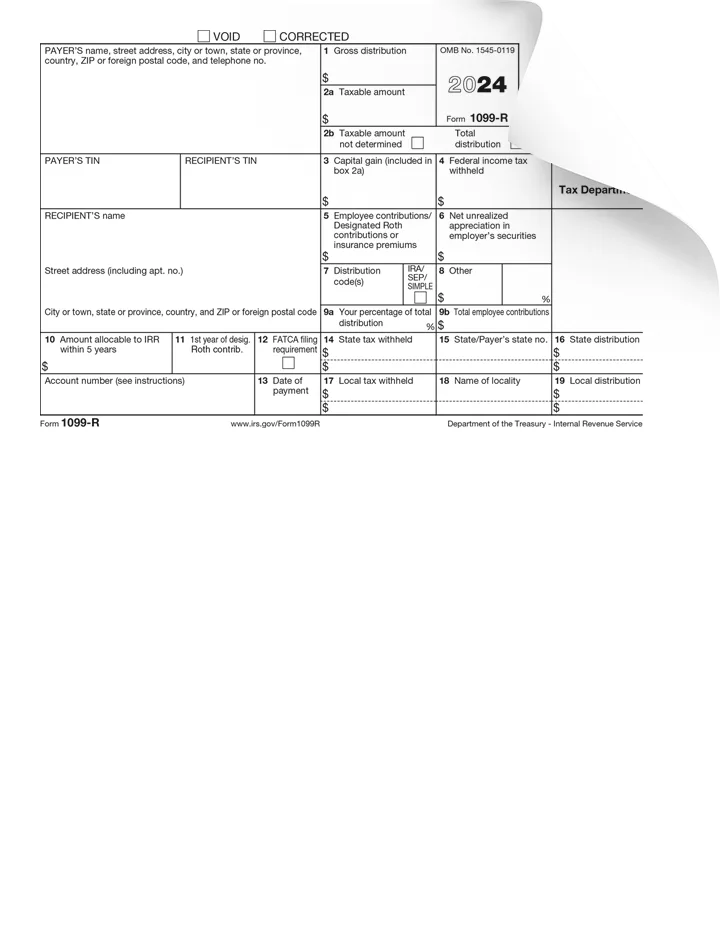

Free 2024 Form 1099 R Download: Understand, Access, and Utilize for Tax Reporting

Navigating the complexities of tax reporting can be daunting, but understanding and utilizing Form 1099-R is crucial for accurate and timely submissions. This comprehensive guide provides a clear overview of Form 1099-R, its significance, and the availability of free downloadable versions for 2024.

Whether you’re a seasoned taxpayer or a first-time filer, this resource will empower you with the knowledge and tools to seamlessly manage your retirement distribution reporting. Dive into the intricacies of Form 1099-R and gain valuable insights into its impact on your tax obligations.

Free 2024 Form 1099 R Download

Blud, listen up! Tax season is coming in hot, and you need to get your hands on Form 1099-R. It’s like the cheat code to making sure the taxman doesn’t come knocking at your door. This free downloadable version of Form 1099-R for 2024 is your golden ticket to sorting out your tax biz.

Form 1099-R is like the VIP pass to reporting your retirement income. It’s the official document that tells the taxman how much dough you’ve been pulling in from your pension, annuities, and other retirement plans. Without it, you’re flying blind, and the taxman might not be too happy about it.

Free Download

The best part? You can get your mitts on this free downloadable version of Form 1099-R for 2024 right now. No messing about, no fuss. Just click the link below and you’re sorted.

- Click here to download your free Form 1099-R for 2024: [link]

s for Downloading Free Form 1099 R

Downloading Form 1099-R is a straightforward process. It can be obtained from official government websites or reputable online platforms. Before proceeding, ensure you have a stable internet connection and the necessary software to view and save PDF documents.

Accessing Form 1099-R from Official Websites

1. Visit the Internal Revenue Service (IRS) website at www.irs.gov.

2. Search for “Form 1099-R” in the search bar.

3. Click on the result that leads to the official Form 1099-R download page.

4. Select the appropriate tax year and click on the “Download” button.

5. Save the PDF file to your computer or device.

Downloading Form 1099-R from Online Platforms

1. Go to a reputable online platform that offers tax forms, such as TaxAct, H&R Block, or TurboTax.

2. Search for “Form 1099-R” on the platform’s website.

3. Click on the link to download the form.

4. Follow the instructions provided on the platform to save the PDF file.

Tax Implications of Form 1099 R

Retirement distributions from employer-sponsored plans, such as 401(k)s and IRAs, are generally taxable as ordinary income. However, there are some exceptions to this rule.

