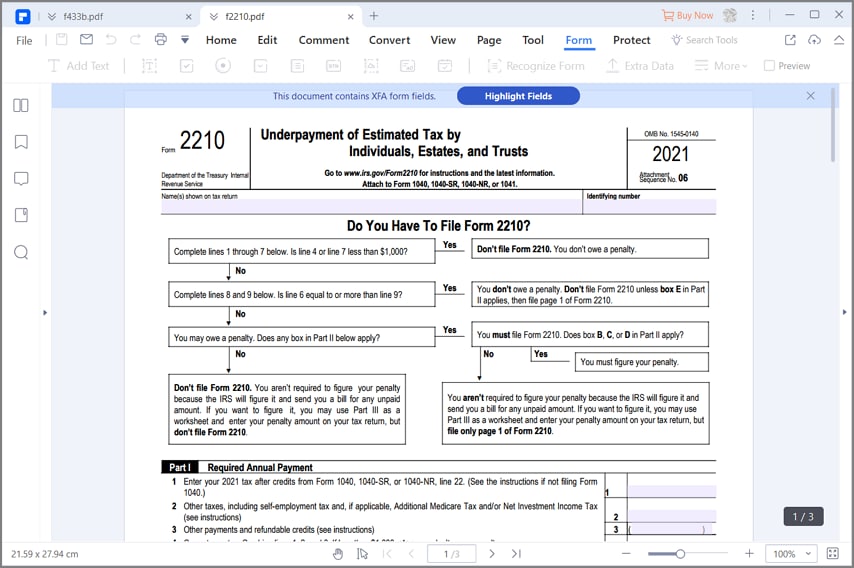

Free 2024 Form 2210 Download: A Comprehensive Guide

Navigating the intricacies of tax filing can be daunting, but the Internal Revenue Service (IRS) offers a helping hand with Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts. This essential document empowers taxpayers to calculate and pay their estimated taxes accurately, ensuring timely fulfillment of their tax obligations. In this comprehensive guide, we delve into the benefits of downloading the free 2024 Form 2210, provide a step-by-step guide to its completion, and address frequently asked questions to simplify the tax filing process.

The 2024 update of Form 2210 incorporates the latest tax laws and regulations, ensuring that taxpayers remain compliant with the ever-evolving tax landscape. Downloading the free version from the IRS website offers significant advantages over paid or printed alternatives, including cost savings, accessibility, and convenience. Moreover, the digital format streamlines the tax filing process, reducing the risk of errors and ensuring a seamless submission.

Introduction to Free 2024 Form 2210 Download

Form 2210, also known as the Underpayment of Estimated Tax by Individuals, Estates, and Trusts, is a tax form used to calculate and pay estimated taxes. It is crucial for individuals who expect to owe more than £1,000 in taxes for the year and have not had enough taxes withheld from their paychecks or through other means.

The 2024 update of Form 2210 brings several significant changes, including updated tax rates and revised instructions. Downloading the free version of the form ensures that you have the most up-to-date information and can accurately calculate your estimated tax liability.

Benefits of Downloading the Free Form 2210

Blud, downloading the free Form 2210 is a right result, innit? You’re gonna be saving dosh and making tax time a breeze. No more shelling out for pricey versions or wasting time with printed copies that can get lost or mangled.

Here’s the lowdown on why you should grab that freebie:

Cost Savings

When you download the free Form 2210, you’re saving a pretty penny compared to buying it. That’s extra dough you can put towards a banging night out or a sick new pair of kicks.

Accessibility

Need to file your taxes on the go? No worries, mate. With the free downloadable Form 2210, you can access it anytime, anywhere, from your laptop, phone, or even your nan’s tablet. It’s like having a tax wizard in your pocket.

Convenience

Filing your taxes with the free Form 2210 is a piece of cake. You can fill it out digitally, saving you the hassle of scribbling and smudging. Plus, it’s easy to save and submit, so you can avoid the last-minute panic.

