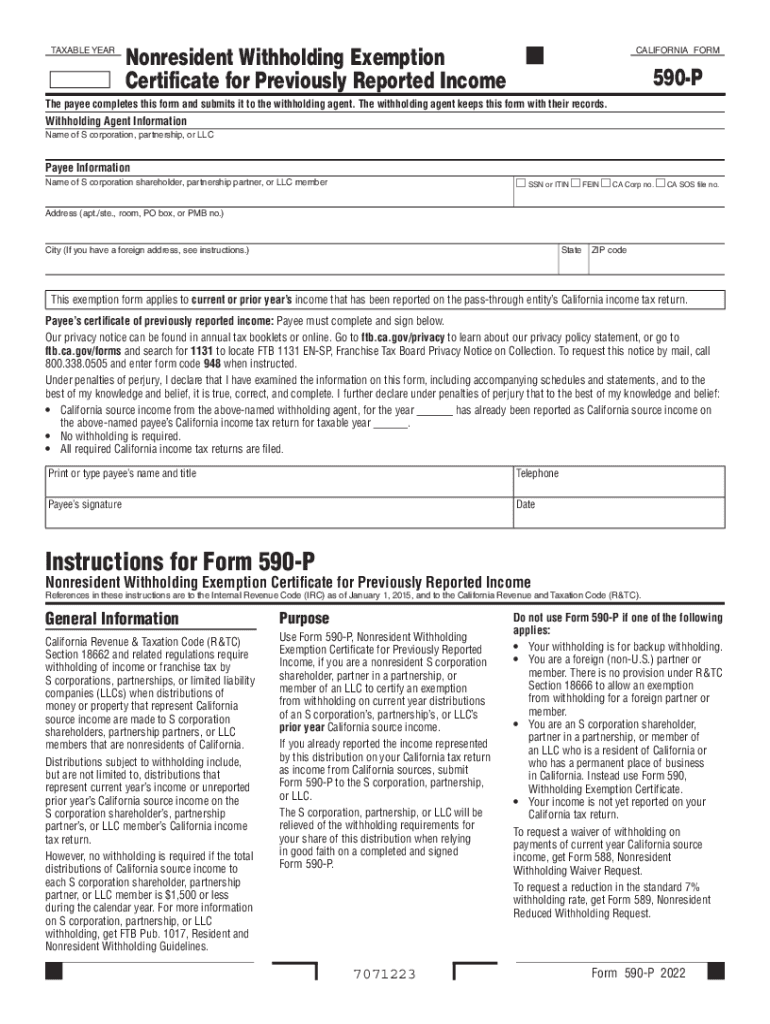

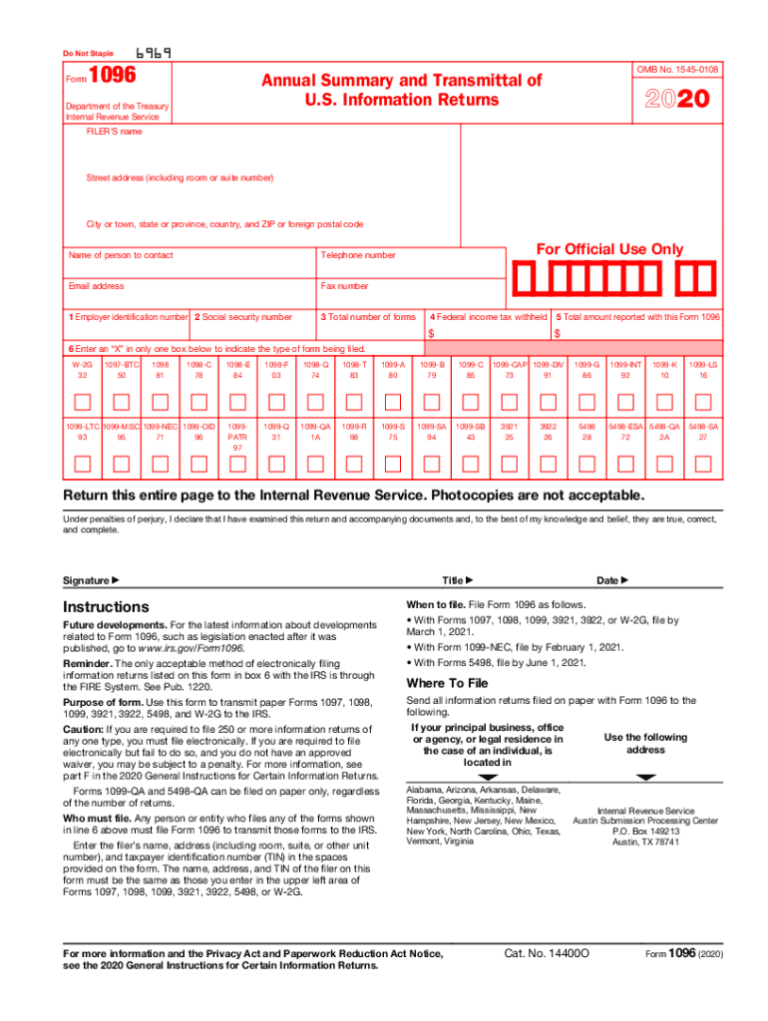

Free 2024 Form 590 Download

The 2024 Form 590 is now available for free download from the official website. Form 590 is an essential tax form used to report individual income, deductions, and credits. It is crucial for taxpayers to file Form 590 accurately and on time to avoid penalties and ensure they receive the full benefits of their tax deductions and credits.

The 2024 Form 590 has been updated to reflect changes in tax laws for 2024. These changes include:

- An increase in the standard deduction

- A new tax credit for low-income families

- Changes to the rules for deducting charitable contributions

Taxpayers should carefully review the instructions for the 2024 Form 590 to ensure they are aware of all the changes that affect them. The instructions are available on the official website.

The deadline for filing Form 590 is April 15, 2025. However, taxpayers can file for an extension until October 15, 2025. Taxpayers who file for an extension will have until October 15, 2025, to file their Form 590 and pay any taxes owed.

There are several ways to file Form 590. Taxpayers can file online, by mail, or through a tax professional. The fastest and easiest way to file Form 590 is online. Taxpayers can file online using the official website or through a tax software program.

Understanding Form 590

Form 590 is a vital document that plays a crucial role in determining your financial aid eligibility. It’s important to understand its sections and fields to ensure you complete it accurately and thoroughly. Here’s a breakdown of the key aspects of Form 590:

Sections and Fields

Form 590 is divided into several sections, each covering specific aspects of your financial situation. The main sections include:

- Student Information: This section gathers basic information about you, including your name, address, and Social Security number.

- Household Information: This section collects information about your family’s income, assets, and expenses.

- Dependency Status: This section determines if you are considered a dependent or independent student for financial aid purposes.

- Financial Information: This section includes details about your income, assets, and other financial resources.

Importance of Accuracy

Completing Form 590 accurately is essential for several reasons:

- Accurate information ensures that you receive the correct amount of financial aid.

- It helps prevent delays or errors in processing your application.

- It maintains the integrity of the financial aid system by ensuring that funds are distributed fairly.

Common Mistakes to Avoid

To ensure accuracy, it’s important to avoid common mistakes when filling out Form 590. Some typical errors include:

- Inconsistent information: Ensure that the information you provide throughout the form is consistent.

- Missing or incomplete fields: Complete all applicable fields and provide as much detail as possible.

- Incorrect calculations: Carefully review your calculations and ensure they are accurate.

- Guessing or estimating: Avoid guessing or estimating when providing financial information.

