Free 2024 Form 1040 Form Download: A Comprehensive Guide

Navigating the complexities of tax filing can be daunting, but it doesn’t have to be. With the right resources and guidance, you can confidently tackle your 2024 Form 1040. This comprehensive guide provides everything you need to know about the Free 2024 Form 1040 Form Download, from eligibility and filing requirements to tax credits and payment options.

Whether you’re a seasoned filer or new to the process, this guide will empower you with the knowledge and tools to file your taxes accurately and efficiently. So, let’s dive in and make tax season a breeze!

Forms and Documents

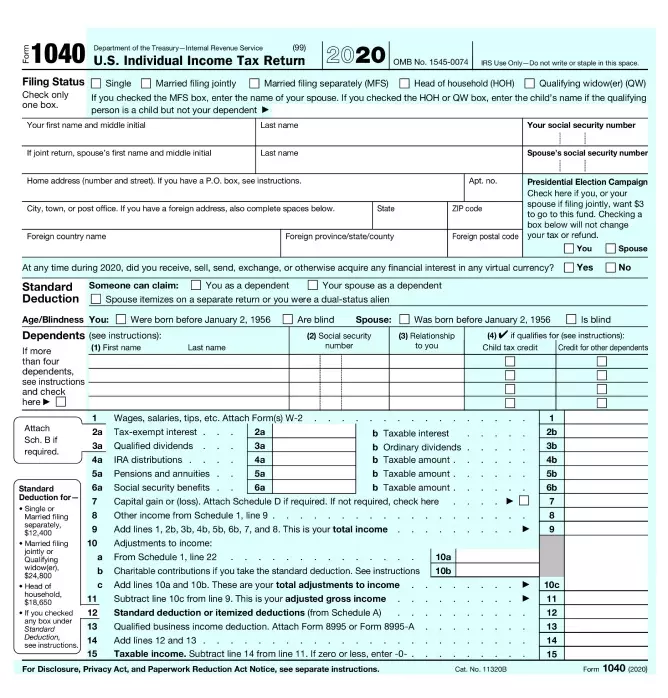

The 2024 Form 1040 is the official tax return form used by individuals to file their annual income taxes. The form is available in multiple formats, including fillable PDF, printable PDF, and an online version.

In addition to the Form 1040, there are a number of other forms and documents that may be required when filing your taxes. These include:

Forms

- Form 1040 – Individual Income Tax Return

- Form 1040-SR – U.S. Tax Return for Seniors

- Form 1040-EZ – Income Tax Return for Single and Joint Filers with No Dependents

- Form 1040-A – U.S. Individual Income Tax Return

- Form 1040-NR – U.S. Nonresident Alien Income Tax Return

- Form 1040-SS – U.S. Self-Employment Tax Return

- Form 1040-X – Amended U.S. Individual Income Tax Return

Documents

- Instructions for Form 1040

- Publication 17, Your Federal Income Tax

- Publication 501, Exemptions, Standard Deduction, and Filing Information

- Publication 972, Child Tax Credit and Credit for Other Dependents

s and Guidance

:max_bytes(150000):strip_icc()/ScreenShot2022-12-14at2.10.22PM-ed1958c9bbb642398aec3cacd721b244.png?w=700)

Filling out Form 1040 can seem like a daunting task, but it’s essential for filing your taxes accurately and on time. This guide will provide you with step-by-step s and helpful tips to ensure a smooth and stress-free process.

Form 1040 is the primary tax form used by individuals to file their federal income taxes. It’s a comprehensive document that collects information about your income, deductions, and credits. By completing Form 1040 accurately, you can calculate your tax liability and ensure that you receive any refunds or credits you’re entitled to.

Step-by-Step s

- Gather your tax documents: Before you start filling out Form 1040, make sure you have all the necessary documents, such as your W-2s, 1099s, and any other tax-related forms.

- Determine your filing status: Your filing status affects how you calculate your taxes. There are five different filing statuses: single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child.

- Calculate your income: Enter your total income from all sources, including wages, salaries, tips, dividends, and interest.

- Claim your deductions and credits: Deductions and credits can reduce your taxable income and lower your tax liability. Common deductions include the standard deduction, itemized deductions, and the earned income tax credit.

- Calculate your tax liability: Based on your income, deductions, and credits, you can calculate your tax liability. The tax tables provided by the IRS will help you determine the amount of tax you owe.

- Pay your taxes or claim a refund: If you owe taxes, you’ll need to pay them by the tax deadline. If you’re due a refund, the IRS will send it to you.

Additional Support and Resources

If you need additional support or resources while filling out Form 1040, there are several options available to you:

- IRS website: The IRS website provides a wealth of information on Form 1040 and other tax-related topics. You can also find free online tools and resources to help you file your taxes.

- Tax software: There are several tax software programs available that can help you fill out Form 1040 accurately and efficiently. These programs can also help you maximize your deductions and credits.

- Tax preparers: If you’re not comfortable filing your taxes yourself, you can hire a tax preparer to assist you. Tax preparers can help you gather your documents, complete the form, and file your taxes on time.

By following these s and utilizing the available resources, you can confidently and accurately complete Form 1040 and fulfill your tax obligations.

Tax Payment Options

Got tax to pay? Don’t fret, mate. Here’s the lowdown on how to settle up with the taxman.

You’ve got a few ways to cough up the cash:

Online

- Head to the government’s website and pay using your debit or credit card. It’s quick and easy, innit?

By Mail

- Scribble a cheque or money order made payable to “HM Revenue & Customs” and pop it in the post. Make sure to include your 10-digit Unique Taxpayer Reference (UTR) on the cheque or money order.

Through a Tax Pro

- If you’re feeling a bit clueless, you can hire a tax professional to sort it out for you. They’ll charge a fee, but they’ll make sure everything’s done right.

Remember, late or short payments could land you in hot water. You might have to pay interest and penalties, so don’t be a mug and get it done on time.

Q&A

Q: Where can I download the free 2024 Form 1040?

A: You can download the free 2024 Form 1040 directly from the IRS website.

Q: Who is required to file Form 1040?

A: Generally, you must file Form 1040 if your gross income exceeds a certain threshold, which varies depending on your filing status.

Q: What is the deadline for filing Form 1040?

A: The deadline for filing Form 1040 is typically April 15th, but it can vary depending on the year and your circumstances.

Q: Can I file Form 1040 electronically?

A: Yes, you can file Form 1040 electronically using tax software or through the IRS website.

Q: What tax credits and deductions can I claim on Form 1040?

A: There are various tax credits and deductions available, such as the child tax credit, earned income tax credit, and mortgage interest deduction.