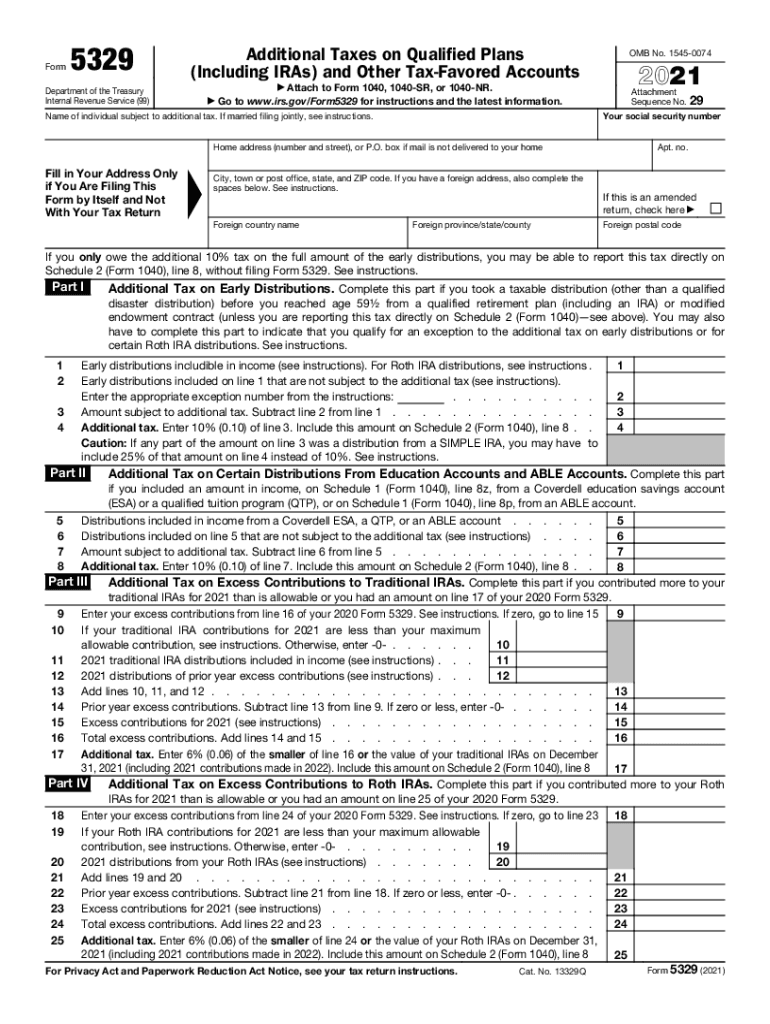

Free 2024 Form 5329 Download: Simplify Your Tax Reporting

Filing taxes can be a daunting task, but it doesn’t have to be. With the right tools, you can simplify the process and save yourself time and effort. Form 5329 is a valuable tool that can help you report your income and expenses accurately and efficiently.

In this comprehensive guide, we’ll provide you with everything you need to know about Form 5329, including how to download it for free, its benefits, and step-by-step instructions on how to complete it. We’ll also cover common mistakes to avoid and provide additional resources for your convenience.

Common Mistakes to Avoid When Using Form 5329

Filing Form 5329 can be a straightforward process, but it’s crucial to avoid common errors that could delay or even invalidate your application. Here are some pitfalls to watch out for:

Mistakes can lead to delays in processing, incorrect calculations, or even denial of benefits. It’s essential to be meticulous when filling out Form 5329 to ensure accuracy and a smooth application process.

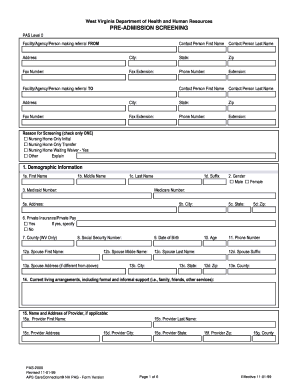

Incorrect Personal Information

- Mistyped name, address, or Social Security number can lead to processing delays or errors in calculating benefits.

- Ensure all personal information is accurate and matches official records.

Missing or Incomplete Information

- Incomplete sections or missing information can delay processing or result in incorrect calculations.

- Provide all required information clearly and concisely.

Incorrect Income Reporting

- Errors in reporting income can affect the accuracy of benefit calculations.

- Double-check all income sources and amounts to ensure accuracy.

Incorrect Tax Filing Status

- Choosing the wrong tax filing status can impact the amount of benefits you receive.

- Determine your correct filing status based on your marital status and other factors.

Missing or Incorrect Signatures

- Unsigned or incorrectly signed forms can delay processing or render them invalid.

- Ensure both the applicant and spouse (if applicable) sign the form in the designated areas.

Additional Resources for Form 5329

If you need more information or assistance with Form 5329, here are some additional resources:

Official IRS Websites

- IRS website: About Form 5329 – Provides general information about Form 5329, including instructions and filing requirements.

- IRS website: Form 5329 (PDF) – Downloadable PDF version of Form 5329.

- IRS website: How do I get help with my IRS Notice CP25? – Provides information and contact details for assistance with IRS Notice CP25, which is related to Form 5329.

Other Reputable Sources

- TaxAct website: IRS Form 5329 Additional Child Tax Credit – Provides a comprehensive guide to Form 5329, including eligibility requirements and how to claim the credit.

- H&R Block website: Tax Form 5329 Additional Child Tax Credit – Offers information about Form 5329, including who can claim the credit and how to file.

- NerdWallet website: Form 5329: What It Is and Who Needs It – Provides an overview of Form 5329, including eligibility criteria and how to claim the credit.

Contact Details

If you have any further questions or need assistance with Form 5329, you can contact the IRS at 1-800-829-1040. You can also visit the IRS website at www.irs.gov for more information.

FAQ

What is the purpose of Form 5329?

Form 5329 is used to report additional income, such as self-employment income, dividends, and capital gains, that may not be included on your W-2 form.

Who is eligible to download Form 5329?

Anyone who needs to report additional income on their tax return is eligible to download Form 5329.

Can I download Form 5329 from the IRS website?

Yes, you can download Form 5329 for free from the IRS website at www.irs.gov.

What are some common mistakes to avoid when completing Form 5329?

Some common mistakes to avoid include entering incorrect information, failing to include all necessary attachments, and making math errors.

Where can I get help with completing Form 5329?

You can get help with completing Form 5329 by contacting the IRS at 1-800-829-1040 or visiting their website at www.irs.gov.