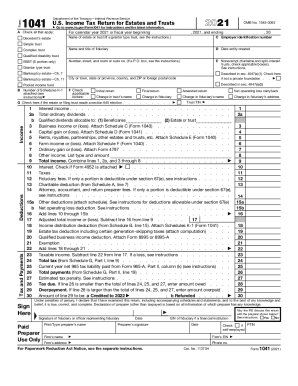

Free 2024 Form 1041 Download: A Comprehensive Guide

Filing taxes can be a daunting task, but it doesn’t have to be. With the availability of free tax forms like Form 1041, you can easily and accurately file your taxes without breaking the bank. In this guide, we’ll provide a comprehensive overview of the free 2024 Form 1041 download, including how to access it, complete it, and file it. Whether you’re a first-time filer or a seasoned pro, this guide will help you navigate the process seamlessly.

The Internal Revenue Service (IRS) provides free access to Form 1041, U.S. Income Tax Return for Estates and Trusts, for the 2024 tax year. This form is essential for estates and trusts to report their income, deductions, and credits. By downloading the free form, you can save money on tax preparation costs and ensure that your return is filed correctly.

Free 2024 Form 1041 Download Overview

Blimey, guv’nor! The spiffing free 2024 Form 1041 is nowt but a click away, innit? This right corker of a form is your golden ticket to filing your US income tax return if you’re a trust or estate, no sweat. And the best part, mate? It’s absolutely gratis!

So, what’s the niff naff about this Form 1041, then? Well, it’s a doddle to use, and it’ll save you a bob or two on your tax bill. Plus, it’s bang up-to-date with all the latest tax rules and regs, so you can rest assured you’re doing it right as rain.

Benefits of Downloading the Free Form

- It’s free, innit? Who doesn’t love a bit of a freebie, eh?

- It’s easy-peasy to use, even if you’re a bit of a fiscal featherbrain.

- It’s bang up-to-date with all the latest tax rules and regs, so you can avoid any nasty surprises.

- It’s a doddle to download, so you can get cracking on your tax return right away.

Downloading the Free Form 1041

Yo, listen up, it’s time to get your mitts on the free 2024 Form 1041, innit? It’s a doddle to do, bruv. Just follow these sick steps, fam.

Downloading from the IRS Website

Head over to the IRS website, yeah? Then, search for “Form 1041”. Once you’ve found it, click on the “Download” button. Easy peasy, lemon squeezy.

Downloading from Tax Software

If you’re using tax software, you can usually download the form right from the program. Just go to the “Forms” section and look for Form 1041. It’ll be there, mate.

Alternative Methods

If you can’t download the form online, you can also order it by phone or mail. Just call the IRS at 1-800-TAX-FORM (1-800-829-3676) or write to:

Internal Revenue Service

P.O. Box 25866

Richmond, VA 23289

Sorted, blud? Now you can fill out your Form 1041 and get your taxes sorted. Peace out!

Form 1041 Completion s

Get ready to fill in the blanks on Form 1041 like a boss! We’ll break down the structure and give you the lowdown on completing each section with finesse. Don’t worry, mate, we’ll also sort out the common pitfalls so you can avoid any nasty surprises.

General Structure

Form 1041 is split into two main parts: the front page and the schedules. The front page is where you’ll find the nitty-gritty details about the trust, like its name, address, and tax year. The schedules provide more in-depth information about the trust’s income, deductions, and distributions.

Completing Each Section

Front Page

- Part I: Fiduciary Information: This is where you’ll enter the trust’s name, address, and other basic info.

- Part II: Tax Computation: Here’s where you’ll calculate the trust’s taxable income and tax liability.

- Part III: Payments and Refunds: Enter any estimated tax payments or refunds the trust has made.

- Part IV: Sign Here: Don’t forget to sign and date the form before you send it off!

Schedules

- Schedule A: Income: List all of the trust’s income, including dividends, interest, and capital gains.

- Schedule B: Deductions: Enter any deductions the trust is eligible for, such as charitable contributions and administrative expenses.

- Schedule D: Capital Gains and Losses: Report any capital gains or losses the trust has incurred.

- Schedule G: Distributions to Beneficiaries: Show how much money the trust has distributed to its beneficiaries.

Common Errors and Pitfalls

- Forgetting to sign the form: This is a common mistake that can delay the processing of your return.

- Making math errors: Double-check your calculations to avoid any nasty surprises.

- Missing required schedules: Make sure you include all the necessary schedules with your return.

- Not reporting all income: Be sure to report all of the trust’s income, even if it’s not taxable.

- Claiming ineligible deductions: Only claim deductions that the trust is actually eligible for.

Filing and Submission of Form 1041

Innit, filing Form 1041 is easy peasy lemon squeezy. You’ve got two main options, mate: e-filing or paper filing. E-filing is the way to go, it’s quick, secure, and you can do it from the comfort of your own gaff.

If you’re an e-filing kinda person, you’ll need to use authorised e-file software. Once you’ve got that sorted, follow these steps:

- Download the Form 1041 from the IRS website.

- Open the form in your e-file software.

- Fill out the form electronically.

- Transmit the form to the IRS.

Paper filing is a bit more old school, but it still works. Just download the form from the IRS website, print it out, fill it in by hand, and mail it to the IRS. Make sure you use the correct address, which you can find on the IRS website.

No matter which filing method you choose, it’s important to file on time. The due date for Form 1041 is April 15th, but if you file electronically, you have until October 15th. If you miss the deadline, you could face penalties and interest charges.

Resources for Assistance

If you need help completing Form 1041, there are several resources available to you.

Contacting the IRS

The IRS has a dedicated hotline for taxpayers who need assistance with Form 1041. You can reach the hotline at 1-800-829-1040. The hotline is available Monday through Friday from 7:00 AM to 7:00 PM Eastern Time.

Tax Professionals

You can also seek help from a tax professional. Tax professionals can help you prepare and file your Form 1041, as well as answer any questions you may have. You can find a tax professional in your area by searching online or asking for referrals from friends or family.

Online Forums

There are also several online forums where you can get help with Form 1041. These forums are a great way to connect with other taxpayers who are also working on their Form 1041. You can ask questions, share tips, and get advice from other taxpayers.

Additional Information and Support Materials

The IRS website has a wealth of information and support materials available for taxpayers who need help with Form 1041. You can find instructions for completing the form, as well as frequently asked questions and other helpful resources. You can access the IRS website at www.irs.gov.

FAQs

What is Form 1041?

Form 1041 is a tax return filed by estates and trusts to report their income, deductions, and credits.

Is Form 1041 available for free?

Yes, the IRS provides free access to Form 1041 for the 2024 tax year.

How can I download Form 1041?

You can download Form 1041 from the IRS website or through tax software.

What are the benefits of using the free Form 1041?

Using the free Form 1041 can save you money on tax preparation costs and ensure that your return is filed correctly.