Accuracy

The free Form 2210 is designed to make sure your tax filing is on point. It’s got built-in checks and balances to help you avoid any cock-ups that could land you in hot water with the taxman.

Guide to Downloading Free 2024 Form 2210

Fam, getting your hands on the free 2024 Form 2210 is a doddle. Just follow these sick steps and you’ll be sorted in no time:

- Blaze it to the IRS website (https://www.irs.gov/forms-pubs/about-form-2210).

- Click on the “Forms” tab at the top of the page.

- In the search bar, type “2210” and hit enter.

- On the results page, click on the “2024 Form 2210” link.

- Scroll down and click on the “Download PDF” button.

There you have it, mate. The free 2024 Form 2210 is now in your crib, ready for you to fill in.

If you run into any snags during the download, check if your internet connection is solid. If that’s not the issue, try refreshing the page or clearing your browser’s cache.

Tips for Filling Out Form 2210

Get your ducks in a row before you start filling out Form 2210. Make sure you have all the necessary information, like your Social Security number, income, and deductions. This will help you fill out the form quickly and accurately.

Read the instructions carefully before you start filling out the form. This will help you avoid making mistakes.

Use a black pen to fill out the form. This will make it easier for the IRS to process your form.

Write legibly. This will help the IRS to read your form and process it correctly.

If you make a mistake, don’t panic. Just cross out the mistake and write the correct information next to it.

Don’t forget to sign and date the form. This is required for the IRS to process your form.

Double-check your work

Once you’ve filled out the form, take a few minutes to review it carefully. Make sure you’ve answered all the questions and that all the information you’ve provided is correct.

Common mistakes to avoid

There are a few common mistakes that people make when filling out Form 2210. Here are a few tips to help you avoid these mistakes:

– Don’t forget to include your Social Security number.

– Don’t forget to sign and date the form.

– Make sure you’ve answered all the questions.

– Make sure all the information you’ve provided is correct.

Frequently Asked Questions (FAQs)

Form 2210 can be a complex document, so it’s natural to have questions. Here are some of the most frequently asked questions, along with clear and concise answers to help you out.

General Questions

- What is Form 2210?

Form 2210 is an IRS tax form used to report the sale or exchange of certain types of property, such as stocks, bonds, and real estate.

- Who needs to file Form 2210?

You need to file Form 2210 if you sold or exchanged property that resulted in a capital gain or loss.

- When is Form 2210 due?

Form 2210 is due on or before the same date as your income tax return.

Specific Questions

- How do I determine my cost basis?

Your cost basis is the amount you paid for the property, plus any additional costs, such as commissions or fees.

- What if I sold property at a loss?

If you sold property at a loss, you can use Form 2210 to report the loss and reduce your taxable income.

- What if I have multiple sales or exchanges?

If you have multiple sales or exchanges, you can use a separate Form 2210 for each transaction.

Help and Resources

- Where can I get help with Form 2210?

You can get help with Form 2210 from the IRS website, a tax professional, or a software program.

- What resources are available to me?

There are a number of resources available to help you with Form 2210, including the IRS website, tax software, and tax professionals.

FAQ Corner

What is Form 2210?

Form 2210 is an IRS document used to calculate and pay estimated taxes for individuals, estates, and trusts. It helps taxpayers avoid underpayment penalties by ensuring timely payment of estimated taxes throughout the year.

What are the benefits of downloading the free 2024 Form 2210?

Downloading the free 2024 Form 2210 offers several advantages, including cost savings, accessibility, convenience, and reduced risk of errors compared to paid or printed versions.

How do I download the free 2024 Form 2210?

To download the free 2024 Form 2210, visit the IRS website and navigate to the Forms and Publications section. Search for Form 2210 and select the “Download” option.

What are some tips for filling out Form 2210 accurately?

To ensure accuracy when filling out Form 2210, gather necessary information beforehand, read the instructions carefully, and double-check your calculations. Avoid common mistakes, such as using incorrect income or deduction amounts.