Free 2024 Form 5695 Download: Everything You Need to Know

Navigating the complexities of tax filing can be a daunting task, but understanding the significance of Form 5695 is crucial for a seamless tax season. This form plays a vital role in ensuring accurate reporting of your financial transactions and compliance with tax regulations. In this comprehensive guide, we’ll delve into the intricacies of Form 5695, providing you with clear instructions on how to download, complete, and submit it for the 2024 tax year.

Whether you’re a seasoned tax filer or tackling your taxes for the first time, this guide will empower you with the knowledge and confidence to navigate Form 5695 effectively. So, let’s dive right in and make tax filing a breeze!

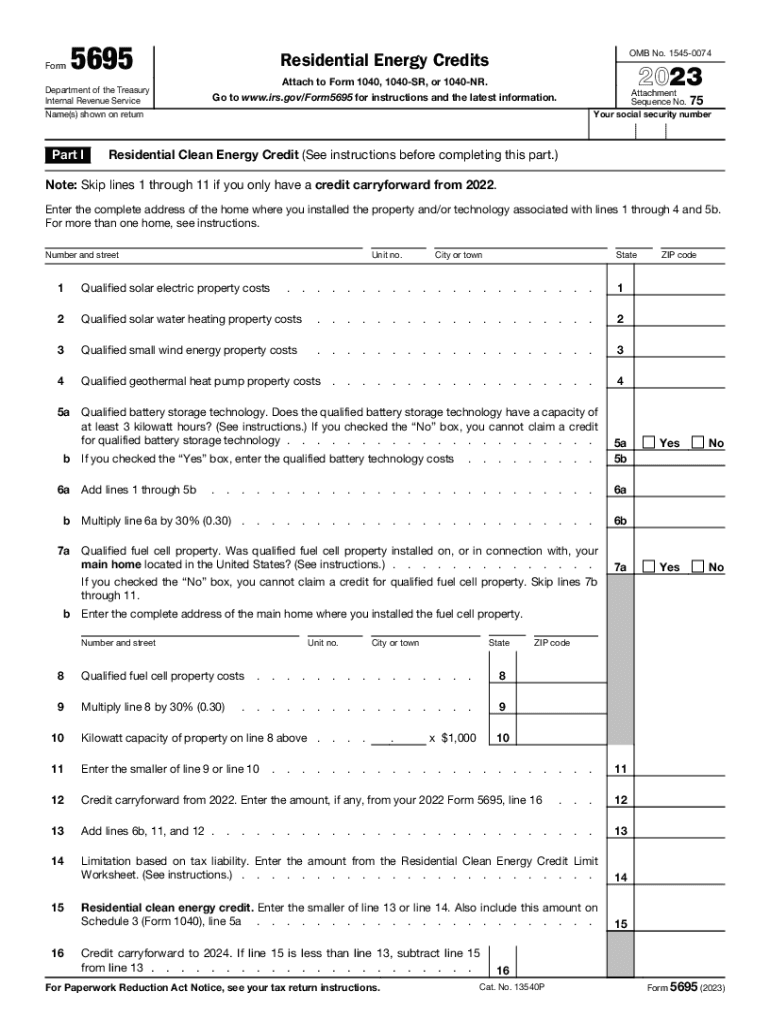

Form 5695 Structure and Sections

Form 5695, Residential Energy Credits, is structured into distinct sections, each serving a specific purpose in capturing information related to energy-efficient home improvements. Let’s delve into the structure and significance of each section:

Section 1: Taxpayer Information

This section collects basic personal details, such as your name, address, and Social Security number. It ensures proper identification and helps connect the tax credit claim to the eligible taxpayer.

Section 2: Home Information

In this section, you provide information about the residence where the energy-efficient improvements were made. This includes the address, property type, and whether it’s your primary residence or a second home.

Section 3: Eligible Expenditures

Here, you list down the qualifying energy-efficient improvements you made to your home. Each eligible expenditure has its own line number, and you must provide details like the date of installation, cost, and a brief description.

Section 4: Tax Credit Calculation

Based on the eligible expenditures you claimed in Section 3, this section calculates the amount of residential energy credit you’re entitled to. It applies the applicable tax credit percentage to the eligible costs.

Section 5: Certification

In this section, you attest to the accuracy of the information provided on the form and certify that you meet the eligibility requirements for the residential energy credit.

Filling Out Form 5695: Essential Information

Completing Form 5695 requires some key info, bruv. Let’s break it down, innit?

First off, you’ll need your basic deets: name, addy, and all that jazz. Then, you’ll have to provide info about your income, expenses, and any other financial details that might be relevant.

Your Income

Make sure you have your payslips or other proof of income handy. You’ll need to list all your income sources, including wages, salaries, tips, and any other forms of earnings.

Your Expenses

Next up, it’s time to list your expenses. This includes everything from rent or mortgage payments to food, travel, and entertainment. Make sure you have receipts or bank statements to back up your claims.

Specific Formatting and Calculations

There are a few specific formatting and calculation requirements you need to be aware of. For example, all amounts should be entered in whole pounds, and you may need to use specific formulas to calculate certain deductions.

Filing and Submission Process

You can file Form 5695 electronically or by mail. If you’re filing electronically, you can use the IRS e-file system or tax software that supports electronic filing.

To file by mail, you must print and complete the form and mail it to the IRS address listed on the form instructions. Make sure to include all required attachments.

Deadlines and Penalties

Form 5695 is due on April 15th of the year following the year in which the transfer was made. If you file late, you may be subject to penalties and interest.

Helpful Answers

Where can I find the official IRS website to download Form 5695?

To obtain the official Form 5695 directly from the IRS, visit their website at www.irs.gov. Once there, navigate to the “Forms and Publications” section and search for Form 5695.

Are there any software programs that can assist me in completing Form 5695?

Yes, there are several reputable tax software programs available, such as TurboTax, H&R Block, and TaxSlayer. These programs can guide you through the process of completing Form 5695 and ensure accurate calculations.

What is the deadline for filing Form 5695?

The deadline for filing Form 5695 is typically the same as the deadline for filing your individual income tax return. For the 2024 tax year, the filing deadline is April 15, 2025.

Can I file Form 5695 electronically?

Yes, you can file Form 5695 electronically using the IRS e-file system. This method is convenient, secure, and can expedite the processing of your return.

What are the penalties for filing Form 5695 late?

Filing Form 5695 late may result in penalties and interest charges. The specific penalties depend on the amount of tax owed and the length of the delay.