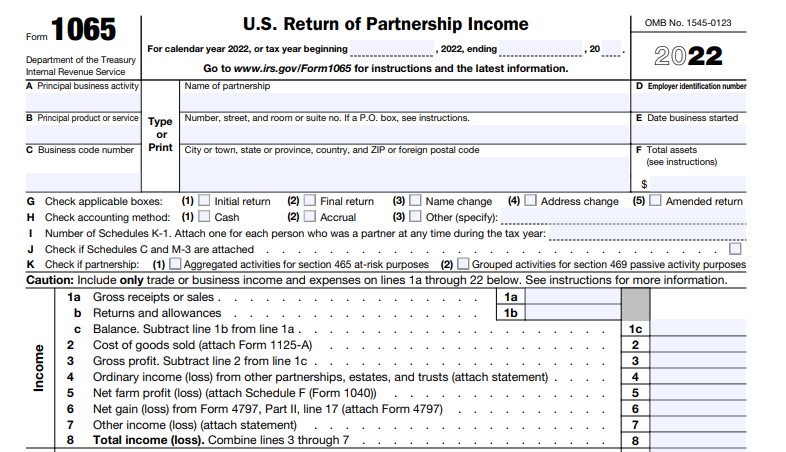

Free 2024 Form 1065 Instructions Download: A Comprehensive Guide

Navigating the complexities of tax season can be daunting, but with the right resources, you can streamline the process. The Form 1065, used by partnerships to report their income and expenses, is a crucial component of this process. To ensure accurate and timely completion, it’s essential to have access to clear and comprehensive instructions. In this guide, we provide a free download of the 2024 Form 1065 instructions, along with expert guidance to help you understand and complete the form with ease.

Whether you’re a seasoned tax professional or a first-time filer, this guide is designed to empower you with the knowledge and resources you need to navigate the Form 1065 with confidence. By providing step-by-step instructions, highlighting key sections, and addressing common issues, we aim to make your tax preparation journey as smooth and stress-free as possible.

Common Issues and Resolutions

Completing Form 1065 can be a bit of a faff, but it’s important to get it right to avoid any aggro with the taxman. Here are some of the most common issues that people run into, along with some tips on how to sort them out:

One of the most common issues is forgetting to include all of the necessary information. Make sure you’ve included everything that’s asked for on the form, including your business name, address, and taxpayer identification number. If you’re not sure what something means, check the instructions or give the IRS a bell.

Incorrectly Calculated Income or Expenses

Another common issue is making mistakes when calculating your income or expenses. This can be a bit of a pain, but it’s important to take your time and make sure you’re doing it right. If you’re not sure how to calculate something, check the instructions or give the IRS a call.

Missing or Incorrectly Reported Distributions

Distributions are payments made to the partners of a partnership. It’s important to report these correctly, as they can affect your tax liability. Make sure you’ve included all of the distributions that were made during the year, and that you’ve reported them correctly on your tax return.

Incorrectly Reported Basis

Your basis in a partnership is the amount of money you’ve invested in the partnership. This is important because it can affect your tax liability when you sell your interest in the partnership. Make sure you’ve calculated your basis correctly, and that you’ve reported it correctly on your tax return.

Additional Resources

To further assist you with form completion, we recommend exploring the following resources:

These resources provide valuable insights and supplementary information that can enhance your understanding of the form and ensure accurate completion.

IRS Publications

- IRS Publication 541: Partnerships

- IRS Publication 938: Real Estate Mortgage Investment Conduits (REMICs) Reporting Information

Online Tutorials

FAQ Corner

Q: Where can I download the free 2024 Form 1065 instructions?

A: You can download the free 2024 Form 1065 instructions from the official IRS website or reputable online sources such as tax preparation software providers.

Q: What are the key sections of the Form 1065 instructions that I should pay attention to?

A: The key sections include Schedule K-1, which provides information on each partner’s share of income, deductions, and credits; Schedule M-1, which details reconciliation of income per books with income per return; and Schedule D, which reports gains and losses from the sale or exchange of capital assets.

Q: What should I do if I encounter any issues while completing the Form 1065?

A: If you encounter any issues, refer to the Form 1065 instructions for guidance. You can also consult with a tax professional or utilize online resources and tutorials for additional support.