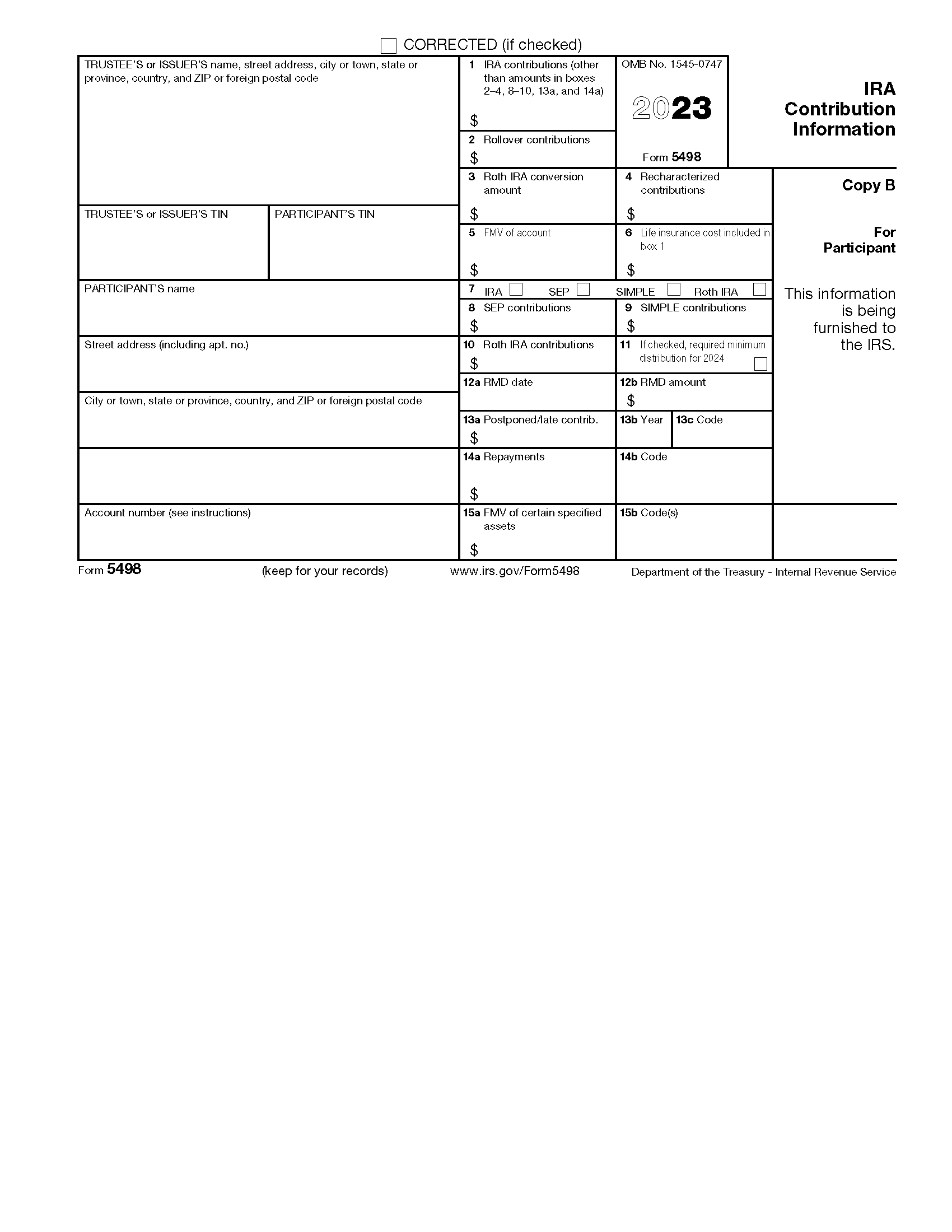

Free 2024 Form 5498 Download: A Comprehensive Guide

Navigating the world of IRAs can be a daunting task, but it doesn’t have to be. Form 5498 is an essential tool for individuals looking to make IRA contributions and track their retirement savings. In this guide, we will provide you with a comprehensive overview of Form 5498, including its purpose, how to download it for free, and the key information you need to complete it accurately. Whether you’re a seasoned investor or just starting out, this guide will empower you with the knowledge and resources you need to manage your IRA effectively.

Understanding Form 5498 is crucial for maximizing your retirement savings and ensuring compliance with IRS regulations. This guide will delve into the different sections and components of the form, explaining the various types of IRA contributions that can be made and providing examples to illustrate how to fill it out correctly. By following our step-by-step instructions and utilizing the additional resources we provide, you can confidently navigate the complexities of Form 5498 and take control of your financial future.

Free 2024 Form 5498 Download

The Internal Revenue Service (IRS) Form 5498 is used to report Individual Retirement Arrangement (IRA) contributions, rollovers, and distributions. This form is important for taxpayers who have made contributions to an IRA or have received distributions from an IRA.

Using Form 5498 can provide several benefits, including:

– Accurately reporting IRA contributions and distributions to the IRS

– Avoiding penalties for incorrect reporting

– Tracking IRA activity for tax purposes

How to Download the Free 2024 Form 5498

Downloading the free 2024 Form 5498 is a simple process. Follow these steps:

1. Visit the IRS website at www.irs.gov.

2. In the search bar, type “Form 5498.”

3. Click on the “Forms” tab.

4. Scroll down and click on the “2024 Form 5498” link.

5. Click on the “Download PDF” button.

Information Required to Complete Form 5498

Before you can complete Form 5498, you will need to gather the following information:

– Your name, address, and Social Security number

– The name and address of your IRA custodian

– The account number of your IRA

– The type of IRA you have (traditional or Roth)

– The amount of your IRA contributions

– The amount of your IRA distributions

– The amount of any rollovers you made to or from your IRA

Form 5498 Overview

Form 5498, IRA Contribution Information, is an IRS tax form used to report contributions made to individual retirement accounts (IRAs). It provides a detailed record of IRA contributions for the tax year and is used by both individuals and financial institutions to ensure accurate tax reporting.