The taxability of a retirement distribution depends on the type of distribution and the distribution code reported on Form 1099-R. The distribution code indicates the type of distribution and the amount of tax that has been withheld from the distribution.

Taxability of Different Distribution Codes

The following are the most common distribution codes and their taxability:

- Code 1: Early distribution from a traditional IRA or 401(k) plan. This code indicates that the distribution was taken before the age of 59½ and is subject to a 10% early withdrawal penalty in addition to income tax.

- Code 2: Normal distribution from a traditional IRA or 401(k) plan. This code indicates that the distribution was taken after the age of 59½ and is not subject to the 10% early withdrawal penalty. However, the distribution is still taxable as ordinary income.

- Code 4: Rollover distribution. This code indicates that the distribution was rolled over to another qualified retirement plan. Rollover distributions are not taxable as long as they are rolled over within 60 days.

- Code 7: Distribution from a Roth IRA. This code indicates that the distribution was taken from a Roth IRA. Roth IRA distributions are not taxable if the account has been open for at least five years and the distribution is taken after the age of 59½.

Calculating Taxes on Form 1099-R Distributions

The amount of tax that you owe on a retirement distribution depends on the amount of the distribution, your other income, and your filing status. You can use the IRS Form 1040 to calculate your taxes.

The following is an example of how to calculate taxes on a retirement distribution:

- Enter the amount of the distribution on line 4a of Form 1040.

- Enter the amount of tax that was withheld from the distribution on line 4b of Form 1040.

- Subtract the amount of tax that was withheld from the amount of the distribution to get the taxable amount of the distribution.

- Add the taxable amount of the distribution to your other income.

- Use the IRS tax tables to calculate your tax liability.

You can also use a tax software program to calculate your taxes. Tax software programs can help you to ensure that you are calculating your taxes correctly.

Using Form 1099 R for Tax Filing

Form 1099-R is a tax form used to report retirement distributions. It’s essential to use Form 1099-R accurately when filing your taxes to avoid penalties and ensure you receive the correct tax refund or pay the appropriate amount of tax.

Reporting Retirement Distributions

There are two main methods of reporting retirement distributions on Form 1099-R:

- Code 1: This code indicates that the distribution is fully taxable.

- Code 2: This code indicates that the distribution is partially taxable, meaning a portion of it is tax-free.

Additional Resources for Form 1099 R

If you need further assistance with Form 1099-R, here are some helpful resources:

You can find more information on the IRS website, including FAQs and help center resources. There are also various software programs available to assist you in understanding and completing the form. If you have any specific questions, you can contact a tax professional or the IRS directly for assistance.

Online Resources

- IRS website: https://www.irs.gov/forms-pubs/about-form-1099-r

- FAQs: https://www.irs.gov/newsroom/heres-what-you-need-to-know-about-form-1099-r

- Help center: https://www.irs.gov/help/ita/how-do-i-get-help-with-my-irs-account-or-my-tax-return

Software Tools

- TurboTax: https://turbotax.intuit.com/tax-tools/calculators/1099-r-calculator

- H&R Block: https://www.hrblock.com/tax-center/filing/tax-forms/form-1099-r

- TaxAct: https://www.taxact.com/support/1099-r-calculator

Contact Information

- IRS phone number: 1-800-829-1040

- IRS website: https://www.irs.gov/

FAQ Corner

Q: What is Form 1099-R and why is it important?

A: Form 1099-R is an IRS document that reports distributions from retirement plans, such as pensions, annuities, and IRAs. It’s crucial for tax reporting as it provides information about taxable income and potential tax withholding.

Q: Where can I download a free copy of Form 1099-R for 2024?

A: The IRS website (www.irs.gov) and reputable tax software providers offer free downloadable versions of Form 1099-R for 2024.

Q: What information is included on Form 1099-R?

A: Form 1099-R includes details such as the payer’s name and address, the recipient’s name and address, the amount of the distribution, and any applicable tax withholding.

Q: How do I report Form 1099-R information on my tax return?

A: The information from Form 1099-R is typically reported on Schedule 1 (Form 1040) or Form 8606, depending on the type of distribution.

Q: What if I have questions or need assistance with Form 1099-R?

A: You can refer to the IRS website, consult with a tax professional, or contact the IRS directly for guidance and support.