Benefits of Using Form 590

:max_bytes(150000):strip_icc()/Screenshot2023-03-01at5.54.48PM-ad096c49c37f47b4928897c111aa845e.png?w=700)

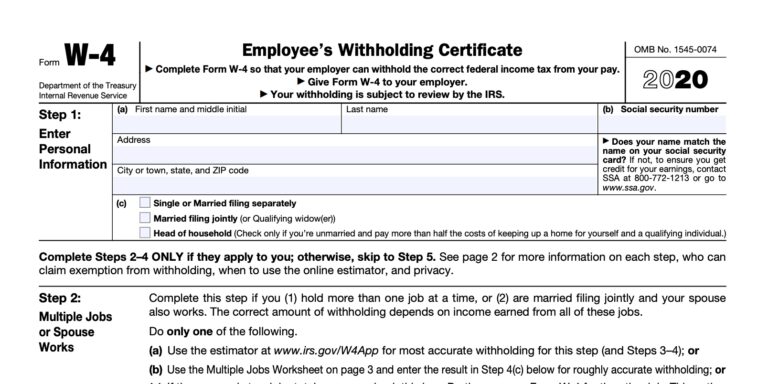

Form 590 is a breeze to use and can save you a bomb when it comes to tax prep. It’s designed for simple tax returns, so if you don’t have any fancy deductions or investments, this is the form for you. Plus, it’s free to download and use, unlike some other tax forms that cost a pretty penny.

Compared to other tax forms, Form 590 is a walk in the park. It’s straightforward and easy to understand, even if you’re not a tax whizz. You won’t need to hire an accountant or spend hours deciphering complicated instructions.

And if you’re still not convinced, here’s a success story: Last year, Sarah, a uni student, used Form 590 to file her taxes. She was able to do it all herself in under an hour and got a decent refund. She was so chuffed with how easy it was that she’s recommending it to all her mates.

So, if you’re looking for a simple, free, and effective way to file your taxes, Form 590 is the way to go. It’s the perfect choice for students, freelancers, and anyone with a straightforward tax situation.

Additional Resources

If you need further assistance with Form 590, here are some additional resources that you can refer to:

These resources provide detailed information, guidance, and support to help you complete and file Form 590 accurately and efficiently.

IRS Website

- The IRS website offers a comprehensive guide to Form 590, including instructions, frequently asked questions (FAQs), and downloadable forms.

- You can access the IRS website at https://www.irs.gov/forms-pubs/about-form-590.

Tax Professionals

- Tax professionals, such as accountants and enrolled agents, can provide personalized assistance with Form 590.

- They can help you understand the form, gather the necessary information, and ensure that your return is filed correctly.

Taxpayer Advocate Service

- The Taxpayer Advocate Service (TAS) is an independent organization within the IRS that provides free assistance to taxpayers who are experiencing problems with the tax system.

- You can contact the TAS at 1-877-777-4778 or visit their website at https://www.taxpayeradvocate.irs.gov/.

FAQ Summary

Q: Where can I download the official 2024 Form 590?

A: You can download the official 2024 Form 590 from the Internal Revenue Service (IRS) website at this link: [Insert IRS Form 590 Download Link]

Q: What is the purpose of Form 590?

A: Form 590 is used to report distributions from IRAs and other retirement plans. It provides the IRS with information about the amount and type of distribution, as well as the recipient’s tax basis in the plan.

Q: Is Form 590 required for all IRA distributions?

A: No, Form 590 is only required for distributions that are not eligible for the IRA rollover exception. This exception applies to rollovers to other IRAs or qualified retirement plans.

Q: What are some common mistakes to avoid when filling out Form 590?

A: Some common mistakes to avoid include entering incorrect account numbers, miscalculating the amount of the distribution, and failing to report the distribution on your tax return.

Q: Where can I get help with completing Form 590?

A: You can seek assistance from a tax professional, such as a certified public accountant (CPA) or enrolled agent (EA). You can also contact the IRS for guidance at 1-800-829-1040.