Key Sections and Components of Form 5498

Form 5498 consists of several key sections and components, including:

- Part I: IRA Information – This section includes basic information about the IRA, such as the account holder’s name, address, and Social Security number, as well as the account number and type of IRA.

- Part II: Contributions – This section summarizes the total contributions made to the IRA for the tax year, including traditional IRA contributions, Roth IRA contributions, and rollovers from other retirement accounts.

- Part III: Distributions – This section reports any distributions taken from the IRA during the tax year, including regular distributions, qualified distributions, and rollovers to other retirement accounts.

- Part IV: Other Information – This section includes additional information about the IRA, such as the account balance at the end of the tax year and any excess contributions or withdrawals made during the year.

Types of IRA Contributions

Form 5498 can be used to report various types of IRA contributions, including:

- Traditional IRA Contributions – These are tax-deductible contributions made to a traditional IRA. The deduction is subject to income limits and phase-outs.

- Roth IRA Contributions – These are non-deductible contributions made to a Roth IRA. Roth IRA earnings grow tax-free, and qualified distributions are tax-free.

- Rollover Contributions – These are contributions made to an IRA from another retirement account, such as a 401(k) or 403(b) plan.

Examples of Filling Out Form 5498

Filling out Form 5498 can be straightforward if you have the necessary information. Here are a few examples of how to fill out the form for various scenarios:

- Traditional IRA Contributions – If you made traditional IRA contributions for the year, you will need to report the total amount of contributions in Part II, Box 1 of Form 5498.

- Roth IRA Contributions – If you made Roth IRA contributions for the year, you will need to report the total amount of contributions in Part II, Box 2 of Form 5498.

- Rollover Contributions – If you made a rollover contribution to an IRA from another retirement account, you will need to report the amount of the rollover in Part II, Box 3 of Form 5498.

Tax Implications of Form 5498

Submitting Form 5498 has major tax implications, innit? It’s the snitch that tells the taxman about your IRA contributions. So, if you’re a cheeky chappy who wants to avoid any tax-related aggro, it’s best to fill this form in right and on time.

Not filing Form 5498 or making mistakes on it can land you in hot water with the taxman. You might have to pay penalties and interest, and in extreme cases, the taxman could even come knocking on your door for an audit.

Avoiding Common Errors

To dodge these tax nightmares, it’s important to steer clear of common blunders when filling in Form 5498:

- Incorrect IRA account information: Make sure the details of your IRA account, like the account number and the name of the financial institution, are spot on.

- Mixing up contribution types: Don’t get your knickers in a twist by confusing traditional IRA contributions with Roth IRA contributions. They’re different, so make sure you’re ticking the right boxes.

- Missing deadlines: The taxman has a deadline for everything, and Form 5498 is no exception. File it by the 31st of May, or you’ll be facing some tax-related grief.

Additional Resources for Form 5498

Innit, fam, if you’re gassed about Form 5498, there’s a stack of resources to get your knowledge on point. Dive into these sick websites and guides to level up your Form 5498 game.

Let’s bounce to the IRS crib first. They’ve got the lowdown on Form 5498 and all the deets you need to file it like a pro. Check out their pubs and guidance to stay ahead of the curve.

Reputable Websites and Resources

- IRS Website: https://www.irs.gov/forms-pubs/about-form-5498

- TurboTax: https://turbotax.intuit.com/tax-tips/irs-tax-return/form-5498-ira-contribution-information/L5mU99z1Z

- HR Block: https://www.hrblock.com/tax-center/filing/forms/form-5498-ira-contribution-information/

IRS Publications and Guidance

- Publication 590-A: Contributions to Individual Retirement Arrangements (IRAs)

- Publication 560: Retirement Plans for Small Business

- Revenue Procedure 2023-16: IRA Contribution and Benefit Limits

IRA Comparison Table

Not all IRAs are made equal, bruv. Check out this sick table to compare the different types and see which one vibes with your financial goals.

| Type of IRA | Contribution Limit |

|---|---|

| Traditional IRA | $6,500 ($7,500 if age 50 or older) |

| Roth IRA | $6,500 ($7,500 if age 50 or older) |

| SIMPLE IRA | Employer must contribute between 2% and 100% of eligible compensation |

| SEP IRA | Employer must contribute up to 25% of eligible compensation |

Frequently Asked Questions

Can I download Form 5498 online for free?

Yes, you can download Form 5498 for free from the IRS website or through various reputable online resources.

What information do I need to complete Form 5498?

To complete Form 5498, you will need your personal information, IRA account details, and contribution information, such as the amount and type of contributions made.

What are the tax implications of making IRA contributions on Form 5498?

IRA contributions may be tax-deductible or non-deductible, depending on your income and other factors. Consult with a tax professional for personalized guidance.

What are the penalties for not filing Form 5498 correctly?

Failure to file Form 5498 correctly may result in penalties and additional taxes. It is important to complete the form accurately and on time.

Where can I find additional resources and support for Form 5498?

The IRS website, reputable financial websites, and tax professionals are valuable resources for additional information and support related to Form 5498.